Are you Overpaying for American Hops?

American Hop Farmers Make Billions More than their German Counterparts

The numbers

In 2020, Germany and the U.S. produced 38 and 39 percent of the global crop respectively so a comparison between the two hop producing countries seems reasonable. Between 2009 and 2020, the annual farmgate value of American hops as reported by Hop Growers of America almost tripled (+282%)[1]. When added together that means that approximately 70 farmers in the Pacific Northwest (PNW)[2] received roughly $4.7 billion during that time. What’s striking is that that figure is approximately $2.9 billion more than the estimated $1.87 billion the 1,087 German hop farmers[3] received during the same period[4][5][6][7]. The spoils aren’t evenly distributed. Several American farms produce thousands of acres while others produce only hundreds. A large farm in Germany, by contrast, is 100 hectares (247 acres). If you like averages though, that translates into the “average” American hop farmer receiving $41.1 million more than their German counterpart during that time. Are American hops THAT MUCH BETTER?

Maybe brewers don’t mind the price discrepancy so long as they’re making money selling their beers. Maybe they don’t mind what happens in the hop industry so long as they’re making money. The focus on short-term decisions with little regard for their long-term consequences has been common over the past century. It’s why there’s so much concern by world leaders over climate change today. We like to think we live in a world where we are aware of such things, but our actions don’t suggest we do.

Why the price increases?

It would be easy to attribute the difference between German and American hop value to the high demand for American proprietary aroma varieties. That demand is obvious and indisputable. According to Brewers Association national statistics, the U.S. craft industry grew from $7 Billion to $22.2 Billion in annual revenue between 2009 and 2020.[8] Perhaps American proprietary hops are the cause of all that success. Hop Growers of America reported that U.S. acreage increased during that time by 105%[9]. According to the USDA, U.S. season average prices increased by 182%[10]. The German industry has not stood still. Their gains paled, however, by comparison to the Americans. Between 2009 and 2020, German hop acreage increased a mere 12% while the annual farmgate value increased by 145%[11].

“Don’t cross a river if it is on average four feet deep.”

- Nassim Nicholas Taleb, The Black Swan

Something is rotten in Denmark

The Washington State University (WSU) Cost of Production Survey for hops (a survey for which hop farmers provide the data), reported that the cost of producing hops increased 249% between 2009 and 2020[12][13][14]. U.S. Inflation during that time increased by 21%[15]. For those of you curious about the math, we are to believe the cost of producing hops increased at 11.85 times the rate of inflation between 2009 and 2020! I can understand hop production being more expensive since there are new environmental regulations to deal with and because aroma hops have lower yields than the alpha hops American farmers produced prior to 2009, … but 11.85 times greater than CPI? All the while they’ve been touting the need for sustainable prices. I’m curious what exactly they are trying to sustain?

In 2022, there’s a legitimate reason for prices to increase for hop farmers everywhere as rising energy costs and inflation hurt the farmer as much as anybody. American farmers are fortunate though. They’ve done the work while inflation was low to build the narrative that American hops are extremely expensive to produce.

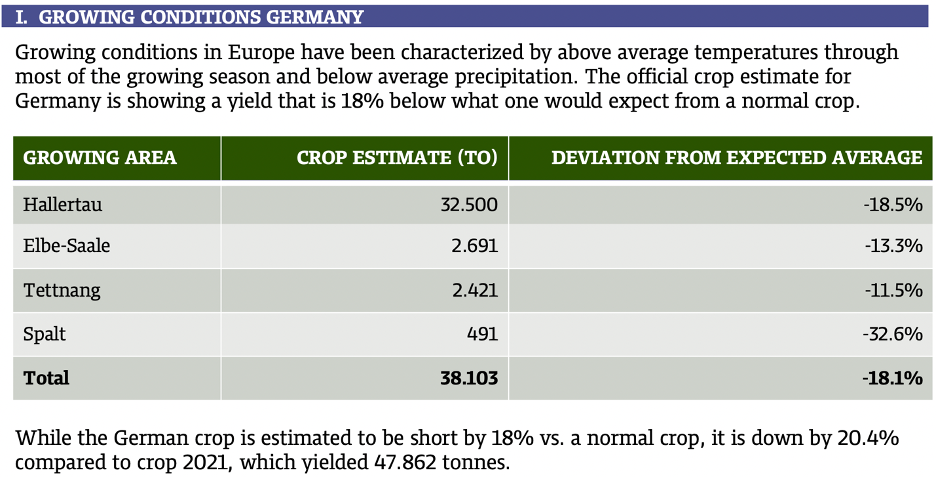

European farmers have had a rough year in 2022 (Figures 1 & 2). They’ve been victims of heat waves, drought, hail storms, high energy costs and increasing costs of inputs, but their contracts don’t allow for adjustments. Detachment from the economy is a reason to revisit the idea of locking in prices with long-term contracts as discussed in, The Con in Hop Contracts. Most European hop producing countries are contracted at levels higher than the estimated yields of the BarthHaas® company (Figure 3). Fortunately, there is plenty of surplus inventory and a record U.S. crop to counter the poor crop in Europe.

Figure 1: Crop Estimates for German Hop Production Regions

Source: BarthHaas® Hop Report August 2022

Figure 2: Crop Estimates for Czech, Slovenia, and Poland

Source: BarthHaas® Hop Report August 2022

Figure 3: Hop Forward Contract Rates

Source: 2021-2022 BarthHaas® Report

The American cost narrative

If the cost of production for hops increased so dramatically between 2009 and 2020, and if American farmers are still losing money, maybe hop farmers in the PNW should leave hop farming to the Germans who seem to be able to do it for less than half their cost. I’m kidding of course … I’m sure American hop farmers are doing fine despite their claims to the contrary. It defies logic that American hop farmers in the PNW are losing more than $2,408.66 … per acre … every year (Figure 4).

Figure 4: Table detailing projected losses by American farmers[16].

Why would any reasonable person continue to expand their business if they were losing so much money? They wouldn’t. The farmers who loved to farm, for whom that might have been true, were driven out of the business years ago by the ones who remain. No … Clearly that’s not what is happening. It seems to me the only other alternative is that farmers are misrepresenting their costs for this survey. That would be useful as they could then justify inflated prices … to make more money.

American hop farmers are certainly smart enough to understand it wouldn’t serve their interests to admit that they’re making a fortune at current prices. More importantly, they know their customers are not farmers. Brewers have no way to discern the true costs from the narrative presented so they are left with no other option than to trust the fox who is guarding the henhouse. With inflation and the cost of inputs increasing worldwide in 2022, every brewer should expect the cost of their hops to increase dramatically. That increased cost will be locked in for at least the next five years due to the current contracting system, which as I’ve mentioned in a previous article, is more about opportunity than cost.

Runaway Production

There’s plenty of incentive for American farmers to try to get their house in order. They tried for decades during the 20th century with no success. When prices spiked in 1980-1982 and again 2007-2008 (periods during which production was essentially unrestrained) the result was runaway production (Figure 5). The surpluses that followed caused prices to plummet. Prices today are higher in real and inflation-adjusted terms than any time since the post-World War II period. We can infer, therefore, from the lack of disorder in the U.S. market that a “pro-farmer agenda” must be restraining supply to maintain premium prices. The primary difference in 2022 relative to the markets of 1980-1982 and 2007-2008 is the overwhelming presence of proprietary varieties. Through a complicated web of entities, proprietary varieties are ultimately owned by people with financial interests in vertically integrated farming and merchant dynasties … Hence the pro-farmer agenda.

Figure 5: U.S. Hop Production & Season Average Price 1972-2021

What is driving the proprietary trend?

Proprietary varieties have been the most successful strategy ever to be implemented in the hop industry. It’s understandable that American hop farmers wanted an alternative that could break the macro brewer oligopsony. They suffered with low prices for a generation as their prices were dictated by their largest customers who knew their costs. They had no alternatives. Today the tables have turned. It appears those same farmers are taking advantage of their opportunity to dictate prices. Today, brewers are the victims of American farmer control brought on by the popularity of proprietary varieties. It’s a cycle as old as the hop industry. Proprietary varieties and the entrance of thousands of brewers unfamiliar with the way the game has been played for centuries have delayed the swing of the market back in favor of the brewers. Is it a new era, or just a delay of the same old hop cycle? Many brewers have not yet become aware of the monster they have created through their wholesale commitment to proprietary varieties, or that they have the power to neuter it (for now).

Is it no longer possible to create flavors with varieties like Cascade, Centennial, Chinook, or the many varieties from around the globe like Fuggle, Mittelfruh or Saaz? Are there no interesting flavors a brewer can find in different malts, yeast, or adjuncts? Is it possible that proprietary hop varieties are the only way to get interesting beer flavors in 2022? I am not a brewer so I can’t say, but that doesn’t seem logical. I might believe that for a minute if people like Ken Grossman and Jim Koch hadn’t enjoyed decades of success before proprietary hop varieties grew in popularity[17]. Both men became billionaires before proprietary variety popularity surged[18]. I’ve heard stories from farmers and merchants claiming to have sold Ken a few bales of Cascades back in the 80’s when he’d drive up from Chico, California during harvest in his VW bus. If the stories are true, that sounds like passion to me. Have Cascade hops changed … or is it the level of passion that has changed? Follow the money I guess. Maybe that was the change Greg Koch was referring to in a recent Stone Brewing blog about why he sold the brewery when he said cryptically, “the brewing industry has changed”[19]. I know a few brewers who truly love to brew. They’re all great people. They won’t be on the cover of any magazines, but they love what they do, which is a wealth more important than money. My guess is that passion and hard work contributed more to the successes of guys like Ken, Jim, or Greg than the hop varieties they used. Maybe passion no longer drives the industry but they stick with the passion narrative because it scans well and make people feel warm and fuzzy. Is it all just about money?

With each purchase of proprietary varieties from the PNW, brewers facilitate greater consolidation of power and influence. Why does that matter? It wouldn’t if it had been in moderation and with some restraint … but it hasn’t. The overwhelming migration of brewers toward proprietary varieties since 2009 puts pressure on the few remaining independent merchants and farmers around the world. Of course … a lot of people don’t like hop merchants. Maybe those people think a world with fewer hop merchants and less competition will be one filled with more rainbows and unicorns. More likely is that as market concentration increases there will be consequences unfavorable to the brewing industry (think higher prices, less selection and more rigid contract terms). If the status quo continues, by 2030 there is a good chance all that will remain will be a few allied merchant-farmer groups offering hops. Truly independent hop farmers and merchants will be gone. Sound like hyperbole? It’s already begun.

[1] Hop Growers of America Statistical Packets 2009-2020

[2]https://www.barthhaas.com/fileadmin/user_upload/kampagnen/barthhaas_bericht/2022/BarthHaas_Report_2021_2022_EN.pdf

[3]https://www.barthhaas.com/fileadmin/user_upload/kampagnen/barthhaas_bericht/2022/BarthHaas_Report_2021_2022_EN.pdf

[4] Source for German season average price: IHGC November country reports 2009-2020

[5] Adjusted for annualized German Consumer Price Inflation rates to 2020 dollars using calculator software available at https://www.lawyerdb.de/Inflationrate.aspx

[6] Adjusted for annualized average foreign exchange rates using calculator software available at https://www.macrotrends.net/2548/euro-dollar-exchange-rate-historical-chart

[7] Adjusted for annualized U.S. Consumer Price Inflation rates to 2020 dollars using online calculator software available at https://data.bls.gov/cgi-bin/cpicalc.pl

[8] https://www.brewersassociation.org/statistics-and-data/national-beer-stats/

[9] Hop Growers of America Statistical Packets 2009-2020

[10] USDA NASS National Hop Reports 2009-2020

[11] Source for German farmgate value calculated from IHGC November country reports 2009-2020

[12] http://ses.wsu.edu/wp-content/uploads/2015/02/eb1975e_hops.pdf

[13]https://www.usahops.org/cabinet/data/TB38E%20Conventional%20and%20Organic%20Hops%20Enterprise%20Budget%20in%20PNW.pdf

[14] This is by no means a criticism of the WSU analysis of the data. There does not appear to be anything wrong with their methodology.

[15] https://data.bls.gov/cgi-bin/cpicalc.pl?cost1=1&year1=200912&year2=202012

[16] https://www.usahops.org/growers/cost-of-production.html

[17] https://www.craftbrewingbusiness.com/business-marketing/beer-billionaires-new-breed-craft-brewers-emerging/

[18] https://www.brewbound.com/news/press-clips-sierra-nevadas-ken-grossman-billionaire

[19] https://www.stonebrewing.com/blog/philosophy/2022/its-time#ageGatePassed