The hop industry has been through a lot the past couple years. While it may seem a lot has changed, the surplus caused by the overproduction of proprietary varieties hasn’t begun to take its toll. It’s not happening randomly. Almost as if by design, despite massive acreage decreases since 2022, the percentage of proprietary variety production has not declined (Figure 1). The hopocalypse, which will end a lifetime of hop farming for some, is being managed.

Figure 1. U.S. hop acreage breakdown in the Pacific Northwest

Source: USDA

HOP CYCLE

The longest bull market in history, which saw prices increase for over a decade, set the industry up for the largest and most rapid acreage decline not caused by prohibition or a World War (Figure 2 & 3).

Figure 2. U.S. Season average hop prices 2011-2023

Source: USDA

“What Goes Up Must Come Down”

- Sir Isaac Newton

Figure 3. U.S. hop acreage changes 2011-2025

Source: USDA[1]

If you’re reading this article, you must be getting some value from it. I’d appreciate it if you could return some value … not by paying anything for it, but by sharing it with a friend who you think might also find some value here.

I enjoy writing these articles. It’s nice to know people find value in them. If you really want to do something nice since it’s Christmas time, send me a message on LinkedIn and let me know your thoughts.

Now back to the article …

This hop cycle resembles those that came before, but it’s different. According to the timeline of previous hop cycles as outlined by BarthHaas, acreage should continue to decrease as we are still at a period when there is a glut of hops. It’s difficult to pinpoint exactly where 2024 falls on the ellipse, but it is safe to assume the industry has not yet reached the bottom (Figure 4).

Figure 4. Anatomy of a Hop Cycle

Source: Barth-Haas Hops Academy

In the past, acreage decreases preceded prices hitting their low point. Surplus inventory prices are low in 2024, while fresh inventory prices remain high. That’s unique in hop cycle history. Brewers burdened by expensive hops are reluctant to take the loss and sell their contracted inventory at market prices. That too is unique as that has been the fate of merchants in the past.

“Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.”

- Winston Churchill[2]

The power dynamic between merchants and brewers shifted over the past decade. During previous cycles, big brewers dictated the terms of their contract renegotiations. With blatant disregard for the consequences, some abandoned their contracts altogether in 2009[3]. In 2024, only the largest brewers can name their terms.

Today, monopolistic control over proprietary varieties gives merchants unprecedented power over their brewery customers. This might sound like a karmic moment, but the brewers forced to fulfill their contracts in the 2020s are not those who abandoned their contracts a 15 years earlier.

Smaller brewers can’t afford to burn the bridges with the larger merchants (i.e., those who control the proprietary varieties). That’s something many might have considered with a smaller merchant. As a result, aging hop inventory sits in storage waiting to be used.

Image credit: ChatGPT 4o

Brewers fulfilling contracts they don’t need sounds great for merchant/farmers, but it’s a double-edged sword for the hop industry. The losses a brewer might take selling expensive contract hops at lower current market prices are unattractive. Brewers are incentivized to use them instead. Storage and interest fees are much less expensive and the hops can be used for future years’ beer production. The dilemma this creates is obvious. By not rolling contracts forward, merchants reduce the need for future crops.

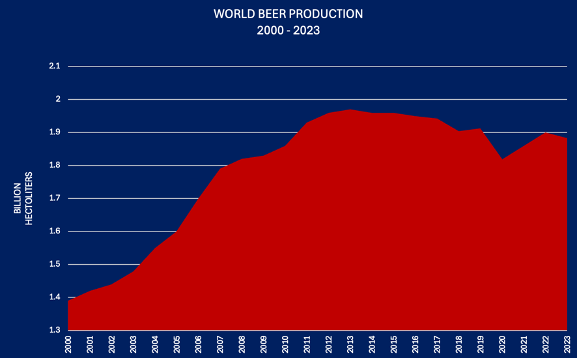

Due to the ongoing decline in global beer production, this is not a problem isolated to American proprietary varieties (Figure 5). It is true for stable European aroma varieties like Perle, Tradition and Saaz as well. In short, there is no corner of the hop industry that will go unaffected.

Figure 5. World Beer Production Decline

Source: BarthHaas Reports

CORRECTION

Although U.S. acreage has decreased since 2022, the supply correction has not begun in earnest. Relative to production, September 1 stocks from the same year set an all-time record high in 2024 (Figure 6).

Figure 6. Stocks relative to production

Source: USDA

The aggressiveness of the 2025 acreage cuts will determine the speed at which the industry moves through this cycle. If the past is prologue, the supply/demand situation will begin correcting in 2025. With the information currently available, I estimate the surplus will continue until 2027 or 2028. At some point, supply and demand will pass like two ships in the night creating another imbalance unless somebody is proactive about managing supply. Proprietary varieties make a soft market reentry possible in the U.S.

Germany must also reduce acreage. Herkules contracts at 20 Euros/KgA are well below what farmers say they need to breakeven. Many farmers claim they need 30 or 35 Euros/KgA to breakeven due to increased costs and declining yields. Alpha acid is a commodity and sales will go to the low cost producer. Americans eager to keep their acreage will try to compete at these prices. Their Perle/Tradition situation is a different story and will be affected by the challenges mentioned above.

RESTRUCTURING

The hop industry will get much smaller between now and 2030. Brewers might think: “Why does any of this matter?” or “This isn’t really my problem.” or my favorite “The hop industry has been through this before. This is nothing new.”

I’ve discovered that brewers don’t care what happens in the hop industry if they can get their hops. From my time as a merchant, I know most brewers complain that hops are too expensive regardless of the price they pay. Somebody always paid less than them. Their behavior, on the other hand, implies they don’t care how expensive hops are. The reality, I assume, is that most brewers are busy and care, but don’t have time to do anything about it so they need a solution presented to them.

Now that the brewing industry is more competitive, brewers are more inclined to be efficient. It’s in their interests to change the status quo to ensure future prices are not dictated to them by a hop cartel.

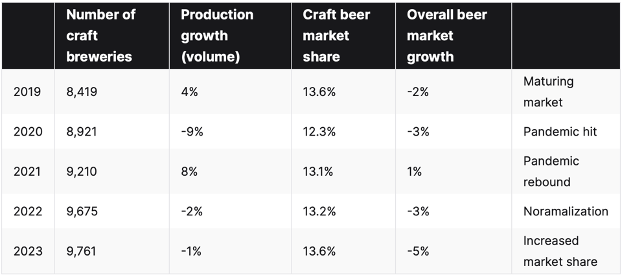

Proprietary varieties led to unprecedented hop price inflation (Figure 2). If breweries don’t act before April, 2025, that will be their fate. Once the surplus is gone, premium and increasing prices every year will be the norm for all varieties public and private. Brewers in a more competitive shrinking market will feel the pain (Figure 7)[4].

Figure 7. Changes to the U.S. craft beer market

Most independent American farms invested in infrastructure over the past 15 years to accommodate growing brewer demand. Proprietary variety owners exploited their neighbors for a quick way to scale production of their varieties. It was a brilliant strategy. Most farmers did not factor in the cost of losing their autonomy. Now merchants are doing something similar by trading access to their markets in exchange for access to varieties. They will suffer a similar fate when they become redundant. As they say … the devil is in the details.

By 2030, there will be fewer hop farmers worldwide. In the October 2001 edition of the Hop Growers of America newsletter Hops U.S.A., I published a graph showing a 96.5% decrease in the number of American hop farmers between 1933 and 2001 (Figure 8).

Figure 8. American Hop Producers 1933-2001

Source: Hop Growers of America

Based on the current outlook, I estimate the US hop industry should cut another 15-20 million pounds (6,803 - 9,071.94 mt) of production per year in 2025[7]. Based on the 2023 average yield of 1,915 pounds per acre (2.14 mt/ha.), that represents 7,832 – 10,443 acres (3,170 - 4,228 ha.). I believe it’s possible for the number of American farmers in the Pacific Northwest to fall below 50 by 2030.

Look for the net result of 2025 cuts combined with the planting of different varieties to produce what appears to be a lower net decrease. That will make the numbers look confusing on the surface. This will be part of the reshuffling of market share mentioned in the next section. Whatever the level of cuts, they won’t be equally distributed. More power will be concentrated into still fewer hands. Refer to my April 2023 article entitled, “The secret behind who controls the hop industry” to understand who the winners and losers will be.

“Competition is a sin”

- John D. Rockefeller

CHALLENGES

For the market to return to equilibrium several countries must cut below estimated demand and sustain a reduced production level for several years while surpluses are used. Once that has passed, they must then increase acreage to the proper production level. There are at least four challenges with that idea.

The increased use of extracts and oils combined with decreasing beer consumption and massive surplus inventories around the world in brewer hands means there is a declining demand for fresh hops between now and 2030.

Farm survival while brewers use surplus inventory will present a serious challenge. Farmers in Washington and Idaho will fare better than the rest of the world where the first profitable yield may be in year two or three. Farmers will find it hard to survive the interim period with reduced income and stable fixed expenses. Timing the reentry of new production will be difficult at best. If they continue to produce, however, they perpetuate the oversupply problem.

Between now and 2030 farmers will battle for acreage. Americans will grab German alpha market share. Germans will grab market share from their neighbors, many of whom produce substitute varieties. Poland and Slovenia will struggle to compete with Germany except as a low-cost producer. The Czech Republic will fight to maintain the integrity of the Czech Saaz brand as Germans just across the border produce the same variety without the pedigree.

The industry has never aligned supply with demand. Overcorrections in both directions are the norm. I believe an overcorrection may be the only way to bring an end to the surplus. Merchant/farmers obsess about not cutting too much acreage because they are all farmers. That, however, delays the surplus response. They should cut as deep as possible and obsess about the reintroduction of supply on the other end. The question is how long to prolong the pain. Although impossible, a one year 100% cut would fix the global supply problem.

OLIGARCHY

If brewers allow the industry to continue down its current path, the next iteration of the hop cycle will be bad for them. With one third to one half fewer farmers by 2030, it will be easier for global hop oligarchs to dictate prices to brewers large and small. The wealthier they grow the more powerful they become. The likely winners have been clear for some time. I wrote about some of them two years ago in my December 2022 article, “Hop Supremacy”.

Reducing market concentration increases the bargaining power for brewers large and small. I’ve heard from some brewers they’re concerned they’ll be cut off from the varieties they want if they offend the big hop merchants. They don’t want to risk that. I’ve been told by others they would change if they had the option. Brewers have all the power. They need to use it. More on how in my next article.

[1] 2024 acreage is an estimate based on the December 10 USDA Crop Production Report available at: https://downloads.usda.library.cornell.edu/usda-esmis/files/tm70mv177/qf85q680x/7m01df76q/crop1224.pdf.

[2] The International Churchill Society https://winstonchurchill.org/the-life-of-churchill/war-leader/1940-1942/autumn-1942-age-68/

[3]https://www.brewersassociation.org/attachments/0000/3982/2010_WSU_Hop_Cost_Of_Production_Study_Producer_Version.pdf

[4] https://www.beveragedaily.com/Article/2024/12/12/craft-beer-market-data-and-trends-for-2025/

[5] available at: https://www.beveragedaily.com/Article/2024/12/12/craft-beer-market-data-and-trends-for-2025/

[6] The chart is gaslighting brewers by implying their market share increased in 2023. That’s not true. According to the Brewers Association, the total market declined while their share of it did not decline as quickly. https://www.brewersassociation.org/statistics-and-data/national-beer-stats/

[7] This may be a conservative estimate. My estimate includes the increase of several thousand acres of alpha producing varieties American farmers plant that German farmers are currently supplying.