Update: Bankruptcy, Quo-Vadis, Partnerships, Weather & Closures

It's a busy time in the hop world!

Once hops have been planted and strung, spring is often a slow time for hop related news. Not in 2024! Brewers may have missed some of the latest news. Below you will find some of the highlights from the past month.

Empty hop trellis in Oregon

THE WILLAMETTE VALLEY HOP BANKRUPTCY PLAN

For those who have not already read the March MacKinnon Report on the Willamette Valley Hops Bankruptcy (WVH), you might want to read that first.

When you’re in a Chapter 11 bankruptcy, the debtor (Willamette Valley Hops (WVH) in this case) must submit a “Debtor’s Plan of Reorganization” (the plan) to explain if and how he plans to repay his creditors. In a typical Chapter 11, this is a straightforward process. When one or more of the creditors negotiates in bad faith with an ulterior motive of driving the debtor out of business the process can be derailed[1]. The WVH plan submission was scheduled for May 20. The judge extended the deadline to June 3 at the debtor’s request. The WVH plan consists of several parts.

1. WVH agrees to repay their outstanding tax liabilities ($1.25 million) plus interest within 60 months.

2. WVH agrees to repay U.S. Bank the $942,078.83 in full plus 10% interest within 60 months. WVH proposed selling property belonging to Bruce Wolf to repay this debt.

3. WVH agrees to repay a loan of $648,263.33 to Bruce Wolf and his wife that was guaranteed by the debtor.

4. For claims exceeding $15,000, which total $8.7 million, WVH proposes to repay creditors approximately 11% of the amount owed between April 2025 and September 2029. Specific payments will be determined based on the proportion of money they are owed relative to the total. If the plan is accepted, payments will be on the schedule below. The WVH 11% estimate is in real dollars. It does not consider the reduced value of future dollars due to inflation. Projecting forward using the current annual inflation rate of 3.5%, the percentage to be repaid is 9.8% of the roughly $8.7 million outstanding claims (Table 1) [2][3][4].

Table 1. WVH proposed payment schedule and payments adjusted to present value accounting for inflation.

Source: WVH Debtor’s Plan of Reorganization, filed June 3, 2024

5. For claims less than $15,000, creditors, WVH will pay 90% of their claims within 90 days of the plan’s confirmation. Creditors with claims greater than $15,000 can join this group. They would receive $13,500 in exchange for satisfaction of their claim.

Analysis

I’m not a lawyer and I don’t play one on the internet. I suspect there will be negotiation prior to this plan’s approval. I think creditors will believe they deserve the $648,263.33 WVH would like to repay Bruce Wolf and his wife. There will be other parts of the plan to which people object. Since there is no creditor’s committee, this will be the judge’s decision. Unsecured creditors (of whom John I. Haas is the largest) are owed over eight millions of dollars. While the payments may seem trivial, they are better than nothing. I suspect everybody involved has reached that conclusion. The challenge going forward will be for WVH to survive in a buyer’s market without access to suppliers who may not want to work with them. Through their proposal, they create a situation where creditors risk losing very little if WVH goes out of business. Whether WVH can survive to fulfill the payments mentioned in the plan is key to the plan’s approval. If it is not approved, they may need to convert their chapter 11 to a chapter 7 liquidation plan.

Given the decreased value of future dollar payments proposed by WVH, unsecured creditors owed $137,755.10 or less would be smart to accept the proposed $13,500.00 payment within 90 days of plan confirmation. The alternative would result in their receiving a smaller sum over a longer time (i.e., from 2025 to 2029). All of that assumes WVH can continue to survive in a very difficult hop market.

ANOTHER ONE BITES THE DUST

On May 14, Brew Culture announced it will be closing with the statement below, which is reprinted in its entirety below and may be found on the company website.

Dear Valued Customers;

It is with a heavy heart that we announce the impending closure of Brew Culture. After careful consideration and evaluation of current market conditions, we have made the difficult decision to cease operations due to challenges posed by the global hops surplus, increased competition within the Canadian market, industry downturn, and overall economic challenges that continue to persist.

This decision was not made lightly, and we understand the impact it may have on our loyal customers and team members. We want to express our deepest gratitude for your support and patronage over the past 10+ years. Your loyalty and trust have meant the world to us, and we are truly grateful for the opportunity to have served you.

Unfortunately, despite our best efforts to weather the storm, the challenges facing our industry have proven insurmountable. The combination of continued economic uncertainty, and intensified competition within the Canadian market, has created a highly challenging business environment making it unsustainable for us to continue operation.

We want to assure you that we are committed to a smooth transition during this difficult time. Here are some important details regarding the closure;

· Closing Date: Our exact closing date will be determined after a liquidation period on all in stock inventory.

· Customer Support: Our customer support service team, and local representatives, will be available to assist with any inquiries or concerns you may have during the transition period. Please don’t hesitate to reach out for assistance at info@brewculture.com, or call 1.877.889.2739.

· Liquidation Sale: We will be holding a liquidation sale effective immediately, where you will hae the opportunity to purchase remaining inventory of Hops, Malt, Yeast, Brewing Aids, and Cleaning Chemicals at 50% Off. We encourage you to shop online at brewculture.com for live inventory and pricing.

· Hop Contract Customers: A Brew Culture representative will contact you directly to discuss options available for fulfillment directly with hop suppliers, or the cancellation of your contract.

In an effort to limit disruption to your production, we advise you to contact our partners directly for all other non-stocked brewing needs.

Analysis:

I believe we will see several more notices like this from other small to midsize merchants in the next year or two. The easy money that came from the craft beer boom is gone. The company appears to be cutting its losses rather than finding a way to serve their customers in the face of increased competition in Canada. In the end, Brew Culture’s competitors will absorb their business. They will not be missed. This is not a criticism of Brew Culture. The same fate awaits every merchant/farmer that doesn’t have a unique selling proposition (USP). They too will announce “with a heavy heart” … yadda yadda yadda. We are witnessing the Wal-Mart Effect happening to hops[5].

I don’t know how Brew Culture treated their customers, or whether there were good people who worked there. They were small and local. Now they are gone. In their place, a global cartel will serve their customers. I believe these giants will be kind at first. When the market stabilizes, they will dictate prices, availability and terms. It’s a classic bait-and-switch[6]. Their goal is total market dominance. The owners of craft breweries should understand why it is important to support small independent merchants. They are the hop equivalent of a craft brewery … but these are difficult times. Everybody needs to save money to survive. What then is the argument for drinkers of craft beer to support their local brewery? We must support local or we will there will be very few choices in the future.

If you find my articles valuable in any way, I would like to ask you to return some of that value by subscribing or sharing it with somebody else who might find it valuable. A few months ago, I decided to charge for these articles. Thank you to the many people who subscribed to support my work. That was a mistake. I discovered that charging for the articles took the joy of writing out of the process. I would rather continue to write these articles and provide them for free and enjoy the process than sell them and lose the pleasure in writing. Those who paid for a subscription received a refund. That is why I ask that you please consider subscribing to this Substack if you haven’t. You can also share the articles to spread the word and enlighten brewers around the world. That would make writing them even rewarding. Thank you.

CLASH OF THE TITANS

On May 20, Roy Farms and Loftus Ranches announced a new partnership (Figure 1). You may have heard of Roy Farms as they sell hops direct to brewers[7]. For those of you who haven’t heard of Loftus Ranches, it’s owned by the Smith family[8]. That’s the same Smith family that is an owner of Yakima Chief Hops (YCH)[9] and Yakima Chief Ranches (YCR)[10]. you’ll see a page about Loftus Ranches. It is through YCR that they own part of the Hop Breeding Company (HBC)[11].

Figure 1. Press Release regarding Loftus-Roy Partnership

Analysis:

I’ve been contacted by several people asking what I think this means. I want to preface my comments by saying that I don’t have any inside information from either of these companies. The opinions below are mine and mine alone as is the case with the analyses in this entire article.

Several people who read the press release thought that perhaps this meant that Roy Farms is now part of YCH. Below is my interpretation of the announcement and its significance.

Roy Farms owns the ADHA (now Latitude 46) together with Greenacre Farms[12]. According to the 2023 USDA National Hop Report, the total acreage for the ADHA varieties Azacca®, ADHA-483 and Pekko®, ADHA-871 was 1,446 acres (585 hectares)[13]. That’s not enough acreage to sustain those two farms at the level to which they had grown accustomed prior to the 2023/2024 mandatory acreage reductions. The other four varieties owned by the group (i.e., Summit™, Adeena®, ADHA 218 and ADHA 1624) were not published by the USDA in 2023. That means they were not produced on more than three separate farms and fall in the other category. Most varieties that fit that description lack the necessary demand to warrant production on more than three farms.

The owners of Loftus Ranches (i.e., the Smith Family) has partial ownership in Yakima Chief Ranches, Yakima Chief Hops, the Hop Breeding Company, Balebreaker Brewing. Those are the highest profile hop-related entities. There are many more. I explained their involvement with cited sources in my April 2023 article entitled, “The secret behind who controls the hop industry”. The proprietary varieties to which they have access can easily fill Loftus Ranches acreage. I suspect Loftus did not have mandatory acreage cuts in 2023 and 2024.

Most farmers in the Pacific Northwest produced Citra®, HBC 394 or Mosaic®, HBC 369 for HBC-affiliated merchants. These two varieties have been two of the three most widely-planted varieties since 2020 (Figure 2).

Figure 2. Hop Growers of America Top Ten Pacific Northwest Varieties by Acreage.

Source: Hop Growers of America Statistical Report.

According to the YCH website, Roy Farms is not an owner in YCH[14]. As a non-owner of YCH, there is a good chance they were one of many independent farms forced to cut acreage of those and other proprietary varieties in 2023 and 2024. I explained why independent companies like Roy Farms were vulnerable is in my November 2023 article, “A Silent Hop Crisis is Brewing”.

The press release references the younger generation (i.e., Patrick Smith and Michael Roy) instead of their fathers (i.e., Michael Smith and Leslie Roy). This is a significant sign of a generational transition taking place behind the scenes as the elder generation takes a less prominent role. My personal belief is that the elders negotiated this deal due to its sophisticated nature.

In my opinion, the move has the potential to be brilliant for both parties. Loftus gains access to idle acreage and efficient picking capacity without building or buying it. They can grow faster and at lower cost than their competitors (i.e., every other hop farm in the Yakima valley … including other YCH owners who should be concerned as this may signal long-term intentions). Roy Farms can avoid downsizing and removing efficient infrastructure into which they invested heavily. Roy Farms attaches their infrastructure to YCH-related demand despite the fact that they are a non-owner. Opportunities like this offer a chance at future survival. They will be limited.

The risk for Roy Farms is that Loftus grows stronger while Roy Farms grows weaker. That could lead to the absorption of Roy Farms hop-related facilities by Loftus Ranches. That may not be obvious today, but in 2021 this type of partnership would have been unthinkable. I am reminded of the merger between the YCH craft division and HopUnion. That led to the ultimate disappearance of HopUnion[15].

If craft brewers continue their insatiable demand for proprietary varieties, farmers who lack access to popular varieties will have difficulty finding a future in the industry. Farms that produce proprietary varieties can produce public varieties. The opposite will not always true as consolidation continues. The access to additional acreage and picking capacity this agreement provides supplants the need for several smaller farms. That enables an accelerated industry wide consolidation. I believe it insulates Roy Farms from further HBC-related acreage reduction while allowing them to remain independent. That means they have a chance for success in the future. Farms that want to succeed need to be in the game going forward. They’re not guaranteed success by any means. If they aren’t in the game, they cannot win. Many farms will struggle to survive the coming hopocalypse[16].

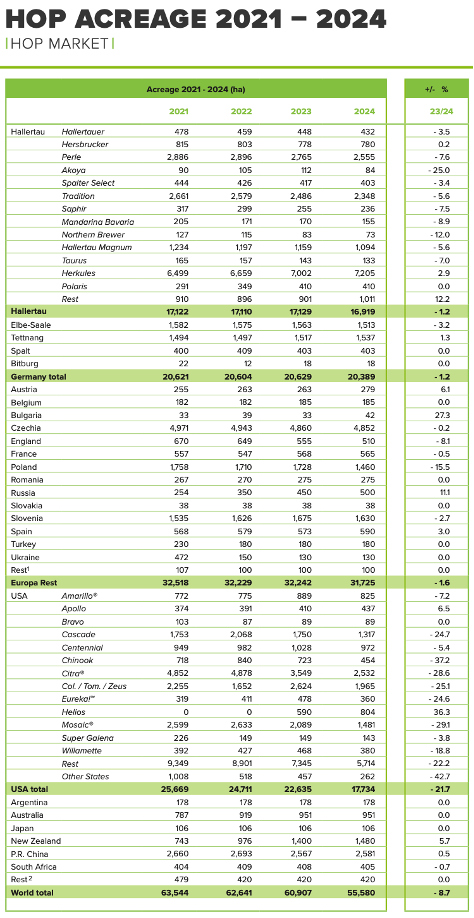

HOPSTEINER ACREAGE ESTIMATES

In mid-May, Hopsteiner Germany published global acreage estimates for 2024. These data, which they made available on their web site and on Instagram, provided a first look at U.S. acreage changes. They paint a clear picture of a contracting industry with the greatest amount of change coming from the U.S. (Figure 3).

Figure 3. Hopsteiner 2021-2024 global acreage estimates

Source: Hopsteiner[17]

USDA acreage figures for the Pacific Northwest will be available in the second half of June. I will wait to provide my analysis of the data until then. While I have no doubt the Hopsteiner numbers are accurate, USDA statistics have been the base for U.S. data comparisons for decades. For consistency, I will continue to use them.

Hopsteiner has several Instagram pages that appear to give realistic assessments of current growing conditions. The Hopsteiner UK page published a May 2024 Hop Crop Report in early June that appears to give a good unbiased view of growing conditions.

During May, the Hopsteiner Instagram page posted multiple weather updates that provided accurate reports of growing conditions in the U.S.

If you haven’t already followed the Hopsteiner pages on Instagram, and you’re interested in knowing what’s happening in the industry, you might consider following them. Of course, they post Hopsteiner promotional posts like their competitors. They seem to understand the principles espoused by Gary Vaynerchuk in his book “Jab Jab Jab Right Hook”[18]. In it, Gary states you should be giving much more value to your audience than you are asking from them.

Posting accurate reports about growing conditions should be the industry norm. It’s not. Social media posts by merchant/farmers often try to sell something or exaggerate concerns over weather and pest related problems to create the impression the crop is in jeopardy. I believe they do this to create contract demand and sales. Since brewers may not know any better, they believe what they read. That’s a greedy strategy.

Thank you Hopsteiner for introducing honest reporting and great educational material into the social media mix. I hope more merchant/farmers begin to follow your lead to encourage greater transparency in an opaque industry.

WATER WATER EVERYWHERE

Heavy rains in Germany flooded towns across the hop growing regions. As the Instagram page of the German Hop Growers Association (verbanddeutscherhopfenpflanzer) shows, hop fields were not spared. Although it looks bad, as mentioned by the association in their post (translated from the original German), it is too soon to say whether the crop will be affected. That depends on the weather conditions in the coming weeks.

Source: Instagram[19].

IHGC MAY MEETING

On May 17, 2024, the International Hop Growers Convention (IHGC) met in Freising, Germany[20]. Representatives from each country in attendance presented a report on the situation in their production area. They highlighted acreage changes and trends in supply and demand. They commiserated about the surplus and its effect on the market while trying to find a solution. Although I was in Germany that week, I did not attend the meeting. Meetings are open to members only. For the past few years, the most valuable IHGC information is behind a paywall with restricted access. The merchant/farmer collusion I discussed in my September 2022 article, “Who Sets Hop Prices … and How?” however is effective at disseminating this type of information behind the scenes. There are no secrets for long in the hop industry.

As a result, I was able to read the merchant market report. In it, there were plenty of details that hop nerds like me love reading. I won’t bore you with those though as none of them were unique to the IHGC. The merchant report was more interesting. It contained an article published in the German Hop Growers Magazine in March 2024 titled “Hop Market – Quo Vadis”[21]. As I could not find that article anywhere online, it is included in its entirety below (Figure 4).

Figure 4. March 2024 German Hop Growers Magazine article “Hop Market – Quo Vadis”

Press release German Hop Industry Association

Hop market - Quo vadis?

We are pleased to take the half-time of the marketing campaign for the 2023 harvest as an opportunity to present the current market situation to you and to take a look into the near future.

Although the slowdown in the global economy in previous years did not usually have a direct impact on the brewing industry and the hop industry apparently came through the pandemic years 2020 and 2021 better than expected, in retrospect influences have accumulated that are the cause of the visible turna- round in the hop market.

The inflation that set in after the pandemic had an impact on the hop market, with the result that the brewing industry worldwide was confronted with considerable cost increases in the amount of 20-25% and purchasing power was weakened at the same time. As a result, beer consumption patterns changed on almost every continent, making a return to pre-pandemic beer output levels a distant prospect.

The disruptions to supply chains that began in the same period caused numerous brewery customers to increase their physical stockpiling in 2022 being in concern about supply - an effect that became apparent last year, when physical stocks began to be reduced after supply chains returned to normal and a noticeable decline in call-offs characterized market activity. As a result, the seemingly brisk call- off behaviour in the calendar year 2022 gave a false picture of the actual demand situation.

For all these above mentioned reasons, a cumulative stock of at least one normal harvest equivalent to approx. 110,000-120,000 tons of raw hops has probably built up globally, of which an estimated 25% relates to the European market. These roughly estimated stocks of hop products with a market value of around 250 million Euros of German or European provenance are mainly held by hop marketing com- panies in cold storage facilities in Germany. This is increasingly leading to major financial burdens due to increased interest rates and storage costs. The purchasing behaviour of the brewing industry has visibly changed in recent decades, similar to other sectors. While it used to be common practice for the hops ordered by the brewery for the upcoming brewing year to be delivered to the brewery relatively shortly after the harvest, paid for and stored there, storage has increasingly been switched towards hop marketers over the years.

A visibly more restrictive alcohol policy in the leading industrialized nations, fears of inflation, political crises and the demographic ageing of society are not helping to strengthen beer sales and are hindering the reduction of stocks sold under contract but not delivered. In addition, there are increasing changes in recipes, with cost savings being generated by switching from more expensive aroma hops to bitter varieties.

All these factors mean that the hop industry is reaching its limits along the supply chain in terms of financing and storing stocks, which are mainly financed by loans from banks, which in turn are placing increasing demands on their borrowers.

In order to bring the market back into balance in the foreseeable future, the acreage would have to be noticeably reduced in order to adapt to the lower demand situation. Particular attention should be paid to some flavor varieties whose global demand is declining disproportionately. There is currently no acute oversupply of marketable bitter varieties of German origin, although the general reluctance to buy can also be felt in this segment.

In this context, in order to ensure a stable and reliable supply chain from hop growers to brewers, all market participants are required to negotiate the adjustment of preliminary contracts, for which the ne- cessity of each adjustment varies depending on the merchant, and to meet their respective responsibil- ities for correcting acreage and adjusting contract volumes.

This is particularly important because hop growers in Germany currently still have a high proportion of preliminary contracts until 2025. Sustainable follow-up contracts on the part of the brewing industry are essential for maintaining production at cost-covering prices beyond this period in order to provide secu- rity in planning for the coming decade. A lack of follow-up contracts after the 2025 harvest could lead to the acreage reacting too strongly, with many hop growers reducing or even giving up hop growing.

Pascal Piroué

Chairman

German Hop Industry AssociationPfaffenhofen, March 4, 2024

In my opinion, the most noteworthy part of the Quo-Vadis article was:

“a cumulative stock of at least one normal harvest equivalent to approx. 110,000-120,000 tons of raw hops has probably built up globally, of which an estimated 25% relates to the European market.”

For anybody who may not be so comfortable with the metric system, 110,000 – 120,000 tons of raw hops translates into 242,5 – 264.5 million pounds of hops! That sounds like a lot of hops. I believe the cumulative stock mentioned in the article is a conservative estimate of the surplus. Over the past 20 years, the industry has stored an increasing volume of hops for the brewing industry. Since 2011, it has become common to store the equivalent of two years of U.S. hop production (Figure 5).

Figure 5: Depletion of U.S. stocks relative to total supply

Source: USDA

The Quo Vadis article mentions raw hop inventory. Figure 5 represents total hops, processed and non-processed, domestic and foreign, that moved from inventory between September 1 and March 1 of the following year. Factor a three to seven percent loss based on the type of processing (i.e., pellets or extract). If the hop industry held no aging inventory in storage for breweries, the ideal depletion rate would be 50% by March 1st, halfway through the year. Because the hop industry has moved to holding an increasing amount of aging inventory for the brewing industry, the depletion number is much lower. The lower this number goes the greater the financial burden for the companies holding that inventory … and the higher the price of hops must be. While it may be tempting to blame breweries for not taking their inventory in a timely manner, the surplus is a self-inflicted wound. Forced long-term contracting results in surpluses. I’ve explained why merchant/farmers push contracts in my August 2022 article, “The Con in Hop Contracts”. I’ll explain in a future article how contracts guarantee surplus production every year.

The 2024 depletion number in figure 5 above should be at least 25% for the brewing industry to make steady progress toward using the two years of inventory in storage in a timely manner. Ten of the past 12 years have been below 25% depletion. This is evidence of overproduction and a growing inventory problem. Despite the acreage reductions of 2023 and 2024, the situation has not improved.

The Quo-Vadis letter referred to the additional expense associated with financing hop inventory. That is an important part of the problem that brewers may not see at first. The cost of storing over two years of hops worth more than over one billion dollars is now over $100 million per year. The U.S. Federal Reserve (FED) is not expected to decrease interest rates when it meets on June 11th and 12th [22]. The interest and storage fees charged by various merchants are do not pay for the principal associated with the growing surplus.

Surplus Market Sales Tactics

This has the potential to change the way hops are sold in the future. In March 2023, I wrote an article called “Surplus Contracting Tactics” which you should read if you want to understand the hop cycle. I believe once the surplus is fixed the next wave of sales to brewers will include more innovative ways to supply breweries. They will find a way to lock in brewers to capture value and supply hops while somehow enabling flexibility to revise contracted amounts. If they do, this will be a welcome relief to the old ways that served the needs of hop merchant/farmers. Any new system will survive until a shortage arrives, at which time the industry will revert back to locking brewers in for five years by threatening not to produce. Why … because in a seller’s market hop merchant/farmers capitalize on brewer fear to get whatever they want.

[1] https://drescherlaw.com/chapter-11-three-reasons-why-reorganizations-fail/

[2] https://www.capitalpress.com/state/oregon/hop-merchants-founder-to-sell-farm-under-proposed-bankruptcy-plan/article_74ce930a-237e-11ef-b52b-df7fe87a1642.html

[3] https://tradingeconomics.com/united-states/inflation-cpi

[4] https://www.rl360.com/row/tools/inflation-calculator.htm?Currency=1&AmtSaved=130000.00&YrsToKeep=5&InflRate=3.5&Calculate=Recalculate

[5] https://www.investopedia.com/terms/w/walmart-effect.asp

[6] https://www.merriam-webster.com/dictionary/bait%20and%20switch

https://shop.royfarms.com

https://www.loftusranches.com

[9] https://www.yakimachief.com/commercial/about-us/our-company

[10] https://yakimachiefranches.com/history/

https://www.hopbreeding.com

https://latitude46.com

[13]https://www.nass.usda.gov/Statistics_by_State/Regional_Office/Northwest/includes/Publications/Hops/2023/hops1223.pdf

[14] https://www.yakimachief.com/meet-the-growers

[15] https://brookstonbeerbulletin.com/hopunion-merges-with-yakima-chief-craft-division/

[16] https://mackinnonreport.substack.com/publish/posts/detail/143473720?referrer=%2Fpublish%2Fposts

[17] https://marketing.hopsteiner.de/hubfs/campaigns/Anbauflächen%20Update/2024-05_acreage-forecast.pdf?utm_medium=email&_hsmi=87685343&utm_content=87685343&utm_source=hs_email

[18] https://www.amazon.com/Jab-Right-Hook-Story-Social/dp/006227306X

[20] https://www.ihgc.org/activities/freising-germany-2/

[21] “Quo Vadis” is Latin for “Where are you going?”

[22] https://apnews.com/article/federal-reserve-rate-cuts-inflation-spending-b85c813418a1d00cfcf0391e9441ce02