Collaboration, bankruptcy, low hop prices, two predictions and more

The MacKinnon Report: March 14, 2024

Introduction

The name of this first section will change when I come up with something more clever than “Introduction”. The idea is just to share some things going through my mind as I write the rest of this edition of the MacKinnon Report. You’ll notice the format of the report is quite different than in the past. My goal is to have multiple smaller articles covering various topics instead of focusing on one larger topic. I hope you enjoy it.

In 2008, the U.S. hop industry increased acreage by 9,987 acres (4,043.3 hectares) over 2007 production. Because of the way contracts are structured and how the industry is financed, it has never been good at decreasing. That’s causing a lot of grief for farmers and merchants today. I didn’t happen in 2023 when Alex Barth told the industry a 10,000-acre (4,048 ha.) reduction was necessary[1][2]. Again, in 2024, the industry has been called upon to reduce 10,000 acres[3]. I predict it won’t happen in 2024 either. This is due to the delayed surplus response[4] (DSR). A significant portion of the infrastructure in place that created the surplus must go. Farmers and merchants leaving the industry or filing bankruptcy is inevitable. There is no graceful way out of the industry in a down market. The Willamette Valley Hops LLC chapter 11 bankruptcy is a sign that these are desperate times (See: “The Willamette Valley Hops LLC Bankruptcy” below). This will create amazing purchase opportunities for aroma hops that may be two to four years old. Speaking of which … That’s already happening (See: “How low can you go?” below). If for no other reason, these old hops represent an opportunity to purchase cheap bittering at significant discounts.

The global slowdown in demand for beer is causing significant changes and creating opportunities for greater localization in the brewing industry[5]. The most significant source of income for the hop industry (other than bank financing) is the brewing industry. Brewer cash flow shortages have trickled down to hop merchants and farmers for the past few years combined with the hop industry’s reluctance to stop expansion resulted in tens of millions of pounds (thousands of metric tons) of surplus. Companies without huge lines of credit enabling them to carry brewing industry inventory will have trouble surviving inventory … hence the problems at Willamette Valley Hops (WVH). This means the number of independent farms and merchants will decline. That will lead to a leaner less competitive hop industry. The question in 2024 is who will stay and who will go. Once the surplus has cleared, if brewery preferences do not shift away from proprietary varieties, future inventory will be better managed, and prices will be higher.

The dominance of proprietary hop varieties has led self-censoring. I have spoken with several brewers who were afraid to speak out against, or do anything that might be perceived as negative by hop merchants they dislike. They were afraid they might lose access to the proprietary aroma varieties those merchants control. Yakima Chief Hops™, as one of the largest hop merchants in the world, is one of those companies many brewers fear. I’ll explore some potential consequences of their recent collaboration with Charles Faram (See Yakima Chief Hops™ below).

Proprietary variety owners are the oligarchs that run the U.S. hop industry. A change back to public aroma hop varieties would reduce their power. Their desperate extraction of surplus high alpha aroma varieties to restore balance to the aroma markets will destroy the world alpha market for years to come. That has not been their primary profit center for the past decade. Since alpha acid remains a commodity, the proprietary alpha variety game will remain price based for some time to come. That too represents a buying opportunity for breweries using alpha acid. I’ll include some suggestions for brewers below.

The Willamette Valley Hops Bankruptcy

Most people in the hop industry have heard about the Willamette Valley Hops LLC (WVH) bankruptcy. Over the past two months, they have still not acknowledged the bankruptcy filing on their website. Nor have they responded to requests for comment by media or on their social media accounts (Figure 1)[6][7].

Figure 1. Willamette Valley Hops LLC LinkedIn header

Source: LinkedIn[8]

According to profit and loss statements available at the government website Pacer, WVH experienced financial problems since 2021[9]. They reported a $3.5 million loss on total income of $18.8 million in 2021. In 2022, their total income declined to $15.7 million. WVH reported a loss of $158,560.02 that year. In 2023, WVH total income declined again to $12.77 million while reporting a loss of $1.59 million.

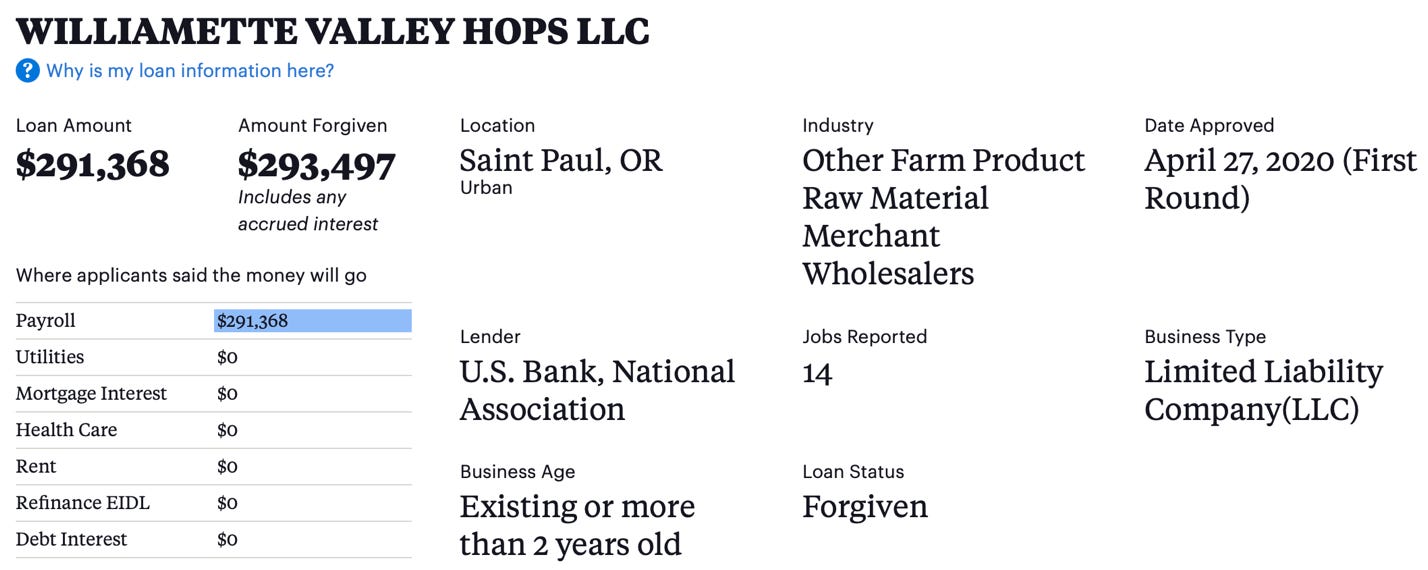

Bankruptcy court does not require more than three years of financial reporting, so we do not know if WVH financial problems existed prior to 2021. The company received a Paycheck Protection Program (PPP) loan in 2020 for $291,368 that was forgiven together with accrued interest in 2021 (Figure 2)[10].

Figure 2. Willamette Valley Hops LLC Covid inspired PPP loan amount and forgiveness.

Source: ProPublica

In its February 1 article, the Capital Press reported that WVH expected more than $6.5 million in sales by July, which they claimed would result in $200,000 in profit[11]. For those of you interested in the math, that equates to three percent profit.

As a recovering hop dealer with intimate knowledge of the process WVH is enjoying, I suspect their anticipated revenue estimate is based on their 2023 total reported income. They seem to be using the most optimistic figures available that can be justified. Those sales estimates are too optimistic in my opinion given the circumstances. They don’t consider the trajectory of their 2021–2023 income or, as reported by the Yakima Herald on February 16th, that the hop market is saturated[12].

The WVH February 13th profit and loss statement claimed a total income of $462,492.90 with a net profit of $11,541.38. Hop sales tend to increase in the spring in the U.S. Perhaps a massive surge will enable them to meet their goal of an additional $6 million in sales by July. Their promotional activities on LinkedIn are trying to move toward 2020 and 2021 inventory into the market (Figure 3)[13]. It will be difficult for such old inventory to compete with newer surplus inventory available on sites like the Lupulin Exchange or via private vendors.

Figure 3. Assortment of Willamette Valley Hops promotional LinkedIn posts.

Source: LinkedIn

A chapter 11 bankruptcy is a normal way for companies to restructure their debt while protecting their assets in a changing market[14]. Airlines often reorganize under Chapter 11 bankruptcy[15]. Calls for reduced acreage in 2023 and 2024 by over 25% from its peak demonstrate the extent to which the market has changed[16][17][18]. By giving WVH the opportunity to restructure their debt, the company can emerge from Chapter 11 protection healthy and intact as intended by the bankruptcy statute[19].

According to bankruptcy documents filed, WVH owes John I. Haas (JIH) $8.8 million. Other than Gooding Farms[20]and Clayton Hops[21], there appear to be no other hop suppliers on the WVH creditor list. The JIH leadership has behaved in a rational manner. Despite being part of the Barthhaas group, one of the largest hop merchant groups in the world, their actions reveal that JIH is practical and not ego driven. Instead, they seem clever enough to recognize the survival of WVH will bring them more value than its destruction. According to bankruptcy documents, at this time it seems there will be no creditor committee. That’s a good sign for WVH. It will simplify the procedure and reduce the cost. It also increases the likelihood that they can emerge from chapter 11 protection with manageable payments to the IRS, U.S. Bank and unsecured creditors like JIH.

JIH continues to list WVH as one of their distribution partners on their website (Figure 4)[22].

Figure 4. John I. Haas distribution partners

Source: John I. Haas web site.

During the 2023 Craft Brewers Conference JIH created what they referred to as the “Haas Hop Village”[23]. Despite their relationship, WVH wasn’t among the villagers. Instead, they had a separate booth in a different part of the Brew Expo America®[24]. We can speculate that difficulties between the two companies that led JIH to file suit against WVH for more than $8 million in November 2023 contributed to their absence from the village[25]. JIH has not addressed the WVH bankruptcy filing on their web site[26].

I think the people at JIH recognize there is value in keeping WVH intact … beyond receiving some or all of their outstanding debt. In my opinion, WVH can provide useful functions to JIH.

WVH can service smaller breweries that are more time consuming and expensive at different price points. This does not prohibit JIH from servicing small customers, however, if it chooses,

It enables WVH to dump old surplus inventory on the market at prices JIH would have to reject for fear of word spreading through the brewing industry,

WVH insulates JIH from riskier customers. Smaller companies are more prone to erratic behavior, contract abandonment, inability to pay or even failure than larger well-established companies[27][28][29]. If I oversaw a large merchant company, I would want the most stable customers. If I could still somehow generate revenue from sales to less stable customers. A subsidiary partner like WVH would be an ideal situation.

Other than the risk of not being paid by unreliable customers, the risks of this type of distribution structure to JIH include potential antitrust violations. The differences between legal and illegal activity are subtle. That makes it difficult to prove in court. According to the Federal Trade Commission, antitrust violations can occur when there is:

1) Exclusive trading / Requirement contracts[30] – an arrangement that prohibits the subordinate partner in a vertical arrangement from working with competing producers that are competitors of the more powerful member of the arrangement.

a. A hypothetical example of this would be if JIH required WVH to agree to not sell HopSteiner proprietary varieties. That could cause WVH to lose business they might need to be successful. I did not see any Hopsteiner proprietary varieties listed on the WVH website when I looked on March 9th[31]. That may be the company’s choice. It cannot, in and of itself, however, be interpreted as evidence of any wrongdoing by any of the parties involved.

2) Manufacturer imposed requirements[32] – If a company makes an independent decision to unilaterally restrict its business relationships or price, that is legal. If, however, such decisions are a result of an agreement between two independent suppliers or is imposed upon the subordinate partner, there exists the potential for antitrust violations.

a. Determining whether restrictions are “horizontal” or “vertical” can be confusing. Car manufacturers avoid the appearance of potential antitrust violations by issuing a manufacturer’s “suggested” retail price. The car dealer is free to choose if he wishes to adhere to that price.

3) A refusal to supply[33] – A company must be free to work with whomever they choose “so long as the refusal is not the product of an anticompetitive agreement with other firms or part of a predatory or exclusionary strategy to acquire or maintain a monopoly.”

a. A hypothetical example of this pertaining to the hop industry would be if the owners of Yakima Chief Hops™ and JIH who share ownership in the Hop Breeding Company[34][35][36] agreed to prohibit a common competitor from buying certain proprietary varieties. Each company can come to that decision on its own. If, however, an agreement existed between the companies, that could be reason to investigate for potential antitrust violations.

The WVH bankruptcy is a symptom of a contracting system designed for the world’s largest breweries forced upon smaller craft breweries. It is not able to adapt to decreases in demand. The slowdown in cash flow and the buildup of inventory that led to the WVH bankruptcy are the most obvious side effects of the underlying problem.

Since there is no pressure by creditors wanting to drive WVH out of business, its contracts will remain valid and enforceable. That too is smart. The ability to reorganize their debt to JIH will enable WVH to make payments at a slower pace. That reduces the pressure for WVH to generate cash quickly. If their inventory is contracted, they can force brewers to fulfill those obligations in time. Their debts will be paid, albeit over a longer period. If their outstanding debt consists of unsold spot inventory from older crops, in the current market they will need to sell at deep discounts to be competitive.

It appears from their promotional efforts on social media that WVH has aging inventory they need to sell at low prices (Figure 2). The desperate need for cash under chapter 11 bankruptcy protection means WVH will be inclined to accept low and unreasonable offers. That will lead to the partial repayment of unsecured creditors, like JIH. That will be better than no payment at all, which is the alternative if the company is driven out of business. Reduced payments to unsecured creditors can be renegotiated as part of the WVH plan due on May 20th.

If WVH is unable to sell its inventory and meet its proposed obligations, they may need to convert their chapter 11 to a chapter 7 liquidation bankruptcy. Under that scenario, unsecured creditors receive little if any compensation. Many brewers would escape with little or no payment as forward contracts in that situation are worthless. For brewers looking for a buying tip … this is an opportunity for brewers or merchants with the ability to pay immediately looking for deep discounts.

As the situation continues to develop, I will keep you posted.

“War is peace. Freedom is slavery. Ignorance is strength.”

- George Orwell, 1984

How low can you go?

As mentioned above, there will be incredible buying opportunities in the coming years. One worthy of attention hit the Lupulin Exchange on March 14, 2024 (Figure 5).

Figure 5. Low Price Citra ®, HBC 394 hops for sale on Lupulin Exchange.

Source: Lupulin Exchange

Prices falling to this level is good and bad. It is good because it means that people are beginning to realize they should get ahead of the market if they want to liquidate their surplus. It’s bad because it means there is so much inventory on the market that higher prices aren’t warranted. This represents an incredible buying opportunity for any brewery, large or small. If for no other reason, Citra ®, HBC 394 at $4.00 per pound represents an opportunity for cheap bittering. I’m not suggesting you do anything that makes you uncomfortable. If I were interested in buying that $4.00 Citra ®, HBC 394, I’d contact Randy at US Hop Source directly and see if I could buy it off the LEX to save their commission. You do whatever makes you feel good though. If you’ve heard of any great good prices you’d like to share, please don’t be shy … let me know and I’ll pass the word along.

Houthis & the cost of beer

Geopolitics has affected the cost of container shipping over the past six months. Cargo traffic through the Red Sea is 50% lower than one year ago due largely to the attack by Hamas on Israel on October 7, 2023[37][38]. Tension in the Black Sea resulting from conflict between Russia and Ukraine and a drought in the Panama Canal are no less serious and have contributed to supply issues and a slowdown of container shipments worldwide leading to soaring prices[39][40][41].

The situation in the Red Sea may be far from the minds of most brewers, but fertilizer, grains and other essentials have been detoured around the region[42]. Even if none of the goods traveling around Africa are destined for breweries, shipping times and container availability for goods around the world are affected. The detour around the horn of Africa increases shipping times in the region by 10-15 days (30%). That affects 25-30% of the world’s container traffic[43][44][45]. The supply of containers and ships carrying them has been stretched thin causing prices increases for everything from food to energy[46]. The world’s largest shipping companies are welcoming the price hikes after 2023, which saw decreasing prices[47]. Maersk, the second largest shipping company in the world, says they will increase capacity by nine percent by year’s end[48][49]. Despite that response, Maersk North America regional president, Charles van der Steene says he sees the situation extending into the second half of 2024[50]. With tensions in the middle east high and no end in sight, container rates are expected to remain high[51].

All of this might seem removed from beer production. The globalization upon which the brewery supply chain depends makes it vulnerable to such things. The detour around Africa for 25-30% of the world’s container traffic impacts the cost to ship malting barley and hops to customers worldwide. Although most malting barley is shipped overland by rail due to its weight, a significant amount of malting barley travels by sea in containers[52][53][54]. Terroir and region-specific hop variety production ensures that millions of pounds of hops (thousands of metric tons) travel by container overseas each year. In 2023, the U.S., the world’s largest hop exporter, shipped 16.5% of the 100+ million-pound (45,000+ MT) U.S. hop crop overseas[55].

The shipping market, like the hop market, is experiencing backwardation. Backwardation is when the spot price of a commodity today is higher than its cost in the future[56]. It removes the incentive for buyers to commit to longer-term contracts. Knowing that future shipping prices will decrease has caused companies to delay negotiating new contracts[57]. The world’s brewers, many of whom already have surplus hops they need to use, are in a similar position. The result is that hop farmers in 2024 are seeing few if any forward contracts[58].

Breweries are increasing prices to consumers to compensate[59]. The problem is that breweries are not able to pass along all these costs to their consumers. Today, there is fierce competition among craft brewers experiencing less demand in a mature market while increased competition from other beverage options continues to reduce market share[60][61].

YAKIMA CHIEF HOPS™ … One Ring to Rule Them All

What does the recent announcement about the collaboration of Charles Faram and Yakima Chief Hops™ (YCH) mean? It doesn’t have anything to do with hobbits, but the Lord of the Rings analogy may be relevant. The new collaboration could be, as the press release says, a way for Charles Faram to offer YCH varieties to their customers. That would be wonderful for Charles Faram customers wanting to buy YCH varieties.

When I read the press release, I was reminded of the Arab proverb to not let the camel get his nose inside the tent because if he does, it will soon be impossible to keep the rest of the camel from entering[62]. The language of the press release reminded me of a time in 2006 when Yakima Chief and HopUnion merged their craft divisions[63]. The HopUnion name disappeared from the hop world eight years later. Most brewers today haven’t been brewing since 2006 and may not understand the analogy or the significance HopUnion once had to the craft beer industry. What leads me to make the comparison is not because I think anything bad about Charles Faram. They’re a great company and I hope they continue for another 150 years. I know that the people at Yakima Chief Hops™ are clever. They are crafty, and they seem to have world domination on their to do list.

This article will be a little different from those I’ve written in the past. If I was talking with somebody with a similar amount of time in the industry today, this is what I’d be talking about with them over lunch. I thought I’d share that with you because it’s probably not something you’ll hear anywhere else. Please take into consideration that this article is based on my thoughts and observations and is mainly speculation. That said, I don’t think it paints an unrealistic picture of the future. Time will tell.

Language Matters

It may take years, as it did with HopUnion, but I believe the cooperation announced between YCH and Charles Faram is the equivalent of that camel getting his nose in the tent and may be an early sign of coming industry changes. It’s hard to say exactly what form that might take. A hop merchant company can absorb another as happened with YCH and HopUnion[64]. Two hop merchant companies can maintain the appearance of independence, as is the case with the “strategic partnership” between John I. Haas and Yakima Valley Hops[65]. Based on their actions though, it’s clear that YCH has aggressive goals to grow its global network so they can better distribute their proprietary varieties (see the timeline below). This collaboration between YCH and Charles Faram secures the UK for them.

YCH World Domination Timeline

2018 Yakima Chief-HopUnion rebrands itself as Yakima Chief Hops™

2023 YCH and Charles Faram announce a collaboration in the UK market.

The text from this week’s announcement, which you can read here if you’ve not already seen it, contains some familiar language.

“Following feedback in our customer survey,” says Paul Corbett, Managing Director at Charles Faram “to have more YCH products available we are delighted to announce this new collaboration. We will now be able to offer the excellent YCH varieties and products and give our customers easy access to them from our store here in the UK. We believe it is very positive for all parties.” The announcement continues “To complement YCH’s direct presence in the UK market, we look forward to brewers having improved access to our products through Charles Faram’s extensive network,” says Dean Monshing, Senior Vice President of Global Sales for Yakima Chief Hops. “Charles Faram & Co. works with almost everybody in the United Kingdom. They have a long history with the brewing community, and we are happy to see our brand interlinked with their longstanding service.”

Under this agreement, Charles Faram will sell YCH varieties to its customers[66]. So long as they retain the right to sell YCH varieties, that has the potential to be a great arrangement. If that license expires, everything changes. During my previous life as a hop dealer, I had the owner of a proprietary variety revoke my license to sell his variety. He discovered who my customer was. There were millions of dollars at stake. He decided he wanted to sell to my customer directly. Not nice, but completely legal. Every patent owner has the right to exclude others from producing or selling their property[67][68].

Remember HopUnion?

In 2006, HopUnion merged with Yakima Chief Hops’ craft division. In the press releases regarding the merger, Ralph Olson, general manager of HopUnion at the time, claimed the two companies would continue to run independently[69]. The language used was like this week’s announcement.

“We believe this merger will help provide more selection of hop varieties as well as better stability in the supply and demand chain,” said Ralph Olson, general manager and one of the owners of Hopunion Craft Brewing Sales, LLC. “Our ability to take care of the needs and desires of the customer will be greatly enhanced.”

If we go back a little further in HopUnion USA history to their 2000 merger with John I. Haas, we again see very similar language[70].

"We believe that the new company will be able to give customers the most comprehensive services by offering the widest possible range of products and varieties from all geographic areas," a spokesperson for Joh. Barth said. "The new company will have the critical mass needed to respond to the requirements of a rapidly consolidating worldwide brewing industry. The brewing industry of the future will demand a greater worldwide presence and the ability to satisfy ever growing quality standards. As a fully integrated company, it will have the flexibility to meet the logistic and product requirements of small, medium and large customers."

What’s next?

I think I speak for all English speakers worldwide that we are thankful to abbreviate the Hopfenverwertungsgenossenschaft e.G., as simply HVG. I believe the HVG would be an attractive target for YCH. At the moment, they have an arrangement with the Brewers Supply Group in the U.S. It represents most German farmers and has a well-established customer base[71].

Behind MillerCoors, HVG is listed as Brewers Supply Group’s (BSG) second largest trading partner on the Import Genius web site with 281.5 metric tons (620,594 pounds) shipped in the past year[72]. On the website Import Yeti, BSG is listed as HVG’s largest trading partner[73]. We don’t know the quantity of hops sold between the two companies. That’s confidential. It appears, however, from available public data that the relationship is significant. That alone makes them an attractive target for YCH. The two do not share a similar structure. As a “grower-owned” hop merchant company, HVG fits the YCH model. Even though nobody in 2024 can imagine it, a merger between the two seems inevitable to me.

If not now, when?

The man who made the HVG what it is today, Dr. Johann Pichlmaier, retires at the end of 2024 and his successors named[74][75]. During his tenure, Dr. Pichlmaier unified German farmers and became the face of the German hop industry[76]. I have had the privilege of knowing him and consider him a friend. I can say he is as kind as he is brilliant. The hop and beer world have changed during his tenure. Based on trends in variety acreage, breweries today are not opposed to proprietary varieties even though they concentrate power in fewer hands. The German hop industry has a well-developed variety breeding program. Their proprietary varieties have not enjoyed great success. Distribution and access certainly contribute to their poor performance.

The change in leadership at HVG may open the door to new relationships and a different world view over time. It will not be difficult for a global company like YCH to dangle the carrot of a global distribution network in front of the new leadership at HVG. They may refuse at first. From the YCH perspective, the German hop industry is the biggest piece missing from the puzzle of world domination YCH has assembled. An attractive partnership proposal could appear to be a win-win. From the German perspective, I can imagine how it would be difficult to refuse.

I don’t have any inside information about the long-term plans at YCH. Knowing the industry as I do, I would be surprised if HVG is not on their shopping list. I am not suggesting that would happen in 2025. On a longer time scale, once the current surplus is gone and the people who own proprietary varieties begin to tighten up their supply chains, I believe the odds of some sort of cooperation between the two increases.

“First they came for the socialists, and I did not speak out—because I was not a socialist.

Then they came for the trade unionists, and I did not speak out—because I was not a trade unionist.

Then they came for the Jews, and I did not speak out—because I was not a Jew.

Then they came for me—and there was no one left to speak for me.”

— Martin Niemöller[77]

Prediction:

I will go far out on a limb and make a prediction that will demonstrate the significance of the YCH appetite for world domination. If things proceed as I detailed above (I know there are a lot of variables), the UK is already taken care of. It’s a matter of time. If YCH can merge with HVG, the industry power dynamics will reach a tipping point. Their processing facilities are limited to North America[78]. Through a partnership with HVG, YCH would gain access to the pellet and extract facilities in St. Johann, Germany[79].

If that happens, the Barthhaas Group would find itself at a disadvantage. Stephan Barth retired from his position as CEO of BarthHaas GmbH & Co. KG in 2021. Alex Barth stepped down as CEO of John I. Haas in 2022[80][81]. Both Barth brothers retain board positions[82]. Thomas Raiser will assume the role of managing director on August 1, 2024[83]. Thomas, son of Johannes Raiser owner of HopUnion USA, when it merged with John I. Haas in 2000, has been a shareholder of the Barthhaas Group ever since[84]. A non-family run entity may evaluate change with less emotion.

One possibility is a long-term relationship with YCH. It could be expressed, at first, in unthreatening terms, but would lead the same direction as the company’s merger with HopUnion. If you think that’s crazy, think again. The key owners of the YCH and JIH have already united in their ownership of the Hop Breeding Company (HBC)[85]. They may decide in a smaller more competitive hop market it makes more sense to cooperate. They could concentrate their efforts against Hopsteiner.

I know these predictions seem extreme today. I am not suggesting this will happen in the next year. It may not happen by the end of the decade. With every merger, collaboration and partnership YCH achieves, they grow stronger. In their position as the market leader, the odds of these potential mergers grow.

I hope I’m wrong about my predictions. I would love that. I didn’t share my thoughts because I hate Yakima Chief Hops™ as some people think. I don’t have a dog in the fight so I don’t care about them. I like the idea of the free market, competition and capitalism because I think that’s important to an efficient market. The hop market today is inefficient, which is one reason why brewers were forced into contracting for millions of pounds (thousands of metric tons) of hops they didn’t need. When a company gets too large, the power dynamic shifts. They control their customers. That has already happened in the hop industry. More competition is good for the market. Small craft brewers were supposed to know that. If YCH, or any other merchant can consolidate most of the world hop industry, brewers will not like the result. By then, there will be nothing they can do about it. The world’s largest brewers will continue to receive special treatment. Prices will be whatever the person in control wants them to be. Every purchase of a proprietary variety leads the industry one step closer to total control.

Author’s note:

I did not intend for there to be so many hop-related articles in this edition. There were a lot of newsworthy events happening regarding hops, so they dominated. In the future, there will be more variety in the reporting to demonstrate how world events influence the cost of beer production.

[1] https://www.hoptalk.live/post/too-many-hops-10000-acre-cut-needed-says-barth

[2] https://www.usahops.org/img/blog_pdf/474.pdf

[3] https://hopqueries.com/queries-7-10-checking-the-oil-the-weather-the-outlook/

[4] https://agricecon.agriculturejournals.cz/artkey/age-202208-0002_the-delayed-surplus-response-for-hops-related-to-market-dynamics.php

[5] https://www.bevindustry.com/articles/96474-2024-beer-report-local-brewers-delivering-stronger-performance-in-craft-beer

https://www.willamettevalleyhops.com

[7] https://www.capitalpress.com/state/oregon/oregon-hop-merchant-files-for-bankruptcy-protection-amid-industry-shifts/article_d0296614-c143-11ee-8035-575466316bfe.html

[8] https://www.linkedin.com/company/willamettevalleyhops/

https://pacer.uscourts.gov

[10] https://projects.propublica.org/coronavirus/bailouts/search?q=WILLIAMETTE+VALLEY+HOPS+LLC&v=1

[11] https://www.capitalpress.com/state/oregon/oregon-hop-merchant-files-for-bankruptcy-protection-amid-industry-shifts/article_d0296614-c143-11ee-8035-575466316bfe.html

[12] https://www.yakimaherald.com/news/local/business/a-saturated-hop-market-prompts-layoffs-at-roy-farms-in-moxee/article_7a46239a-cc60-11ee-a9c1-eb7f8f4419dc.html

[13] https://www.linkedin.com/company/willamettevalleyhops/posts/?feedView=all

[14] https://bnnbreaking.com/finance-nav/business/flying-fish-brewery-falls-victim-to-beerpocalypse-willamette-valley-hops-files-for-bankruptcy

[15] https://www.airlines.org/dataset/u-s-bankruptcies-and-services-cessations/

[16] https://www.hoptalk.live/post/too-many-hops-10000-acre-cut-needed-says-barth

[17] https://hopqueries.com/queries-7-10-checking-the-oil-the-weather-the-outlook/

[18] https://mill95hops.com/mill-95-blog-2023hopconvention

[19] https://www.forbes.com/advisor/debt-relief/chapter-11-bankruptcy/

https://www.goodingfarms.com

[21] https://www.claytonhops.co.nz/fresh-hops

[22] https://www.johnihaas.com/how-to-buy/

[23] https://www.craftbrewingbusiness.com/news/hops-yeast-and-more-ingredients-to-see-and-celebrate-at-cbc-2023/

[24] https://cbc2024.mapyourshow.com/8_0/exhview/index.cfm

[25] https://www.capitalpress.com/state/oregon/oregon-hop-merchant-files-for-bankruptcy-protection-amid-industry-shifts/article_d0296614-c143-11ee-8035-575466316bfe.html

[26] https://www.johnihaas.com/news-views/

[27] https://www.fidelity.com/learning-center/trading-investing/markets-sectors/why-market-cap-matters

[28] https://www.financierworldwide.com/global-insolvencies-in-2024-trouble-on-the-horizon

[29] https://www.tbsnews.net/bloomberg-special/rising-small-business-bankruptcies-are-red-herring-730738

[30] https://www.ftc.gov/advice-guidance/competition-guidance/guide-antitrust-laws/dealings-supply-chain/exclusive-dealing-or-requirements-contracts

[31] https://www.willamettevalleyhops.com/hop-pellets

[32] https://www.ftc.gov/advice-guidance/competition-guidance/guide-antitrust-laws/dealings-supply-chain/manufacturer-imposed-requirements

[33] https://www.ftc.gov/advice-guidance/competition-guidance/guide-antitrust-laws/dealings-supply-chain/refusal-supply

https://www.hopbreeding.com

[35] https://www.yakimachief.com/commercial/about-us/our-company

[36] https://yakimachiefranches.com/history/

[37] https://www.imf.org/en/Blogs/Articles/2024/03/07/Red-Sea-Attacks-Disrupt-Global-Trade

[38] https://www.ifw-kiel.de/publications/news/cargo-volume-in-the-red-sea-collapses/

[39] https://www.americancraftbeer.com/why-your-craft-beer-is-getting-more-expensive-2/

[40] https://www.freightwaves.com/news/red-sea-disruptions-among-critical-supply-chain-risks-in-2024

[41] https://www.rfdtv.com/u-s-importers-navigate-uncertainties-as-shipping-costs-soar-globally

[42] https://www.politico.eu/article/how-conflict-red-sea-disrupts-global-trade-by-the-numbers-houthis-shipping/

[43] https://www.forbes.com/sites/jamesfarrell/2024/02/14/maersk-says-red-sea-detours-could-extend-to-second-half-of-2024/?sh=4e0e1c355186

[44] https://www.nationalheraldindia.com/business/as-red-sea-crisis-persists-freight-rates-move-toward-a-25-30-increase

[45] https://sourcingjournal.com/topics/logistics/ocean-freight-rates-drewry-red-sea-suez-canal-houthi-chinese-new-year-486679/

[46] https://unctad.org/news/red-sea-black-sea-and-panama-canal-unctad-raises-alarm-global-trade-disruptions

[47] https://sourcingjournal.com/topics/logistics/red-sea-container-shipping-ocean-freight-rates-profitability-fitch-ratings-maersk-msc-hapag-lloyd-cma-cgm-suez-canal-499509/

[48] https://blog.shipsgo.com/top-shipping-carriers/

[49] https://www.nytimes.com/2024/02/22/business/economy/global-shipping-red-sea-houthi-attacks.html

[50] https://www.forbes.com/sites/jamesfarrell/2024/02/14/maersk-says-red-sea-detours-could-extend-to-second-half-of-2024/?sh=799baeca5518

[51] https://www.tbsnews.net/world/global-economy/container-rates-soar-concerns-prolonged-red-sea-disruption-inflation-773990

[52] https://www.producer.com/markets/malting-barley-test-batches-sent-to-china-by-container/

[53] https://www.handybulk.com/bulk-malt-shipping/

[54] https://blog.greencarrier.com/smooth-sailing-30-years-of-shipping-malt-across-the-globe-for-fuglsang/

[55] https://www.usahops.org/img/blog_pdf/474.pdf

[56] https://www.cmegroup.com/education/courses/introduction-to-ferrous-metals/what-is-contango-and-backwardation.html

[57] https://www.reuters.com/world/middle-east/us-container-shippers-slow-walk-new-contracts-eye-easing-red-sea-rate-hikes-2024-03-06/

[58] https://www.yakimaherald.com/news/local/business/a-saturated-hop-market-prompts-layoffs-at-roy-farms-in-moxee/article_7a46239a-cc60-11ee-a9c1-eb7f8f4419dc.html

[59] https://finance.yahoo.com/news/bud-light-isn-t-only-204611968.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAFI3rz0cg-jMYbnSxFydEd1oKOPmKWjmYf9ja_3XR0WGuSEvIItVzlWgAQi2lALouD152jE_45rB7bEmHkbRniGzFJTxDrjIf-TzrzNHsfM3NaCIRvJQ3C7QqGJxlUl95xTeKqLEXVoQ7bCHBT8zpUgLS0cloJXlBh-KkizORtnj

[60] https://www.france44.com/beer/the-state-of-craft-beer/

[61] https://www.bizneworleans.com/a-challenging-year-for-craft-beer-and-breweries/

[62] https://idioms.thefreedictionary.com/a+camel%27s+nose+(under+the+tent)

[63] https://brookstonbeerbulletin.com/hopunion-merges-with-yakima-chief-craft-division/

[64] https://brewpublic.com/press-releases/yakima-chief-inc-and-hopunion-llc-to-combine-operations/

[65] https://www.johnihaas.com/news-views/john-i-haas-makes-strategic-investment-in-yakima-valley-hops-extending-reach-into-global-home-brewing-and-small-craft-brewing-markets/#:~:text=The%20new%20strategic%20partnership%20provides,1™%2C%20Sabro™%20and

[66] https://www.brewersjournal.info/global-hop-suppliers-collaborate-to-serve-uk/

[67]https://ipmall.law.unh.edu/sites/default/files/hosted_resources/PLANT_PATENT_ARTICLES/Plant_Breeding_Practicum_2011.pdf

[68] https://www.uspto.gov/web/offices/pac/mpep/s301.html

[69] https://brookstonbeerbulletin.com/hopunion-merges-with-yakima-chief-craft-division/

[70] https://www.thefreelibrary.com/Joh.+Barth+%26+Hopunion+announce+merger.-a063915318

[71] https://www.hvg-germany.de/en/

[72] https://www.importgenius.com/suppliers/hvg-hopfenverwertungsgenossenschaft

[73] https://www.importyeti.com/supplier/hvg-hopfenverwertungsgenossenschaft

[74] https://www.donaukurier.de/lokales/landkreis-pfaffenhofen/hvg-chef-johann-pichlmaier-geht-heuer-in-ruhestand-und-setzt-volles-vertrauen-in-seine-nachfolge-15483367

[75] https://www.meininger.de/handel/verbundgruppe/hopfen-generationswechsel-bei-der-hvg

[76] https://www.hvg-germany.de/en/history/

[77] https://encyclopedia.ushmm.org/content/en/article/martin-niemoeller-first-they-came-for-the-socialists

[78] https://www.visityakima.com/yakima-valley-listing-detail.asp?ID=1527

[79] https://brauwelt.com/en/topics/raw-materials/645033-grand-opening-of-new-hop-extraction-plant-in-st-johann

[80] https://www.inside.beer/news/detail/usagermany-alex-barth-steps-down-as-ceo-of-john-i-haas/

[81] https://brauwelt.com/en/news/people-and-positions/643272-stephan-barth-leaves-active-management-position

[82] https://asiabrewersnetwork.com/press_release/change-of-leadership-for-barth-haas

[83] https://brauwelt.com/en/news/people-and-positions/645771-thomas-raiser-appointed-new-managing-director-market

[84] https://www.thefreelibrary.com/Joh.+Barth+%26+Hopunion+announce+merger.-a063915318

https://www.hopbreeding.com