BIGGER ISN’T BETTER

In my February 2023 article, “The Truth Behind the Hop Surplus”, I mentioned how the data suggested that the surplus was at least 54 million pounds (24,494.2 mt). I believe that was conservative. I’ll explain how in this article.

In July 2023, Pete Mahony, Vice President, Supply Chain/Purchasing at John I. Haas, Inc. said when referring to the acreage reduction necessary, “Citra, Mosaic, Idaho7 and Eldorado all need to come down by 20% in our view”[1]. It seems he underestimated the scope of the surplus. Proprietary variety due to their licensing arrangements enable supply control, which during a surplus is a great power to have. Perhaps Pete highlighted those varieties because those are the only varieties that can be controlled. Public variety surpluses rely on the market to return them to balance.

The problem is that the surplus extends far beyond a few proprietary varieties. For example, prior to the 2023 harvest, merchants and farmers emphasized that Centennial yields would be low due to split bloom[2][3]. Long-term readers of these articles know that inferring there will be a short supply is a tactic used in the industry to generate fear in the hope that it will increases sales, contracts and prices[4]. We will know Centennial yields in about three weeks when the USDA releases their National Hop Report. Regardless of whether the yields were good or bad, it seems from the amount available for sale that farmers produced too many (Figure 1).

Figure 1. Excerpt of surplus brewer hops available via US Hop Source.

Source: US Hop Source[5].

You can see the entire list of surplus hops available on their web site at https://www.ushopsource.com/hops-extracts. The list is a way for brewers to anonymously try to move their hops into the market. I’m told millions more pounds are available but have not been listed. The brewers who own them are restricted from listing them for sale by the merchants with whom they contracted. That doesn’t sound like a way for a merchant to treat their brewer “partners”. If you look at the list, you’ll see huge quantities of hops that go back eight years. For example, there’s 39.8 mt (87,875 pounds) available from crop year 2016! If you’re a brewer with extra hops to sell, it would be a good for you to understand the scope of the problem.

THE CRAFT DILEMMA

Hop merchant/farmers are blaming the surplus on bad forecasting by breweries. According to their narrative, they are not responsible for the surplus. That logic doesn’t sync with the claim that contracts help merchant/farmers forecast demand[6][7][8][9]. With the data available the industry can assess demand via deliveries or the lack thereof. When 40 breweries dominated the world, forecasting demand using contracts must have been simpler. Now that the world has over ten thousand breweries and craft beer production has soared, contracts don’t function as advertised (Figure 2).

Figure 2. U.S. hop inventory relative to increases in craft beer production.

Source: USDA, Brewers Association

Hop merchant/farmers never created a contract system to serve the needs of the craft industry. Instead it’s a one-size-fits-all system. That’s because contracts don’t exist for the benefit of the brewer in the first place. They have a higher purpose. If you’d like to read about that, you can in my March 2023 article, “Surplus Contracting Tactics”.

The merchant/farmers are not wrong in blaming some breweries. Some craft brewers bought more hops than they needed thinking they could sell the excess[10]. As a recovering hop merchant myself, I can share with you that hop contracts eliminate ways for brewers to exit a deal while creating maximum flexibility for the merchant/farmer. Terms and conditions have become more oppressive. Brewers fear offending their hop merchants. They don’t dare criticize the forward contracting system[11]. They are coerced into signing contracts for quantities they don’t always want or need.

How hard can it be for a craft brewer to forecast their demand? To project accurate future hop demand, all a brewer needs to know is:

If there will be competing breweries opening nearby,

How future geopolitical changes might affect their local economy,

Whether generational drinking preferences will be changing.

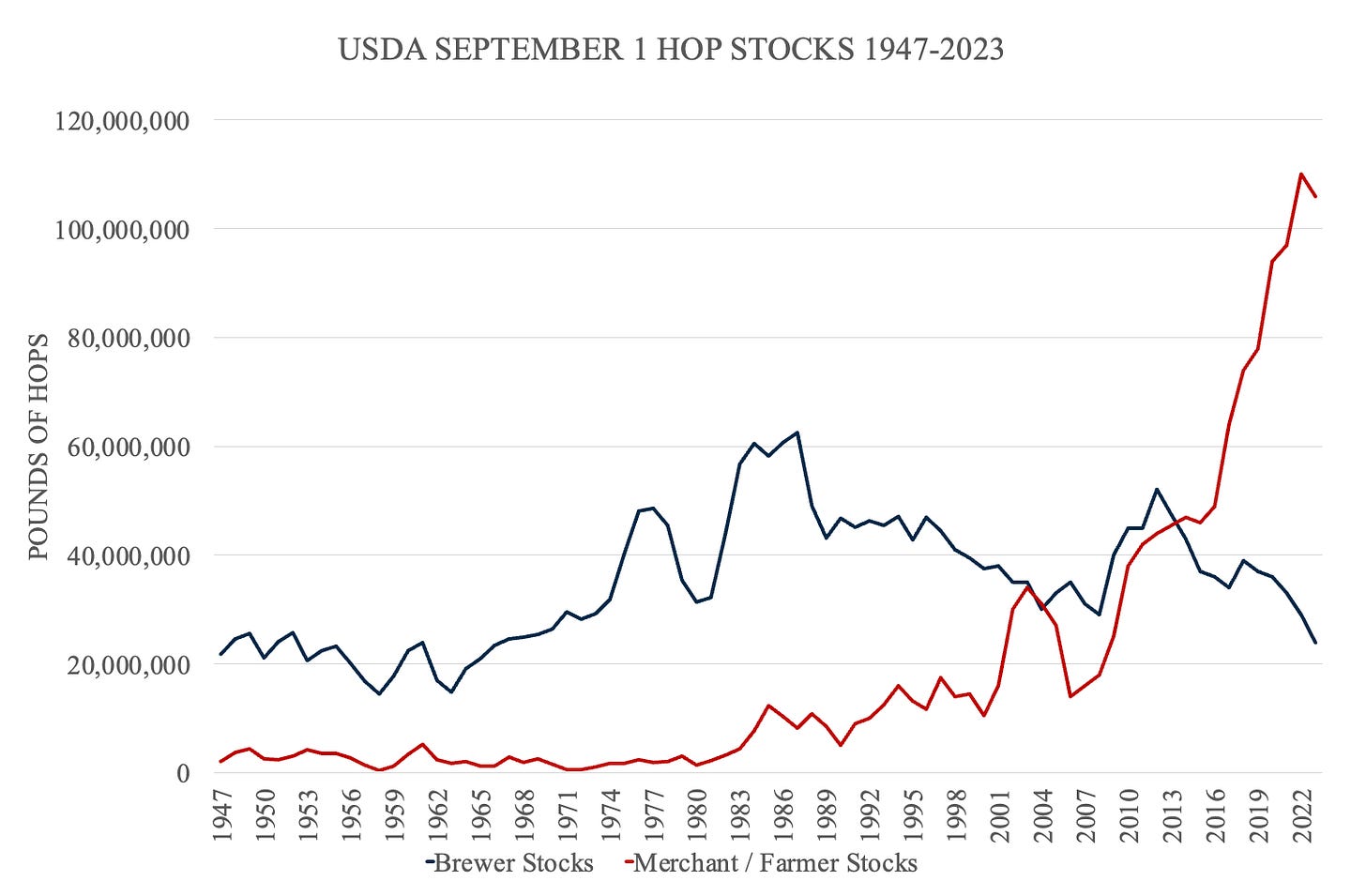

As a result of forcing craft brewers into contracts, inventory held by merchant/farmers in the U.S. has soared (Figure 3).

Figure 3. Hop stocks held by merchant/farmers and breweries 1947-2023.

Source: USDA

MACRO PROBLEMS

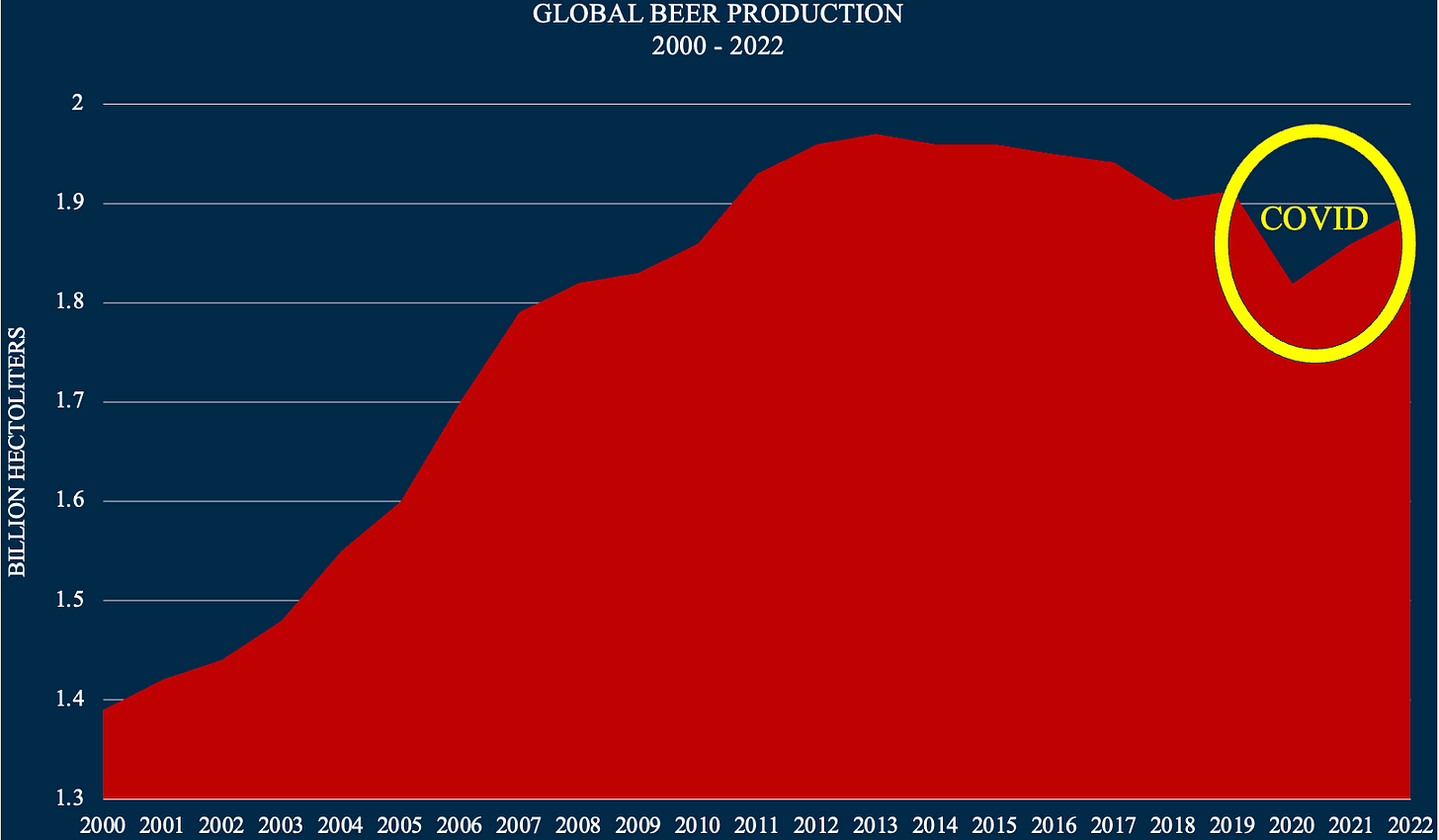

Craft breweries are not alone in their forecasting challenges. Macro breweries are affected by changing demand. The 13.5% decrease in U.S. sales of Bud Light that Anheuser-Busch suffered after the company created a can with Dylan Mulvaney’s face on it was unfortunate and unforeseeable[12]. Their hop contracts could not have anticipated such a big change to their demand for the 2022 crop[13][14]. The decrease in Bud Light sales pales by comparison to the downward trajectory of global beer production and the change in production resulting from the world’s reaction to Covid-19 (Figure 4).

Figure 4. Global beer production change due to Covid.

Source: Barthhaas Reports 2000-2022

The 2020 - 2022 dip in beer production represented 170 million hectoliters (146.86 million U.S. beer barrels) of beer. Barthhaas reported an average hopping rate for those years of 6.17 grams of alpha acid per hectoliter[15]. The decrease in production represented a decrease in global hop demand of 1,048 metric tons of alpha acid (1,048,000 KgA). If that was CTZ producing 15% alpha, it would require 7,028 mt (16 million pounds) of hops. The Covid blip was distributed across high and low alpha yielding hop varieties. As a result, the surplus could total 30-40 million pounds of hops. That might be where Alex Barth got the number he reported at the Hop Growers of America convention in January 2023[16]. I believe the hop surplus is much worse than that.

EARLY SIGNS

An excess supply slowed the market in 2016. It was possible, at first, to shuffle contracted inventory from one brewery who was long to another who was short. By 2017, that was no longer possible. Nobody was short. I believe that is when the current surplus began. The U.S. market was saturated. That’s when merchants focused more on selling proprietary aroma varieties overseas. According to USDA data, acreage in the U.S. Pacific Northwest (PNW) increased every year between 2016 and 2021 (Figure 5).

Figure 5.

Source: USDA

There are a lot of pre-Covid hops available for sale on the Lupulin Exchange. Ten percent of the 1.6 million pounds of hops listed on Lupulin Exchange on November 28th were from crop year 2019 and before (Figure 6)[17].

Figure 6. Lupulin Exchange varieties for sale sorted by oldest first.

Source: Lupulin Exchange, accessed November 28, 2023

Merchant/farmers claim Covid caused the surplus. That’s not true. I believe much of the additional 17,239 acres (6,979 ha.) planted after 2015 could be surplus production. Something caused the responsibility for inventory storage to shift from the brewery to the merchant/farmer. During that time, as seen in Figure 3 above, merchant/farmer held inventory soared by 70 million pounds (31,751.8 mt).

The surplus was a problem long before Covid! There were signs of the surplus in 2018[18]. Louis Gimbel, CEO of Hopsteiner, told attendees at the 2018 Hop Growers of America (HGA) convention that the market was oversupplied[19]. I mentioned this in my March 2023 article entitled “Surplus Contracting Tactics”. If you don’t already subscribe to the MacKinnon Report and this is news to you, you should consider subscribing. It’s free and it always will be.

The warnings didn’t stop there. In July of 2018, Pascal Piroué, as a representative of the German Hop Dealer Association (Deutscher Hopfenwirtschaftsverband e.V., (DHWV)) reported an alpha surplus at the International Hop Growers Convention (IHGC) meeting[20][21][22][23]. In November 2020, Peter Hintermeier, acting as a representative of the DHWV gave a similar warning of surplus at the IHGC meeting[24][25]. In November 2021, Pascal, again in his role as a representative of the DHWV, issued yet another warning of surplus during the November IHGC meeting[26].

The 2023 hop surplus has been building. It’s a buildup of old inventory nobody needs. You won’t find this documented anywhere, but I have been told by people who did it that one common practice 15 years ago or more was to blend old inventory with fresh crop. It prevented inventory buildup. Old inventory was added at a rate of 5-10%. At such a low rate, I was told it didn’t affect the quality of the fresh product. It’s a practice that could be implemented again to fix the current inventory problem.

Example:

If you blend 1,000 pounds (453 kg.) of 2004 Willamette with 10,000 pounds (4,530 kg.) of 2005 Willamette, the quality would not suffer, and the customer would never know the difference. Brewers made plenty of great beer while this was happening. Old inventory didn’t accumulate the same way it does today. A brewer preference for hops from the current crop year led merchants to compete on freshness and advertise that they have “the freshest hops”[27][28][29].

MISINFORMATION?

In a September 2020 article in the Yakima Herald, Yakima Chief Hops™ (YCH) Vice President for North American sales, Bryan Pierce claimed that in February of that same year “the company’s grower members reduced their hop acreage” claiming that it was, “the responsible decision for our growers and breweries” because “No one benefits if there are too many hops”[30]. According to the CDC, the first non-travel related case of Covid was detected in the U.S. on February 26th[31]. There were 60 cases of Covid-19 in the U.S. on March 3, 2020[32]. The World Health Organization (WHO) Director General did not declare Covid-19 a pandemic until March 11, 2020[33][34]. According to this article by Stan Hieronymous, Yakima Chief Hops™ asked their farmers to reduce acreage by seven percent. If that is true, the CDC and the WHO should consult the clairvoyants at YCH about virus-related issues going forward.

According to the same article by Stan, the Oregon Hop Commission asked their growers to reduce acreage by 7-10%. The problem with hop industry organizations like the IHGC, Hop Growers of America or the state hop commissions is that they have no authority over the farmers they represent. They are as powerless as the United Nations[35][36]. They can pass and make resolutions. In the end, they can’t enforce them. Anything they recommend to their members is just a recommendation.

This week at the COP28 summit in the UAE, the U.N. plans to recommend Americans eat less meat to slow greenhouse emissions[37]. The UN has no authority to enact that change much like a hop commission cannot create an acreage reduction.

Jackie Brophy of Hop Growers of America explained the disparity between claims of acreage reduction and the reality of acreage increases by saying, “Each farm has different timing” and that that some farmers increased acreage while others reduced[38]. That may be true. We can’t tell from the data. Serving in an industry organization, it’s important to never say anything too specific in a public statement. Plausible deniability is useful. It may be that the reporter misunderstood. I can imagine a reporter hearing something like “we asked growers to reduce acreage” and misinterpreting that to mean that “farmers will reduce acreage”. Because USDA data is aggregated, we cannot know who increased acreage during the pandemic years.

American hop farmers did not lower production in response to Covid. American production in 2020 was lower due to weather-related yields. Adding insult to injury, many American farms and merchants received millions in Paycheck Protection Programs (PPP) grants[39]. Beyond the profits they received for their hops, they received generous government loans in 2020 and 2021 that were forgiven. With government loans that were forgiven, they ensured they could produce the surplus they now force upon breweries. You can search the database to see which companies received money, how much they received and when the loan was forgiven[40].

SURPLUS FORECAST

I anticipate acreage and price wars in the alpha market due to surpluses and the introduction of new higher alpha yielding proprietary varieties. Heineken, the second largest brewing group in the world, has reported reduced sales in Asian markets[41][42]. Inflation has lowered sales of premium priced beer in the U.S.[43]. Decreasing demand across the beer segment is projected[44]. Younger drinkers do not prefer beer[45]. As a result, fewer hops necessary. No farmers will want to produce less acreage.

I have alluded to a much larger surplus hop inventory than discussed. The circumstances I have mentioned so far in this article will contribute to the existing surplus. How large might it be? Let us revisit the annual depletion rate I mentioned in my September 2023 article, “Hidden Data in the Hop Stocks Report” because it is one way to visualize hop demand (Figure 7).

Figure 7. Hop stock depletion year n-1, year n

Source: USDA

The depletion number becomes more meaningful when we compare it with something. Since it is a measure of the movement of hops stored in the U.S., it is appropriate to measure it against hop stocks. We know U.S. based inventory exceeded annual U.S. depletion by at least 10 million pounds (4,535.9 mt) every year since 2017 with a 20-million-pound (9,071 mt) difference in 2023 (Figure 8).

Figure 8. U.S. annual depletion relative to USDA September 1 hop stocks.

Source: USDA

I believe the 70-million-pound (31,751.8 mt) held by merchant/farmers in the U.S. (Figure 3) represents the slowing of hop shipments. That corresponds with the amount by which hop stocks exceed stock depletion in figure 8. That may not the size of the surplus itself. Slow moving inventory is a sign of a developing surplus, but without more data we cannot be certain … but neither can the merchants. Nobody knows how much of that 70 million pounds (31,751.8 mt) will is surplus.

What we know:

U.S. hop inventory held by merchant/farmers soared by 70 million pounds (31,751.8 mt) between 2016 and 2022[46].

The gap between by which U.S. hop stocks exceeded annual hop depletion expanded every year since 2016.

Global beer production decreased by an amount that represented 1,048 metric tons of alpha acid (1,048,000 KgA). That is spread across all varieties. This could equal 40 million pounds (18,143 mt) of hops.

According to the IHGC, the U.S. hop industry represents 39.9% of global production in 2023. Germany represents 49.29% of world hop production.

The centers for global hop processing are in Germany and the U.S.

The YCH Belgium can house up to 8,800 pallets of product[47][48]. If those pallets were pelleted product in 20kg. boxes, it would represent 7.7 million pounds (3,512 mt) of hops. Extract is also likely stored at the facility on pallets and would represent a higher concentration of hops per pallet. Those figures are not public and cannot be known.

If we use a very conservative 20-million-pound annual surplus figure for U.S. stocks and extrapolate a similar figure to the rest of the world’s production regions, there would be a global surplus of 50.1 million pounds (22,725 mt) in September 2023. This does not account for the cumulative inventory total, but it provides a good lower end for the size of the surplus.

Alpha production is on the rise as I detailed in my previous article. By my calculations and by admissions of representatives of the German Hop Dealer Association listed above, there is already a significant surplus of alpha. This was confirmed yet again during discussions at the IHGC meeting in Nurnberg on November 27, 2023. The shift to more productive alpha varieties will increase that surplus. At the time of this writing, given the preliminary data available, I believe it is possible to add another 10-20 million pounds from the 2023 crop to the estimate of our surplus size. That would equate to a conservative minimum global surplus of 70-80 million pounds (31,751.8 mt – 36,287.7 mt) as of November 2023. As the battle for alpha acreage production begins in the coming years, I expect that to increase. I won’t speculate on the possible upper range of the surplus.

CONCLUSION

Big hop merchants are experiencing some of the pain with which smaller merchants are very familiar, slow or no contract fulfillment. It comes at a bad time. It’s not often a good time to be sitting on $1 billion of hop inventory. Higher interest rates in 2023 make it more expensive today than it was 24 months ago. As a result, I believe even the large merchants are in survival mode. Today, some insist brewers pay for shipments in full prior to their release. That sounds like bank involvement in the decision-making process. That could happen if a line of credit is over extended. Banks don’t want the company to release valuable hop inventory without an equal exchange of value. The extreme circumstances would justify their strict adherence to draconian contract terms.

Opportunity:

To all the brewers or farmers out there … if you would like to share the terms and conditions in your contracts, please black out any sensitive information, create an anonymous Gmail or Proton mail account and send them to me. I don’t want to know who they’re from or even which varieties you bought or prices you paid.

Brewers trying to sell surplus hops should drop their prices to be competitive. Cut your losses and liquidate your position. Sitting on old inventory during the biggest hop surplus in history while prices are decreasing is a bad idea. Leapfrog ahead of your competitors and drop your prices first. That’s not a strategy that will work if every brewery does it, but not every brewery reads my articles so you have an advantage. Breweries who are not allowed to sell to a third party due to oppressive terms and conditions in their contracts need to think outside the box. I won’t make any suggestions here because the merchants reading my articles. You can contact me via LinkedIn if you’d like to chat. There is no risk of a hop shortage in the next few years. Farmers are never quick to remove acreage. I documented and quantified that in my doctoral dissertation. Because low prices displace future demand, I suspect the current market situation will continue for at least the next four or five years.

As a brewer, ask yourself a few questions:

Why buy fresh hops if you can negotiate a lower price on year-old or two-year old hops?

Does the contract the merchant want you to sign serve your needs or is it serving their needs? Check the Force Majeure section to see how you can get out of purchasing.

Why contract for hops when the contract limits your options?

Are there ways to use fewer proprietary varieties? Public varieties support independent farmers and may cost less.

If you’ve read this far, I sincerely want to thank you. I hope you’ve found something of value in what I’ve written. If you haven’t, I’d love to know why you’ve read this far. I don’t charge anything for these articles because I enjoy writing them. It would be nice though if you could return some value for the value you feel you have received. If you’ve not subscribed, you could consider doing that. If you’re already a subscriber, you could share this article with a friend who might not already read it. That would be great. You can’t find such detailed and specific hop market information anywhere else. I am the only person who knows these things who is also interested in sharing them. Everybody else is either afraid or has too much to gain by perpetuating the status quo.

BONUS

For reading this far … here’s the latest. According to the most recent IHGC data, which is current as of November 27, 2023, American aroma acreage decreased in 2023 by 3,695 hectares (ha.) (9,126 acres). This resulted in a decrease of 2,966 mt (6.54 million pounds) of hops. Meanwhile, American alpha acreage increased by 1,207 hectares (2,981 acres), leading to a production increase of 3,896 mt (8,589,121 pounds) of hops. In the end, the U.S. industry experienced a net decrease of 2,489 hectares (6,147 acres) in 2023 that resulted in a net increase of 931 mt (2.05 million pounds) of hops.

German aroma acreage decreased in 2023 by 313 ha. (773 acres). German alpha acreage increased by 178 ha. (439.6 acres). In the end, the German industry experienced a net increase of 25 ha. (61.75 acres) in 2023. Production increased by 6,828 mt (15.05 million pounds) due to the poor yields experienced in 2022.

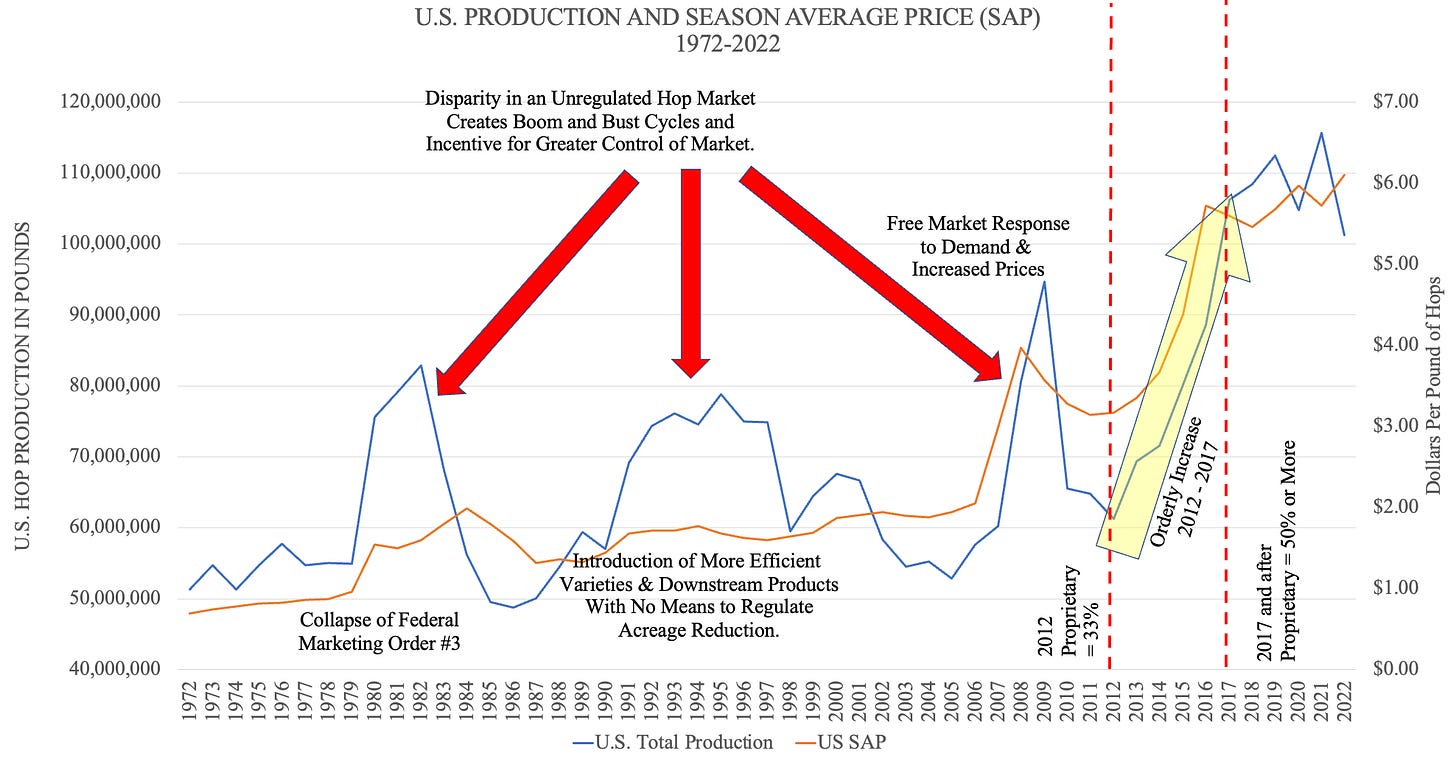

I anticipate the shift in alpha acreage from Europe to the U.S. about which I wrote in my previous article, “A Silent Hop Crisis is Brewing” to begin in 2024. I believe it will continue for several years. If a more efficient alpha varieties like Helios™ enter the market without a corresponding decrease in overall alpha hop acreage, it will result in a surplus of alpha acid on the market that will affect prices. This happened in the 1980s when Nugget and Galena were introduced to the market and again in the 1990s when “Red-Stripe Nugget” and later the CTZ varieties entered the market (Figure 9).

Figure 9. 50-year relationship between hop production and U.S. season average price.

Source: USDA

[1] https://www.probrewer.com/production/ingredients/a-peek-at-the-2023-pacific-northwest-hop-outlook-with-peter-mahony-at-john-i-haas/

[2] https://www.barthhaas.com/ressources/blog/blog-article/hop-update-september-2023

[3] https://www.craftbrewingbusiness.com/featured/video-yakima-chief-hops-gives-us-a-pre-harvest-report-hops-are-blooming-early-but-pests-are-down/

[4] https://mackinnonreport.substack.com/publish/posts/detail/135661071?referrer=%2Fpublish%2Fposts

[5] https://www.ushopsource.com/hops-extracts

[6] https://www.yakimachief.com/commercial/hop-wire/cascade-centennial-contracting

[7] https://www.hops.com.au/how-to-secure-your-future-hop-supply/

[8] https://www.brewersjournal.info/hopssupply-and-demand/2/

[9] https://www.crosbyhops.com/news-blog/blog/hop-contracting-is-changing

[10] https://thebrewermagazine.com/working-hop-contracts/

[11] https://www.forbes.com/sites/taranurin/2018/01/26/hop-vendors-swallow-a-bitter-pill-as-they-confront-an-oversaturated-market-customers-who-cant-pay/

[12] https://apnews.com/article/bud-light-transgender-dylan-mulvaney-442d6d4c3f41d706586de8edd01ac13d

[13] https://nypost.com/2023/10/31/business/ab-inbevs-us-sales-plunge-more-than-13-on-bud-light-fiasco/

[14] https://www.cbsnews.com/news/bud-light-anheuser-busch-marketing-chief-steps-down-boycott-dylan-mulvaney/

[15] https://www.barthhaas.com/resources/barthhaas-report

[16] https://www.hoptalk.live/post/too-many-hops-10000-acre-cut-needed-says-barth

[17] https://lupulinexchange.com/listings?sortby=crop-year-asc

[18] https://www.forbes.com/sites/taranurin/2018/01/26/hop-vendors-swallow-a-bitter-pill-as-they-confront-an-oversaturated-market-customers-who-cant-pay/?sh=55f72aa57343

[19] https://brewingindustryguide.com/rightsizing-the-hop-market/

[20] Pascal is an employee of HopSteiner.

[21] http://www.hmelj-giz.si/ihgc/doc/2018%20JULY%20IHGC%20Market%20Report.pdf

[22] https://www.usahops.org/img/blog_pdf/114.pdf

[23] https://www.hopfen.de/taetigkeiten/vorstand/

[24] Peter Hintermeier is an employee of Barthhaas

[25] http://www.hmelj-giz.si/ihgc/doc/2020_NOV_IHGC_MarketReport.pdf

[26] http://www.hmelj-giz.si/ihgc/doc/2021_NOV_IHGC_MarketReport.pdf

[27] https://www.goodingfarms.com/partners

[28] https://bisonbrew.com/where-to-buy-hops-online/

[29] https://www.brewbound.com/news/dorchester-brewing-company-and-yakima-chief-hops-release-new-england-ipa-beer-collab/

[30] https://www.yakimaherald.com/news/local/hop-growers-make-changes-adjust-acreage-in-response-to-covid-19-pandemic/article_64c56709-9fca-513f-8b59-73095458b508.html

[31] https://www.cdc.gov/mmwr/volumes/69/wr/mm6922e1.htm

[32] https://abcnews.go.com/Health/year-covid-19-us-march-2020/story?id=76204691

[33] https://www.who.int/director-general/speeches/detail/who-director-general-s-opening-remarks-at-the-media-briefing-on-covid-19---11-march-2020

[34] https://www.npr.org/2021/03/11/975663437/march-11-2020-the-day-everything-changed

[35] https://www.ajc.org/news/the-challenge-of-reforming-a-powerless-un-security-council

[36] https://www.japantimes.co.jp/news/2022/09/21/world/un-helplessness/

[37] https://www.foxnews.com/politics/united-nations-set-call-americans-reduce-meat-consumption

[38] https://www.yakimaherald.com/news/local/hop-growers-make-changes-adjust-acreage-in-response-to-covid-19-pandemic/article_64c56709-9fca-513f-8b59-73095458b508.html

[39] https://www.nbcnews.com/politics/justice-department/biggest-fraud-generation-looting-covid-relief-program-known-ppp-n1279664

[40] https://projects.propublica.org/coronavirus/bailouts/

[41] https://www.just-drinks.com/news/thaibev-expects-weak-beer-consumption-in-quarters-ahead/

[42] https://www.bloomberg.com/news/articles/2023-10-25/heineken-premium-beer-volumes-fall-as-drinkers-pull-back?embedded-checkout=true

[43] https://www.wsj.com/articles/beer-sales-drop-as-consumers-balk-at-higher-prices-11673010058

[44] https://www.just-drinks.com/comment/2023-outlook-pockets-of-positivity-in-an-otherwise-pessimistic-beer-industry-landscape/?cf-view

[45] https://www.foodandwine.com/americas-top-alcohol-drinks-7644032

[46] It is important to remember that these are hops from around the world available for breweries in the U.S. and not exclusively U.S. hops.

[47] https://www.prnewswire.com/news-releases/american-hop-supplier-builds-new-european-fulfillment-center-in-belgium-301438602.html

[48] https://www.yakimachief.eu/commercial/press-room/european-fulfillment-center-belgium