Proprietary hop varieties are a gift to the brewing world. They offer exciting flavors. They have enjoyed a cult like following. People who didn’t know what hops were 10 years ago recognize variety names. Breweries tout being first to market with experimental varieties and access to new varieties drives sales. The perceived value of a new variety can be as important as its brewing value[1]. Over the past decade, proprietary hop varieties have helped craft breweries make billions. Every brewer wanted a piece of that success. The current surplus combined with oppressive terms and conditions in merchant contracts has opened some brewers’ eyes. Proprietary varieties are not all unicorns and rainbows.

Proprietary varieties supply control enables merchants to sell them for double or triple the price of “boring” varieties like Cascade, Hallertau Mittelfruh or Saaz. On the Lupulin Exchange earlier this month, I found “2022 US Citra®” advertised for sale for $28.79 per pound ($63.45 per kilogram) (Figure 1).

Figure 1. Lupulin Exchange price listings.

Source: Lupulin Exchange[2]: results are from a search conducted on November 3, 2023.

DON’T BUY A CAT IN A BAG[3]

Are those prices too high? That depends on how you look at it. Brewers might think the “bad” thing associated with proprietary varieties is their high price tag. That’s not true. When I was a hop merchant, I learned most craft brewers are unaware of how the hop industry works or the consequences their actions have. Many of them are artists focused on creating great beer while growing their businesses. That’s different from the purchasing agents for the world’s largest breweries who have mastered the science of hop purchasing. They understand the hop industry as well as they do their own. They know the impact of their actions and they exploit their advantages.

You are probably familiar with the yin yang symbol. It symbolizes the existence of balance[4]. Some think of it as a symbol “good” or “bad”. It demonstrates there is some bad in everything good and some good in everything bad[5]. Proprietary hop varieties are no different.

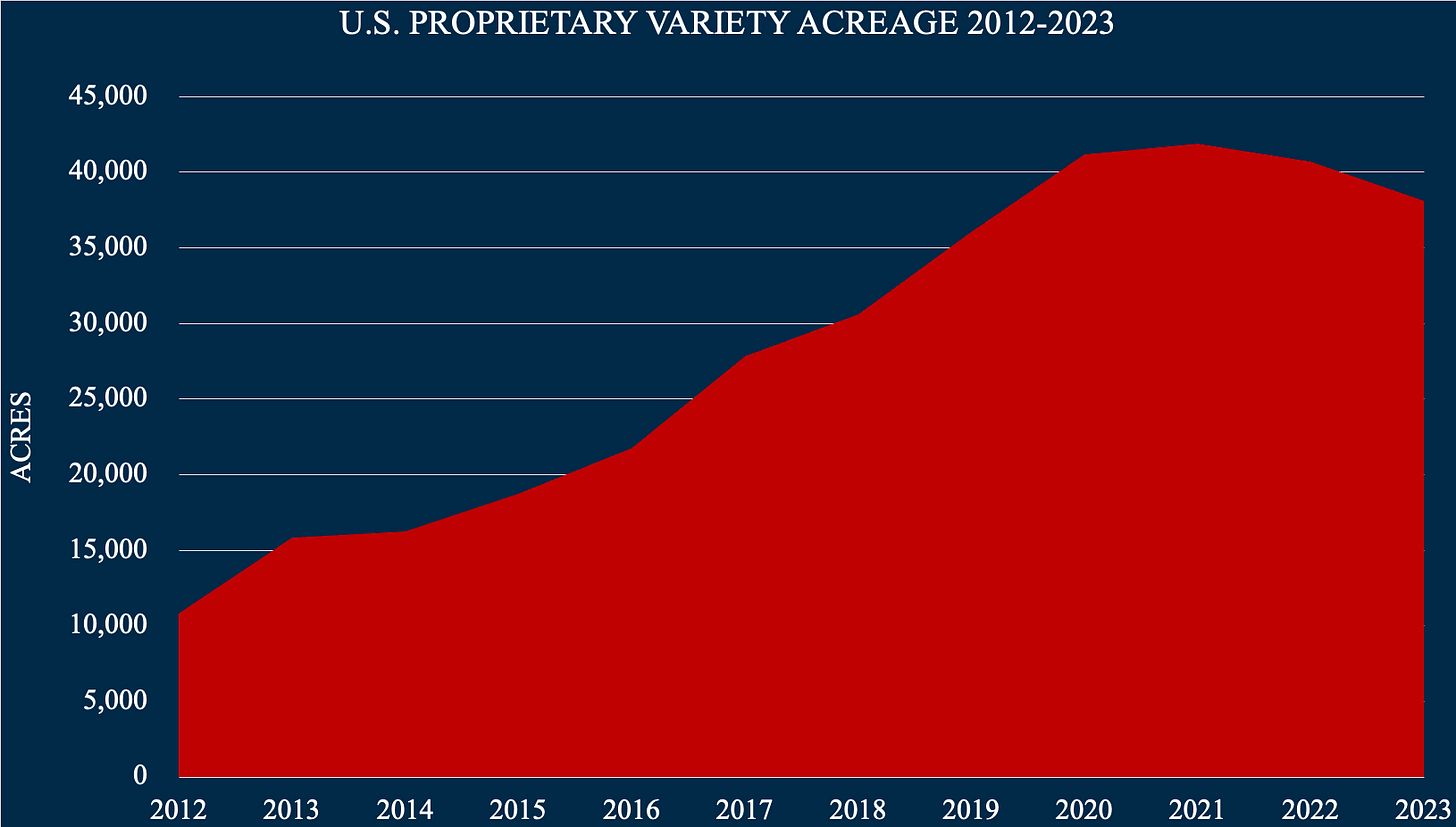

According to the USDA, U.S. acreage of proprietary varieties grew 387% between 2012 and 2021, from 10,822 acres (4,381 hectares) to 41,897 acres (16,962 hectares) (Figure 2). Public varieties increased 16% during the same time[6]. It is not possible for such a lopsided change to occur in such a short time without consequences.

Figure 2. Acreage of U.S. Proprietary varieties between 2012 and 2023

Source: USDA NASS

Expressing proprietary hop acreage by percentage of the total demonstrates how they dominate the American landscape in 2023 (Figure 3). Because a handful of men own them, they have changed the power dynamics of the hop industry. By buying into the idea of proprietary varieties, brewers and farmers have bought a cat in a bag[7].

Figure 3. Proprietary U.S. hop acreage 2012-2023

Source: USDA NASS, IHGC[8]

HIDDEN COSTS

The owners of hop patents extract more value from their varieties than breweries. I’m not talking about royalties, although royalty revenue is significant. In my April 2023 article, “The secret behind who controls the hop industry” I explained how the Hop Breeding Company (HBC) likely made over $22 million in royalties in 2022 alone. You must look beyond dollars and cents. Their true value cannot be calculated by an accountant.

As consumers, we think the price we pay represents the cost of that good plus a little profit. The actual cost is different due to something economists call externalities[9]. The Federal Reserve defines externalities as costs (negative externalities) or benefits (positive externalities) that “spill over to a third party not directly involved in the transaction”[10]. Positive externalities are easy to spot. They provide the motivation for people to act (i.e., “people will buy a lot more of my beer if I make an IPA with Citra”). Proprietary varieties are a Trojan horse. They are a beautiful prize that appear for the benefit of their recipient. Secretly, they are the harbinger of serious negative externalities that will reveal themselves once it’s too late.

Negative externalities can be secondary or tertiary effects that may not even appear related to the original event[11][12]. An easy example of something we’re all familiar with is the fuel we put in our cars. The exhaust that comes out is a negative externality. Politicians focus on that as a cause of climate change. We’ve all smelled exhaust. Regardless of the accuracy of the claim, it’s familiar to people so the idea that it’s a pollutant and causing climate change is easy to sell[13][14]. Electric Vehicles (EVs) don’t have exhaust, so they must be the solution[15]. Government subsidies have driven demand in that direction[16]. Automakers have moved to electric to capture that demand[17][18][19]. BMW says it will no longer produce internal combustion engines in Germany beginning in 2024[20]. Mercedes announced it will only offer electric vehicles by 2025[21]. A lack of awareness of the details of the problem is itself the problem. That is as true in the changing hop industry as it is with regards to climate change.

The secret to magic is deception[22]. Magicians draw the viewer’s attention to one hand while the action is happening in the other. Farm tours, rubbing hops and the sensory overload for a brewer of visiting hop harvest can be an overwhelming glimpse into another world. It provides a great distraction, but that distraction doesn’t last forever. At some point, you know the lady didn’t get sawed in half while having a smile on her face.

Public awareness of the human rights violations and pollution associated with building electric vehicles (EV) batteries is growing[23][24][25][26][27][28][29][30][31][32]. The resources needed to produce an EV create a much more complicated and fragile supply chain than fossil fuels[33]. Most energy grids are unprepared for a surge in EV usage[34]. The big automakers haven’t abandoned their internal combustion engines (ICE) programs[35][36][37][38][39]. That’s smart. As Bill Clinton said to George H.W. Bush in their 1992 presidential debate, “It’s the economy stupid.” EV sales are down[40].

The World Bank has forecast a slowing world economy and interest rates are predicted to increase in 2024[41][42][43][44]. At the same time, according to Bart Watson from the Brewers Association, the craft market has now matured[45]. While a mature market can be an opportunity for established brands to grow, it means more attention to costs[46]. Average hop prices to farmers have increased 321% in the past 20 years[47][48][49]. The days of hops being an insignificant percentage of the brewing process are gone. When I was director of Hop Growers of America, people often joked how the cost of hops in a beer was less than the cap on the bottle. I haven’t heard that one for a while. True or not, hop prices were much lower than today (Figure 4).

Figure 4. Brewer cost breakdown in the year 2000.

Source: Excerpt from the April, 2000 edition of the Hop Growers of America Newsletter

Today, hops can be over 12% of a brewery’s cost of production[50]. Craft beer is expected to experience moderate declines as people search for ways to enjoy an affordable luxury at a more affordable price[51][52]. Breweries will be forced to look for ways to save on their hop bill to compete[53].

Back to our EV example … On October 26, 2023, Ford postponed a $12 billion investment in EV production[54]. Their customers in North America, they explained, aren’t willing to pay a premium for EVs[55][56][57]. I’m no brewer, but I created six blends over the past year that the tasting panel I used said would be perfect for IPAs … “better than Mosaic” was a comment I received on one of them. If somebody like me with no brewing experience can create blends “better than Mosaic”, I’m certain a real brewer could do better.

Most automakers have no preference which technology prevails so long as they make a profit. Tesla is an exception since they don’t produce internal combustion engines. The largest hop merchant companies started by selling public hop varieties. Today, their focus appears to be selling proprietary varieties. The people who own the HBC are the decision makers at the main companies that sell their varieties (John I. Haas and YCH). Follow the money!

Mid November in the Hallertau was beautiful this year.

It’s not only about money. Proprietary varieties are the most recent and effective tool to capture market share. If they were intended for the good of the brewing industry, the HBC (a variety development company, not a hop merchant company) might make their varieties available to every merchant so long as they paid the associated royalty. They could still manage production. They don’t do that[58]. The owners of the HBC use their Intellectual Property (IP) to create a competitive advantage for the merchant companies they also own, John I. Haas and Yakima Chief Hops™ (YCH). That’s not illegal, it just reveals their motives.

In 2016, when Bayer bought Monsanto for $66 billion[59], over 90% of corn, soybeans, cotton, sugar beets and canola produced had some form of IP. That’s an example of the total market control possible if breweries continue to ignore the consequences of buying proprietary varieties. Today five or six men control over 75% of U.S. hop production (that’ 30% of global production). Here are five negative externalities of proprietary hop varieties brewers should understand:

Proprietary varieties enable the manipulation of supply, which enables their owners to inflate prices. The voluntary reduction of 20% of the most popular proprietary variety acreage in 2023 without market prices first crashing is a demonstration of power.

Proprietary varieties restrict competition. A licensed distribution chain forces customers to work through a handpicked group of merchants. That benefits patent owners, not brewers.

Licensed production kills farmer freedom. He needs the permission of the IP owner prior to planting and does not own the plants he produces.

Proprietary varieties create censorship. If somebody speaks out against the establishment (i.e., the owners of the IP), he risks being canceled. Farmers, merchants and even brewers believe they cannot afford that risk so they self-censor. These articles are the only source for this information. Because I have already been canceled, I am free to say things you are not. The merchants downplay the things I write. They don’t want brewers reading these articles. They are afraid to debate the issues, so they criticize the source. Meanwhile, they know everything I’ve written about. If you believe in free speech and support the free discussion of ideas, you should share this article with a friend who may not yet understand the way the industry really works.

Finally, proprietary varieties restrict brewer freedom. Made available only via long-term contracts and with ominous terms and conditions, they lock in breweries with no chance of escape. Some contracts restrict a brewers’ ability to resell hops, or even list those hops for sale … even when they are already paid for!

That sounds like a horrible way to treat a customer you value. By accident, craft brewers have given a handful of men more power over the global hop industry than they ever would have achieved alone.

“The supreme art of war is to subdue the enemy without fighting.”

- Sun Tzu, The Art of War

THE NEW POWER DYNAMIC

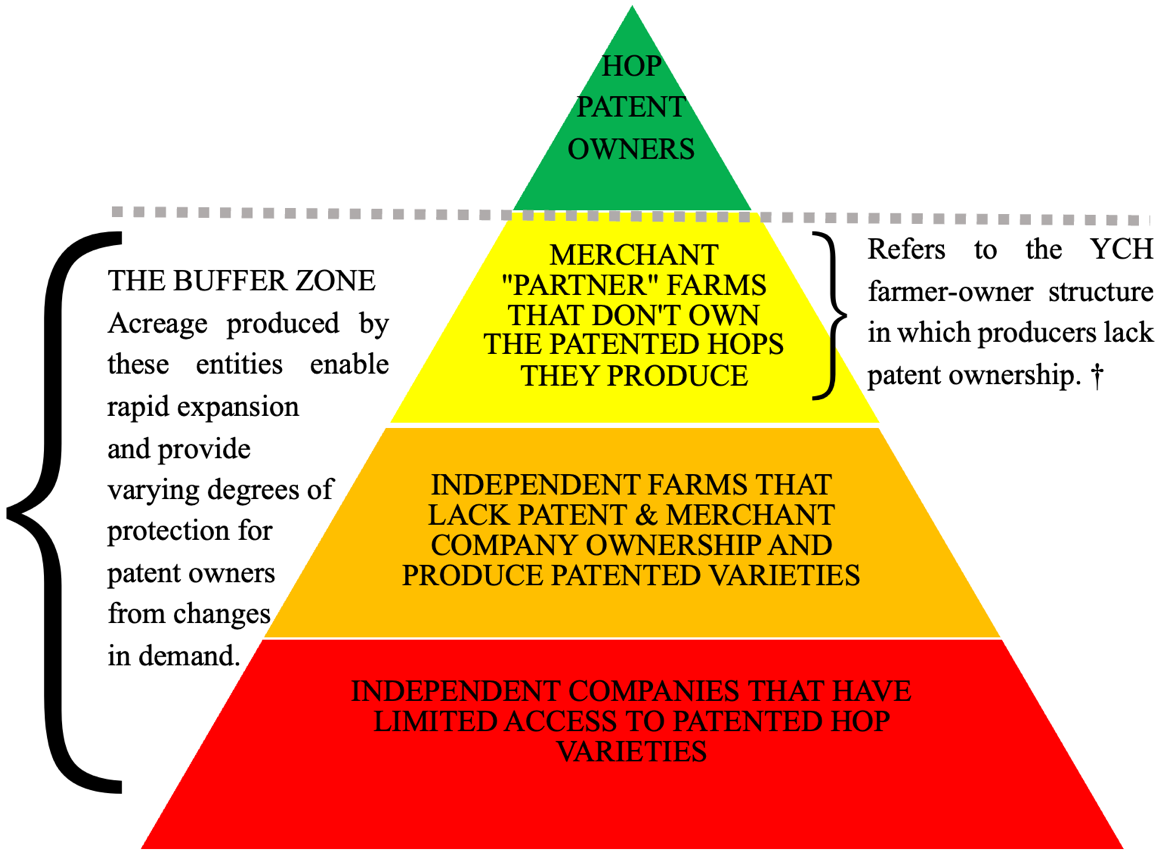

The 2023 reaction to the surplus revealed the extent of the control present. No Federal marketing order empowered a handful of people the way proprietary varieties do. A new power dynamic has emerged. At the pinnacle of power are the IP owners and by extension the companies they own. Other farms producing their varieties and those who don’t produce any proprietary varieties provide a buffer for them against negative market changes. The farther down the pyramid a company is, the more vulnerable it is. (Figure 5).

Figure 5. Power matrix of the U.S. hop industry in 2023

† If you are not familiar with the ownership of the HBC or how their hops get to market, I outlined that in my April 2023 article called, “The Secret Behind Who Controls the Hop Industry”.

SO WHAT!

Should brewers care if independent farms and merchants fail so long as they can get the hops they want? The big merchants can absorb the market share of the smaller merchants and the same can be done with farms. That’s capitalism, right? Increased market concentration (i.e., fewer people controlling a larger share of the industry) reduces independence and competition, which cannot be replaced[60]. The IP owners are incentivized to use the resources of the merchant companies they own to sell public varieties at low prices to target and squeeze competitors out of the market. It’s a tactic one of the larger hop merchants often uses. The hop industry is a zero-sum game. Not everybody is included in the future. Here’s an example one of the targets of their aggression shared with me:

Merchant Y sells a popular proprietary variety. They offer that variety along with several other public varieties to a brewer. It’s a good offer with a reasonable price for the proprietary variety and low prices for the public varieties. After seeing the offer, for whatever reason, the brewer decides he wants to purchase the public varieties from Merchant Z. He tells Merchant Y he wants to buy the proprietary varieties but not the public varieties. Merchant Y replies with a new offer in which the prices for the proprietary varieties he wants are now much higher. The brewer is told if he only wants to buy the proprietary variety in question, that’s possible, but it is available, but at the higher price under those conditions. That’s not illegal, but it shows the character and the intentions of the merchant. According to the U.S. Department of Justice (USDOJ), it would be an antitrust violation for a merchant to tie or bundle two products together[61][62]. An example of that would be if Merchant Y said the brewer could only have proprietary variety A when they buy public variety B. If you’re a brewer and you’ve received an offer like that, you should report it to the USDOJ. The DOJ will protect your confidentiality. If you work for a company making offers like that, the Criminal Antitrust Anti-Retaliation Act (CAARA) protects whistleblowers.

Farmers who produced proprietary varieties owned by other farmers were distracted by huge profits. Then they were told to reduce their acreage. They believed they could trust their fellow farmers. They reinvested millions in their companies thinking their good fortune would continue. In the end, they were pawns in somebody else’s quest for money and market share. It’s a terrible feeling when somebody you know and trust betrays you while telling you they only want what’s in your best interest. I know. The good that comes from it, at least in my own case, was a clearer vision of the world.

That may be little consolation to hop farmer egos. It was a difficult blow to my own ego when it happened to me. They will grasp at every opportunity to keep their farms from shrinking. They will be the ones who determine the winners of future battles for market share when demand for hops decreases. So long as IP owners continue to use their proprietary hop varieties as a weapon against their competitors, the only thing that will change the current trajectory of the industry is if breweries restore balance between public and proprietary variety usage.

“First they came for the socialists, and I did not speak out –

because I was not a socialist.

Then they came for the trade unionists, and I did not speak out – because I was not a trade unionist.

Then they came for the Jews, and I did not speak out –

because I was not a Jew.

Then they came for me – and there was no one left to speak for me.”

- Martin Niemöller[63]

THE GREEK SUN GOD

Since American proprietary varieties reportedly make up a significant part of the 2023 surplus, you might think American farmers would suffer the consequences of the oversupply. That is not how the next act of this play unfolds. The American hop industry is a juggernaut that will destroy its competitors in the name of increased profit. Despite a doubling of U.S. acreage during the previous decade according to Hop Growers of America, farmers there will do anything to keep their acreage from decreasing[64]. According to the most recent data available, there are 4,919 acres (1,991 hectares) of empty trellis in the U.S.[65]. Those empty American hop acres are a liability for every other hop producer on the planet. Now that warehouses around the world are stuffed full of aroma varieties, American merchant/farmers will return to their alpha roots. Enter Helios™.

While American farmers were busy ignoring the world’s largest breweries to exploit proprietary aroma sales to craft breweries, German farmers became the world’s low-cost alpha producers. They planted Herkules … LOTS of Herkules. Between 2012 and 2023, Herkules acreage increased 268%, from 2,584 hectares (6.382.48 acres) to 6,930.8 hectares (17,119.07 acres)[66]. According to the published yields, Helios™ promises an average of 295 kilograms of alpha acid (KgA) per acre (730 KgA/ha)[67][68]. That’s 60% more alpha than Herkules[69] and 67% more alpha than Columbus[70]. If it maintains those yields, that will be the most efficient alpha producing variety in history.

Helios, the Greek god of the sun, drove a chariot across the sky from east to west[71]. Helios™ the hop variety will likely do the same for alpha production. Empty U.S. acreage combined with rising energy prices and inflation in the EU paint a bleak picture for future European farmers. They will struggle to compete in the price-based alpha market. A rebalancing of global alpha production is likely to occur in the coming years. That will decimate the German hop industry and reduce overall global hop acreage. The number of German hop farmers will decrease, while the size of the average German hop farm grows. The further reduction in the number of German farmers is another negative externality of the battle for market share using proprietary varieties. Through their Helios™ variety, Hopsteiner can do to the alpha market what the HBC via John I. Haas and YCH did to the aroma market.

A HOP CRISIS

Craft brewery reliance on proprietary varieties like Citra ®, HBC 394 and Mosaic ®, HBC 369 has changed the soft power dynamics in the hop industry[72]. With no change, independent farmers and merchants around the world will cease to exist. This is a consequence of the concentration of power. Proprietary varieties are the hop industry equivalent of fossil fuels. They can make a brewer’s life easier. It seems they can be used anywhere. They should be used in moderation due to their negative consequences, but they make life so easy they have been overused. Every pound of American proprietary varieties breweries purchase concentrates power among the elites at the top of the pyramid. That ensures a less dynamic and competitive industry in the future[73].

Plastic recycling has been proven to be a scam[74][75]. The green energy revolution has been proven to create more problems than it fixes[76][77]. Information about this has been available for some time, but most people remain uninformed. Through our collective actions it’s obvious that amassing wealth and power is a higher priority than the environment. The same seems to be true in the hop and brewing industries. Proprietary hop varieties are a convenient means by which market domination is achieved. Craft brewers support the idea of independence. The Brewers Association excludes craft breweries that “sell out” to macro breweries. Despite their love of independence, craft breweries buy the very proprietary hop varieties that squash farmer independence. To be fair, most of them are not aware of the consequences associated with buying proprietary varieties. The only source for the truth about their impact on the hop industry are these articles, which is why I thank you for reading. If you’re a brewer and you’re concerned about what’s happening, you might want to share this article with some brewer friends … before it’s too late.

While I was a hop merchant, I noticed that brewers oftentimes cared about the prices they paid for hops. Their unrestricted use of proprietary varieties has brought about the higher prices they despise. If you’re a brewer and you’re ok with that, carry on.

[1] https://www.beervanablog.com/beervana/2023/8/18/are-hop-products-displacing-old-fashioned-hops

https://lupulinexchange.com

[3] Across Europe, it is common to use the phrase to buy a cat in a bag when referring to being cautious about buying something. The equivalent saying in the U.S. is “a pig in a poke”. A poke is also a sack, so the saying is the same.

[4] https://www.britannica.com/topic/yinyang

[5] https://www.cnn.com/2015/09/02/health/who-knows-whats-good-or-bad-wisdom-project/index.html

[6] In 2023, data available at the time of this writing suggest acreage of proprietary varieties decreased by 3,860 acres (1,562.75 hectares) and public variety acreage decreased by 1,332 acres (539.2 hectares). Experimental and other variety acreage increased by 125 acres (50.6 hectares) in 2023. New 2023 USDA data will be available in the second half of December.

[7] https://en.charlingua.de/post/12-idioms-animals-german

[8] USDA National Hop Report data was used for 2012 through 2022. For 2023, the most recent data available was the USDA June strung for harvest plus an additional 500 hectares of Helios™ that was not included in the written report at the August International Hop Growers Convention (IHGC) meeting. It was revealed during a question-and-answer session. Presumably, that acreage will be included in the 2023 USDA National Hop Report.

[9] https://time.com/6160256/gas-prices-climate-cost/

[10] https://www.stlouisfed.org/education/economic-lowdown-podcast-series/episode-11-externalities

[11] https://www.nad.usace.army.mil/Portals/40/docs/NACCS/15Secondary-and-Tertiary_Jan262015.pdf

[12] https://www2.tulane.edu/~sanelson/Natural_Disasters/introduction.htm

[13] https://www.nationalobserver.com/2019/09/04/analysis/canadian-cars-are-worlds-dirtiest-ev-age-essential

[14] https://apnews.com/article/epa-tailpipe-pollution-cars-climate-republicans-biden-fe6bdf52420f083194574d8e0eae6a0f

[15] https://www.energy-transition-institute.com/insights/electricity-storage/natural-resources-and-co2

[16] https://financialpost.com/commodities/energy/electric-vehicles/subsidies-spark-ev-manufacturing-race-in-u-s-states

[17] https://www.nytimes.com/2023/04/11/business/energy-environment/cars-electric-vehicles-epa.html

[18] https://www.nytimes.com/2021/03/02/climate/electric-vehicles-environment.html

[19] https://www.mynrma.com.au/electric-vehicles/basics/what-car-companies-will-go-all-electric

[20] https://www.reuters.com/business/autos-transportation/mercedes-benz-launches-e-class-its-last-new-combustion-engine-model-2023-04-25/

[21] https://www.electrive.com/2022/11/01/mercedes-to-launch-final-combustion-platform-vehicle-in-2023/

[22] https://www.heraldnet.com/life/the-secret-history-of-magic-is-a-study-of-deception-as-art/

[23] https://finance.yahoo.com/news/ford-gm-and-even-tesla-are-warning-about-the-ev-market-194905657.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAJpM5hZxh8EWx1qSSOlXtgoq-xpQiZ7Ud7T1uFVR3-NNFbQncC7n5hxTbdRrBZ1IJ1wyrihiJtNL3fxIUj4VCcYt-CBmrZR1fJcGNr80aG-ca4Ec1PPbW1xUp49zMNf_wzPgsCvvSM0iLZ76_I2XaNnOnP_sKnX4npSbp9VY1V4s

[24] https://www.nytimes.com/2021/03/02/climate/electric-vehicles-environment.html

[25] https://www.theguardian.com/environment/2023/apr/15/germany-last-three-nuclear-power-stations-to-shut-this-weekend

[26] https://www.reuters.com/business/energy/germany-approves-bringing-coal-fired-power-plants-back-online-this-winter-2023-10-04/

[27] https://nypost.com/2022/09/01/californians-asked-not-to-charge-electric-cars-amid-heat-wave/

[28] https://www.npr.org/sections/goatsandsoda/2023/02/01/1152893248/red-cobalt-congo-drc-mining-siddharth-kara

[29] https://interestingengineering.com/science/clean-evs-and-dirty-lithium-mining-business

[30] https://www.milkenreview.org/articles/the-not-so-certain-economics-of-electric-vehicles

[31] https://www.reuters.com/business/autos-transportation/when-do-electric-vehicles-become-cleaner-than-gasoline-cars-2021-06-29/

[32] https://www.ft.com/content/a22ff86e-ba37-11e7-9bfb-4a9c83ffa852

[33] https://rmi.org/the-ev-battery-supply-chain-explained/

[34] https://americanmilitarynews.com/2023/09/new-ev-mandates-threaten-national-security/

[35] https://www.theguardian.com/world/2023/mar/24/germany-facing-eu-backlash-over-u-turn-on-phasing-out-combustion-engine

[36] https://www.thedrive.com/news/bmw-isnt-giving-up-on-internal-combustion-engines-anytime-soon

[37] https://www.guideautoweb.com/en/articles/67798/mercedes-benz-pourrait-offrir-des-moteurs-v8-au-dela-de-2030/

[38] https://www.bbc.com/worklife/article/20231108-three-big-reasons-americans-havent-rapidly-adopted-evs

[39] https://www.topspeed.com/heres-how-porsche-plans-to-keep-internal-combustion-alive/

[40] https://www.reuters.com/business/autos-transportation/tesla-used-car-price-bubble-pops-weighs-new-car-demand-2022-12-27/

[41] https://www.axios.com/2023/11/09/us-economy-outlook-2024

[42] https://www.worldbank.org/en/publication/global-economic-prospects

[43] https://www.cnbc.com/2023/11/01/gundlach-says-rates-are-going-to-fall-as-recession-lands-in-early-2024.html

[44] https://www.brookings.edu/events/state-of-the-global-economy-slowing-growth-rising-risks/

[45] https://www.brewbound.com/news/bart-watson-craft-market-isnt-maturing-it-has-matured/

[46] https://money.cnn.com/magazines/fortune/fortune_archive/1985/11/25/66661/index.htm

[47] USDA NASS National Hop Reports and Hop Growers of America Statistical Packets 2003-2022

[48] https://brewsavor.com/news/whats-the-most-expensive-part-of-the-brewing-process/

[49] https://beermaverick.com/why-are-hops-so-expensive/

[50] https://blackhops.com.au/craft-beer-prices-how-much-does-beer-cost-to-make-2-0/

[51] https://www.reuters.com/business/retail-consumer/ab-inbev-molson-coors-dent-us-craft-beer-competition-with-cheaper-six-packs-2023-06-12/

[52] https://www.forbes.com/sites/bill_stone/2022/06/29/are-alcoholic-beverages-recession-and-inflation-resistant/?sh=276216756a0e

[53] https://utilmanagement.com/beer-cost-crisis/

[54] https://www.cnbc.com/2023/10/26/ford-will-postpone-about-12-billion-in-ev-investment.html

[55] https://www.washingtonpost.com/business/2023/07/27/ford-evs-earnings/

[56] https://www.greencarreports.com/news/1140361_ford-lowers-ev-targets-for-2023-pointing-to-cost

[57] https://www.businessinsider.com/ford-delays-ev-manufacturing-investment-cars-too-expensive-2023-10

[58] Before the most popular HBC proprietary varieties because so popular, they were available through merchant outlets that were not part of the John I. Haas or YCH distribution chains. Once the popularity of those varieties grew, they restricted their distribution channels. I believe the same thing is likely to happen on the growing side.

[59] https://www.bbc.com/news/business-37361556

[60] https://hbr.org/2018/03/is-lack-of-competition-strangling-the-u-s-economy

[61] https://www.justice.gov/atr/chapter-5-antitrust-issues-tying-and-bundling-intellectual-property-rights

[62] https://www.justice.gov/sites/default/files/atr/legacy/2007/04/18/chapter_5.pdf

[63] https://encyclopedia.ushmm.org/content/en/article/martin-niemoeller-first-they-came-for-the-socialists

[64] https://www.usahops.org/img/blog_pdf/405.pdf

[66] Barthhaas reports 2012-2023

[67] https://www.hopsteiner.com/variety-data-sheets/Helios/

[68] http://washingtonbeerblog.com/introducing-helios-a-new-hop-variety-from-hopsteiner/

[69] Herkules yield was calculated by using the 5-year average yield and using 16.3% alpha according to the 2019-2022/2023 Barthhaas report for an alpha yield of 456.4 Kilograms of alpha acid (KgA) per hectare (184.77 KgA/acre).

[70] Columbus yield was calculated by using the 5-year average yield according to the USDA and assuming 15.5% alpha for an alpha yield of 176.89 Kilograms of alpha acid (KgA) per acre (436.92KgA/hectare).

[71] https://www.britannica.com/topic/Helios-Greek-god

[72] https://vinepair.com/articles/citra-mosaic-hops-power-couple/

[73] https://hbr.org/2018/03/is-lack-of-competition-strangling-the-u-s-economy

[74] https://www.npr.org/2020/09/11/897692090/how-big-oil-misled-the-public-into-believing-plastic-would-be-recycled

[75] https://www.theatlantic.com/ideas/archive/2022/05/single-use-plastic-chemical-recycling-disposal/661141/

[76] https://foreignpolicy.com/2022/06/30/africa-congo-drc-ev-electric-vehicles-batteries-green-energy-minerals-metals-mining-resources-colonialism-human-rights-development-china/

[77] https://www.spiegel.de/international/world/mining-the-planet-to-death-the-dirty-truth-about-clean-technologies-a-696d7adf-35db-4844-80be-dbd1ab698fa3