My plan for today’s article was to let you know that I will take a break from writing until mid-September. That’s when season two of The MacKinnon Report will begin. Then, I read a recent article and thought you might enjoy seeing how context can change its interpretation.

PRE-HARVEST CONFUSION

There is never a shortage of news from hop merchants and farmers if events can cause one to infer the supply of hops could be tight. A friend who worked in the American hop business for decades used to joke that the average farmer loses his crop 10 times every year before he harvests an average crop. Of course, that’s an exaggeration he made to make the joke funnier, but I have often found the general idea to be true. Fear is an effective sales strategy and it is used often to sell hops[1].

You may already have heard that a heat wave may threaten a variety or two in the U.S. … or that the German crop may be short again by 20% in 2023[2]. The common thread these stories share is that of farmer hardship and struggle. It capitalizes on the stereotypical image of the hard working farmer on his tractor fighting against the elements to bring his much needed crop to market. That image represents the typical European hop farmer whose farm is so small he has no choice but to accept the offers he receives from the merchants. The average American hop farmer in no way fits that stereotype. Most people don’t realize that. The stories reinforce that narrative in an attempt to pave the way for higher prices[3][4]. News of the short 2022 crop in Europe spread far and wide prior to harvest[5]. Early reports suggest the 2023 German crop will again be 20% short[6][7][8]. Recent rains there have come too late to make any meaningful difference. If the forecasts are accurate, it will create a unique market situation. Much of the massive surplus of contracted proprietary American aroma varieties cannot be used to substitute for European aroma varieties[9].

“Never let a good crisis go to waste.”

- Rahm Emmanuel

I’m not suggesting reports of a short crop in 2023 are inaccurate. As the old hop farmer saying goes, “You only know what you’ve got when it’s in the bale.” This year, everybody from legacy news outlets to the World Economic Forum, claims it is the hottest year on record[10][11][12][13]. In July, the Secretary General of the United Nations, Antonio Guterres, proclaimed, “the era of global boiling has arrived”[14]. My point is not that people in the hop industry are lying. Hyperbole is on the rise.

Hop industry members have always been eager to share news of challenges and of poor crop forecasts prior to harvest. To add insult to injury, it’s often presented as a public service to help brewers. When I was a merchant, I did it, which is why I can recognize it when I see it today. Over the past 20+ years, I don’t recall reading articles predicting a bumper crop prior to harvest. Surpluses are seldom discussed until they are so massive that they can no longer be denied. That wouldn’t fit the narrative the hop industry wants to reinforce, which is the desire for ever increasing hop prices. This year is an opportunity to reinforce that narrative. American farmers even manipulated the results of the WSU Cost of Hop Production survey since 2010 to achieve that goal. If you haven’t already read that, I wrote about that in depth in my October 2022 article, “How Much do U.S. Hops Really Cost?”

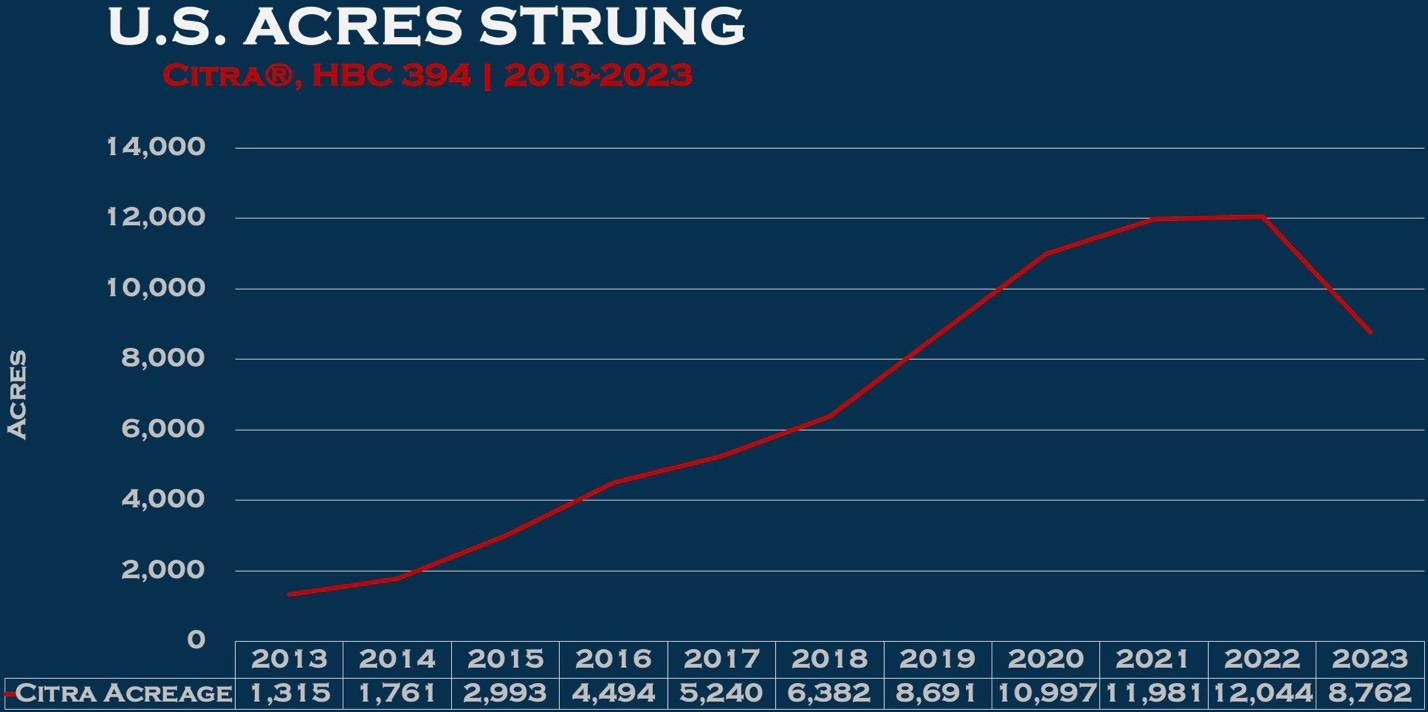

In my May 2023 article, “Propaganda, half-truths and fear porn”, I documented press releases from previous years inferring the crop could be short. In many of those cases, the crop was not short. The most recent example that I believe fits in this category came from the July 26, 2023 edition of the Hop Wire blog from Yakima Chief Hops™ (YCH). In it, the author presented data regarding the acres strung for harvest for several varieties. For simplicity, and because it is the most extreme example, let’s look at the Citra®, HBC 394 variety (Figure 1).

Figure 1. U.S. Citra®, HBC 394 Acreage 2020-2023

Source: Yakima Chief July 26, 2023 Hop Wire Blog[15]

“In the midst of chaos, there is also opportunity.”

- Sun Tsu, The Art of War

The data presented is accurate. The chart combines acres harvested from 2020, 2021 and 2022 and acres strung from 2023. That is a reasonable thing to do. For me, the graph created the impression that the 2023 acreage was massive. I know better. It looks like a big effort relative to acreage changes of the past. It was made easier by the fact that proprietary varieties empower their owners to dictate to farmers on which acreage they can produce those varieties. It’s not a democratic process arrived at by consensus. Why start the graph at 2020? Brewers not familiar with the history of Citra®, HBC 394 production might misinterpret the significance of the 2023 acreage number. Hop industry members know their history well. In February, Pete Mahony, VP of supply-chain management and purchasing at John I. Haas, suggested the 2023 change wouldn’t be enough[16]. A longer timeline provides the historical context to understand why that might be the case (Figure 2).

Figure 2. U.S. Citra®, HBC 394 Acreage 2013-2023

Source: 2013-2022 USDA NASS National Hop Report, 2023 USDA NASS June Acres Strung for Harvest Report.

Additional context will be available if we add another graph regarding the historical relationship of merchant/farmer-held inventory and brewer-held inventory (Figure 3).

Figure 3. March 1 U.S. Hop Inventory 1970-2023

Source: USDA NASS Hop Stocks Reports 1970-2023

GREED

If the growing American hop inventory in merchant/farmer possession is any indication of the oversupply, Pete Mahony will be right. Acreage will need to decrease still further in 2024. It seems the U.S. industry started down a different path beginning in 2011. The relationship between merchant/farmer-held inventory and brewery-held inventory flipped as a result. Not only that, but as figure three demonstrates merchant/farmer inventory began to soar. I believe that was because more acreage fell under the control of a few influential industry elites. Authoritarian regimes that possess a similar structure can be good when the interests of the people (i.e., hop farmers and merchants) align with those of their leaders (i.e., proprietary variety owners). Most American farmers enjoyed unprecedented wealth and prosperity during the previous decade. Now that the tide appears to be changing, if a disproportionate demand for proprietary varieties remains, those in charge and their allies will prosper at the expense of their competitors. This can lead to rebellion sparked by economic, social and political inequity[17].

It is understandable why a massive surplus developed. It’s difficult to say no when a brewer demands a contract for hops, and you stand to make millions. When you say they’ll need to sign a five-year contract and they don’t hesitate, your future looks bright. Greed played a powerful role for me. I suspect I am not the only person for whom greed played a role. Other merchants and farmers as well as the breweries so eager to sign those contracts are also guilty.

The accelerated accumulation of merchant/farmer-held inventory began in 2016. Even as inventory increased those who owned and managed the most popular proprietary brands continued selling into the surplus. They will mask their insatiable greed behind brewer demand taking advantage of plausible deniability. That brewer demand resulted from a fear the hop industry cultivated for years[18].

As figure three above shows, the amount of inventory in merchant/farmer hands today is unprecedented. In my February 2023 article, “The Truth Behind the Hop Surplus” I demonstrated how the data suggests a 54-million-pound surplus began developing in 2016. Since writing that article, I have calculated the effects of several trends that could cause the surplus to be much larger. One of those trends, a continued decreasing of the global hopping rate, was confirmed and documented in 2022 and 2023 on page 37 of the recent 2022/2023 BarthHaas Report[19].

SO MANY OLD HOPS

A quick visit to the Lupulin Exchange on August 1, 2023 revealed that there were 1.6 million pounds of hops available for sale. Some date back eight years to 2015 (Figure 4)!

Figure 4. The oldest hops listed on the Lupulin Exchange on August 1, 2023

Source: www.lupulinexchange.com

There are tens of thousands of pounds of 2016 hops available other than those shown on the Lupulin Exchange. That inventory is dwarfed by the volume of surplus hops available from 2017 and every year after … through 2025. Yes, you read that right. There are contracted hops that have not been produced yet that brewers already don’t need and are trying to sell. I had a conversation with a brewer in that position as I drove to Nashville to attend the Craft Brewers Conference earlier this year.

According to the USDA, proprietary U.S. variety acreage increased from 21,766 acres in 2016 to a peak of 41,897 acres in 2021. If 2016 marked a new stage of surplus accumulation, acreage will need to fall much farther before a meaningful correction can occur. The people responsible for the surplus know this already. They’re working on restoring order. That shouldn’t be comforting if you’re a brewer. They’re doing it so to maintain their control over the market. If you’re a farmer who doesn’t own the proprietary varieties you produce, your farm is at the mercy of somebody else’s agenda.

DIFFERENTIATION

In a 2002 article, the Harvard Business Review explained how sellers of commodities differentiate their product to compete on something other than price[20]. The American hop industry struggled to survive the commoditization of alpha acid in the 1980s, 1990s and early 2000s. Alpha acid is still traded as a commodity. Patents and proprietary products, however, are the ultimate differentiator. A company can’t grow or sell a proprietary variety without a license, or without first buying it from a secondary source, making it prohibitively expensive.

Proprietary plant breeding began in the late 1980s to search for the elusive 20/20 hop[21][22]. Along the way, they discovered varieties with unique flavors and characteristics. The 2022/2023 BarthHaas Report hints at a return to a more active alpha acid battle between Europe and the U.S. in the future[23]. Merchants will want that battle to be fought through proprietary downstream products designed to lock in customers. It doesn’t have to be.

If the disproportionate purchase of proprietary varieties continues when the current surplus is corrected, fewer hop companies will dominate a smaller hop industry going forward. When that happens, brewers can expect ever-higher prices and more limited sources for the hops they want.

WORTHY TANGENT: If you take the time to read the YCH blog cited above, you will also notice the growers to which it refers do not intend on reducing acreage. Based on the text, it would be more accurate to refer to the change in acreage of some varieties as pause in production, not an “acreage reduction”. That should be a warning to the farmers who don’t own the proprietary varieties they produce. As I mentioned in my June 2023 article, “Hidden Truths Behind U.S. Acreage Reduction”, acreage reduction is not real until a farmer removes his trellis. I thought my prediction that farmers would be reluctant to remove trellis would take longer to be proven correct. About that, I was wrong. That’s one reason why I believe the next hop cycle will be a bloodbath.

And now back to our program … You don’t have to wait to see the call for higher prices. Some hop merchants are openly pushing for them now. Later in the Hop Wire blog, the author stated, “it is worth noting that hop prices have not seen a notable increase in years.[24]” You can look at the data for the past 70 years and decide for yourself if that claim is true (Figure 5).

Figure 5. U.S. Season average price 1948-2022 (not adjusted for inflation)

Source: USDA NASS National Hop Report

If the default hop industry behavior is to highlight bad news and to present misleading data, the challenge for brewer is to decipher truth from fiction. That is one reason why, if you work for a brewery, you might want to share these articles with some of your friends who also work at breweries.

“Knowledge is Power”

- Sir Francis Bacon

CONTRACTING

It’s hard to find a hop merchant or a farmer that doesn’t recommend forward contracting. They claim contracts are their guide to brewer demand. They say contracts are the answer to uncertainty and instability[25][26][27]. While some might believe that to be true, 2023 is a perfect example how the current method of contracting fails brewers while enriching the hop industry. Contracts based on craft growth that doesn’t materialize traps brewers in contracts for unneeded inventory. That led to a massive imbalance in the U.S. market[28]. Contracts, as they are written today, are helpless to counter either that or the effects of a poor crop. It’s a system that perpetuates recurring cycles.

Don’t expect a change in the way contracts are structured to come from the hop industry. Contracts lock in the customer and provide a recurring revenue stream. Thousands of brewers with contracted proprietary hops they don’t need now understand that merchants claiming to be their partners are more interested in their own well-being than that of their “partners”. Meanwhile, brewers with contracts for hops that aren’t there, hope for help and search for alternatives.

Considering the unpredictable climate and the concern over climate change, merchants will try to guide brewers toward their brand of proprietary and patented downstream products. They will claim these processed products will increase efficiency. While these solutions may solve one problem, they reinforce another … dependency.

This year is an opportunity to rethink and reevaluate dependency upon a single variety or a single source for hops. Craft brewers worldwide should mimic the behavior of the macros. Their industry consolidated and endured price wars. They learned some valuable lessons from that. They became conscious of the origin of the varieties they purchased, took a proactive role in understanding the costs involved and understood the impact of their purchases on the market. Given the state of the economy and current trends, those would be useful lessons for craft brewers too.

As I mentioned, my next article will not appear until September, which will begin season two of The MacKinnon Report. In the meantime, I’ll be traveling.

Thank you for taking the time to read these articles this past year. That has meant more to me than words can express. The many direct messages I’ve received complimenting and encouraging my work made me feel part of a larger community and for that I am thankful. To all those people who took the time to write and to all those who read every article but never wrote in I appreciate you too … THANK YOU!

[1] https://www.inc.com/heather-r-morgan/how-to-effectively-sell-through-fear-without-going-too-far.html

[2] https://www.brewer-world.com/germanys-hop-yield-down-by-20-encourages-brewers-to-embrace-modern-varieties/

[3] https://news.yahoo.com/changes-brewing-weather-patterns-could-110104580.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAEp4RRzNqcrGlcf98cuEd5e10aCp6x7OBGsGuLFUmuVpJfH5OLv92MCvobiMAYOkVr1QdvqwjKEwI4fyN_jxdj7kQoT6lX_0JRtc8otJHnOQdEcSI6fVTilFiRBAatjGULDfCGOIygTKZFv_PanactbPLV_88DMfkMd5QeaBgGiu

[4] https://www.brewer-world.com/germanys-hop-yield-down-by-20-encourages-brewers-to-embrace-modern-varieties/

[5] https://www.thedrinksbusiness.com/2022/09/poor-hop-harvests-anticipated-in-europe/

[6] Please note the source of these estimates is a hop merchant company.

[7] https://www.brewer-world.com/germanys-hop-yield-down-by-20-encourages-brewers-to-embrace-modern-varieties/

[8] https://www.barthhaas.com/ressources/blog/blog-article/hop-update-july-2023

[9] https://brewhq.ca/blogs/academy/the-lowdown-on-hops

[10] https://www.scientificamerican.com/article/july-2023-is-hottest-month-ever-recorded-on-earth/

[11] https://www.weforum.org/agenda/2023/07/climate-2023-hottest-year-on-record/

[12] https://edition.cnn.com/2023/07/08/world/extreme-global-temperature-heat-records-climate/index.html

[13] https://www.reuters.com/business/environment/july-2023-set-be-worlds-hottest-month-record-scientists-2023-07-27/

[14] https://news.un.org/en/story/2023/07/1139162

[15] https://www.yakimachief.com/commercial/hop-wire/2023-usda-hop-acreage-report-update

[16] https://brewingindustryguide.com/rightsizing-the-hop-market/

[17] https://www.oecd.org/derec/unitedkingdom/48688822.pdf

[18] https://www.forbes.com/sites/taranurin/2018/01/26/hop-vendors-swallow-a-bitter-pill-as-they-confront-an-oversaturated-market-customers-who-cant-pay/

[19] https://www.barthhaas.com/resources/barthhaas-report

[20] https://hbr.org/2002/04/a-smarter-way-to-sell-commodities

[21] A hop that would produce 20 bales per acre (4.48mt/ha.) with 20% alpha acids. Due to the commoditization of alpha acid, the producer with the higher yielding varieties can sell for less or make more profit at market prices.

[22] https://www.wineenthusiast.com/culture/beer/craft-beer-hop-farmers/?queryID=859b04f11b9a65011341f7e244530a8a&objectID=post

[23] https://www.barthhaas.com/resources/barthhaas-report

[24] https://www.yakimachief.com/commercial/hop-wire/2023-usda-hop-acreage-report-update

[25] https://www.crosbyhops.com/news-blog/blog/hop-contracting-is-changing

[26] https://indiehops.com/contract-vs-hop-ordering/

[27] https://www.yakimachief.com/commercial/hop-wire/2023-usda-hop-acreage-report-update

[28] https://www.brewersassociation.org/insights/the-hop-pendulum-a-history-of-the-american-hops-market/