Mafia Tactics, Antitrust or the Hop Cartel?

Which MacKinnon Report articles were the most popular based on 2022-2023 Substack views?

When I began these articles last year, I had a series of topics I planned to cover. While I was researching my Ph.D., I could find only one 195-year-old book that discussed the hop market. Obviously, things have changed since the 1820s. One thing that remains the same is that the hop industry is opaque by design. A small group of people and their companies (some of which were hop merchants when that book was written) profit from the system they inherited. Their actions suggest they wish to eliminate the competition and increase their power and wealth. I decided it would be a good idea to document events during my 20+ years in the industry. It has been rewarding to see that a large audience exists for this type of information.

I am grateful you invested your time to read the articles I wrote this past year. To those of you who shared the articles with others, I cannot thank you enough! It was a wonderful way to return value for the value you received from my articles.

I have written about topics I plan to include in a book I will publish in the coming year. I will continue publishing articles on Substack. For the next year, the format will be different. I’ll explain how that will work in my upcoming post on August 1, 2023. If you haven’t already subscribed, please consider doing that now.

In the meantime, I thought you might like to know which articles from the past year captured the most attention. The articles below are listed by popularity on Substack. Their titles are links to the original article for your convenience. The number of subscribers increased as time passed, but the most widely read articles are not the most recent.

Enjoy!

Mafia Tactics Used in the U.S. Hop Industry

Originally Published: MAY 3, 2023

2,960 Views on Substack

1,802 Impressions on LinkedIn

Article Summary:

This article discusses the premium paid for American hops relative to German hops. Perhaps the reader will question whether the premium is justified. Artificial scarcity is presented and the fact that it is generated through the management of proprietary variety access, which affected contracting rates between 2012 and 2022. The article documents the changes in the industry that facilitated unprecedented control over market prices by hop merchants and farmers between 2016 and 2022. It concludes with five reasons why the U.S. hop industry has more effect on the global market than any other production region.

The Truth Behind the Hop Surplus

Originally Published: FEB 13, 2023

2,580 Views on Substack

15,269 Impressions on LinkedIn

Article Summary:

This article documents when the 2023 surplus began and how hop possession has changed with the introduction of craft brewers and proprietary hop varieties. The scale of the oversupply was addressed, and the Faustian bargain farmers made by producing proprietary hop varieties they did not own is presented. Data demonstrating how the surplus in the U.S. is at least 54 million pounds is presented. A graphic shows the reader where the industry is in the hop cycle in 2023, and speculates on how long it may take to correct.

Antitrust in the U.S. Hop Market

Originally Published: JUNE 5, 2023

1,950 Views on Substack

6,334 Impressions on LinkedIn

Article Summary:

This article presents examples of different types of behavior that constitute antitrust law violations to help readers who may not be familiar with the topic. The facts of the 1984 antitrust case the U.S. government brought against John I. Haas and several other merchants in the 1980s are presented. A brief discussion about the subsequent lawsuit filed by Anheuser-Busch followed. As always, source material used for the article were cited so readers can read the original documents. After a summary of the laws enacted to combat antitrust activity, conditions in the U.S. hop industry in 2023 are presented demonstrating that the environment in 2023 is more conducive to potential antitrust violations than at any time in history. The article concludes with contact information where concerned parties who believe they are victims of antitrust violations can report potential antitrust violations.

Hop Forecast 2023

Are We at the Beginning of the Next Hop Cycle?

Originally Published: JAN 26, 2023

1,910 Views on Substack

14,691 Impressions on LinkedIn

Article Summary:

This article provides a forecast evaluating the health of the industry, which at the time of publication was not good. It discusses the factors leading to where the industry is today and discusses the current situation. The article was released just prior to the Hop Growers of America 2023 convention for maximum impact. I was not privy to the information that would be discussed at the convention. Nevertheless, this article covers much of what was discussed there.

4 Secrets Brewers Don’t Know About Proprietary Hops

And how they have changed the hop industry

Originally Published: MAR 14, 2023

1,780 Views on Substack

8,820 Impressions on LinkedIn

Article Summary:

A look at the less desirable side of proprietary varieties. The title of this article summarizes it all. This is a simple article presenting four truths about proprietary hops and how they have negatively impacted the U.S. hop industry and/or the brewing industry.

PROGRESS REPORT 1:

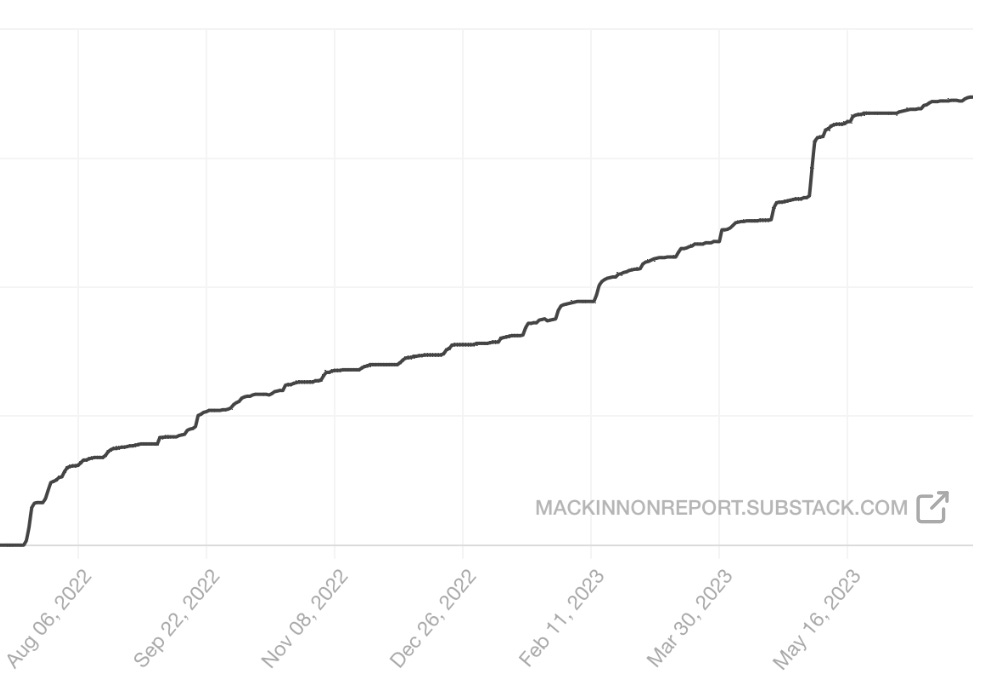

The subscriber base grew quickly at first and steadily until May, 2023 (Figure 1). The reaction to my article “Mafia Tactics Used in the Hop Industry” was outstanding. Something about that article, or the timing of it led to a surge in the number of subscribers. I am not publishing the exact subscriber numbers below because they are not relevant for the point I wish to make, which is this: There is a growing interest in the type of topics about which I have been writing.

https://mackinnonreport.substack.com/p/tactics-of-the-hop-mafia

Figure 1. Subscriber Growth During the Previous July 2022 – July 2023

New Hop Data Reveals Future Trends

A Fresh Perspective on Hop Industry Data Changes the Narrative

Originally Published: JAN 17, 2023

1,660 Views on Substack

12,288 Impressions on LinkedIn

Article Summary:

The article demonstrates the importance of separating out acreage by proprietary and public varieties rather than by geographical area alone as the USDA reports the data. The article demonstrated how using this method of calculating acreage enables the reader to better understand proprietary variety market share and influence the owners of those varieties possess. That influence and its effects upon the industry is quantified for the first time in this article. The article also presents key derivative metrics (not published elsewhere) that quantify industry health. The art for this article was created by AI.

The secret behind who controls the hop industry

Confusion, consolidation and transparency in the U.S. Hop Industry

Originally Published: APR 19, 2023

1,640 Views on Substack

5,567 Impressions on LinkedIn

Article Summary:

This article documents the extent to which a few companies and individuals have dominated the industry through their influence over proprietary varieties. Careful readers will be able to identify one or two individuals whose names appear multiple times. The article discusses and debunks false claims of transparency by one industry member on behalf of a company he once ran. The article concluded by documenting the concerns by Anheuser-Busch executive Don Kloth in 2003 about the formation of a cartel empowered by a Federal hop market order. The article points out the similarities between his concerns over the proposed market structure in 2003 and the structure of the industry in 2023.

Hidden Truths Behind U.S. Acreage Reduction

Originally Published: JUNE 26, 2023

1,570 Views on Substack

309 Impressions on LinkedIn

Article Summary:

Following a summary of other articles that discusses the 2023 June Acres Strung for Harvest Report by the USDA, this article presents an estimate for the 2023 crop based on known acreage and a five-year average yield for proprietary and public varieties. The data tables, once again, are aggregated by variety rather than by state to demonstrate proprietary variety market share and influence. After a brief analysis of that data and the Delayed Surplus Response (DSR), the article explains why the industry can expect price wars in the future.

Propaganda, Half-Truths and Fear Porn

… and how they’re used to increase prices and get brewers to sign contracts

Originally Published: MAY 17, 2023

1,470 Views on Substack

5,316 Impressions on LinkedIn

Article Summary:

This article presents the value of maintaining artificial scarcity. It documents how and why, even during the 2023 hop surplus, merchants and farmers attempt to create fear of a shortage. The article explains why artificial scarcity is desirable. Several examples of the half-truths used to spin facts to generate a sense of urgency and scarcity are documented. All examples contain their respective links. The article concludes with five reasons why a five-year contract might not be the most prudent decision a brewery can make in 2023.

Hop Inventory Facts You Didn't Know

An analysis of the 2023 USDA March 1 Hop Stocks Report

Originally Published: MAR 31, 2023

1,230 Views on Substack

3,624 Impressions on LinkedIn

Article Summary:

This article presents the scale of the hop surplus plaguing the industry in 2023. Graphs demonstrate how traditional inventory possession changed in 2012 and how that accelerated in 2016 with the growth in the influence of American proprietary varieties. The article discusses the idea that contracts do not equal sales and concludes with a discussion of the hop cycle accompanied by a graphic created by the Barth-Haas Hops Academy. Based on the status of the market in 2023 (i.e., oversupplied), the graphic implies that the industry can soon expect lower prices, reduced acreage and supply in the future.

Hop Supremacy

Consequences of an industry in transition

Originally Published: DEC 19, 2022

1,130 Views on Substack

1,180 Impressions on LinkedIn

Article Summary:

The article introduces the concept of increasing market concentration and presents a figure calculated via the Herfindahl-Hirschman Index (HHI). This is the method used by the U.S. Department of Justice (USDOJ) to evaluate whether potential mergers violate antitrust laws. The data demonstrate the rapid increase in market concentration, its effect upon competition over the past 12 years and its impact on hop prices.

Surplus Contracting Tactics

Why would you contract during a hop surplus?

Originally Published: MAR 1, 2023

1,060 Views on Substack

4,888 Impressions on LinkedIn

Article Summary:

This article presents the challenges with the 2023 surplus. It discusses why merchants and farmers have no choice but to enforce billions of dollars’ worth of forward contracts in 2023. The reader will find a list of circumstances that led to the current supply situation and the shift in the balance of power within the U.S. hop industry between 2000 and 2020. In short, the article explains how contracts are the currency of the American hop industry and details how brewers were manipulated to contract hops whether they wanted to or not.

Hops are Green … But Are They Sustainable?

If You Believe Everything You Read on the Internet, They Are.

Originally Published: DEC 2, 2022

994 Views on Substack

1,279 Impressions on LinkedIn

Article Summary:

This article documents how some in the hop industry are capitalizing on their alleged sustainable business practices. It presents the deceptive practices of greenwashing and how it is prevalent, not only in the hop industry but in the business world today. The article uncovers hidden carbon costs in the hop industry for which nobody takes credit and reveals externalities associated with green energy that are not factored into “green” calculations. Members of the hop industry are complicit in this deception, but the article explains how they are following the precedent of a well-organized ruse that originates at a much higher level.

Massive Hop Inventory in the U.S.

… But the numbers reveal so much more!

Originally Published: OCT 1, 2022

956 Views on Substack

3,936 Impressions on LinkedIn

Article Summary:

Months before Alex Barth revealed that a 40-million-pound surplus plagued the U.S. hop industry, this article documented the growing surplus. It explains the reason for the surplus and the problem caused by merchants and farmers holding that inventory. This occurred months before the idea that contracted hops are not sold hops was presented to the public and explains that this has been common knowledge among hop merchants and farmers for decades. The article explores why American merchants and farmers must do or say whatever necessary to perpetuate the myth that contracted hops belong to the brewer even when those hops have been sitting in storage for years.

PROGRESS REPORT 2:

I have enjoyed watching the growth of the report over the past 12 months. I’ve received messages from people around the world sharing their thoughts with me. This has been very rewarding. Many said these articles revealed facts nobody can discuss. For that reason, I believe they add important context to the market.

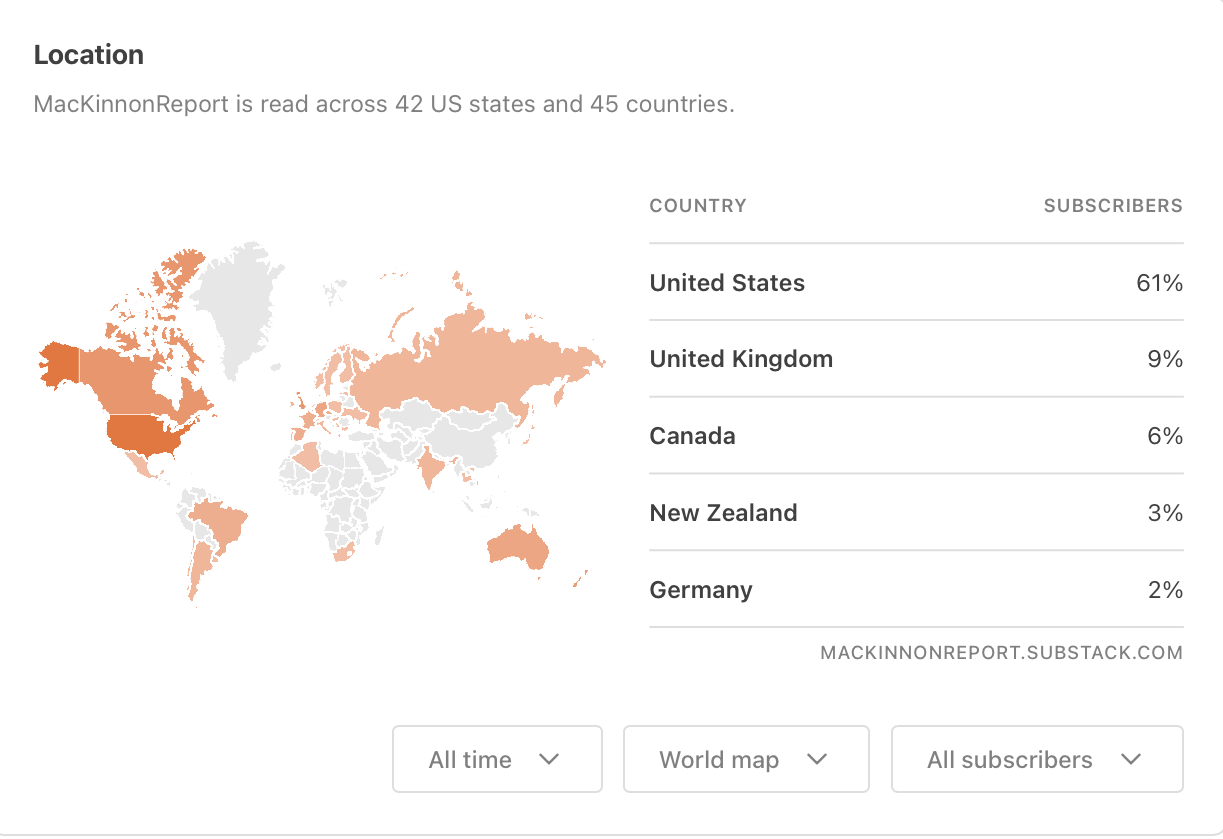

The hop community is global (Figure 2). The often-misunderstood concept of the “Butterfly Effect”, which lay the foundation for branch of mathematics called Chaos Theory, applies[1]. Proprietary variety popularity has changed the industry and the results of those changes are unpredictable. I believe the speed with which these articles spread around the globe is not a testament to the demand by the audience for this type of information to be revealed. Until now, nobody could risk exposing the topics these articles discuss.

Table 2. Global Reach of the MacKinnon Report

The Con in Hop Contracts

Hidden benefits from forward contracts … for suppliers

Originally Published: AUG 1, 2022

937 Views on Substack

769 Impressions on LinkedIn

Article Summary:

This article reveals and discusses the negative aspect of hop contracts and how they are often used as an inferred threat. There is a discussion of how hop contracts benefit the seller more than the buyer and how other methods could be used to replace the current contracting system so as to benefit both parties equally.

Are you Overpaying for American Hops?

American Hop Farmers Make Billions More than their German Counterparts

Originally Published: SEP 3, 2022

927 Views on Substack

892 Impressions on LinkedIn

Article Summary:

This article was the first to document at the massive deception regarding the cost of production of U.S. hops. Together with the subsequent article, ”How Much do U.S. Hops Really Cost” the reader can better understand how the brewing industry has been misled since 2010 by what appeared to be a hop industry content with taking revenge upon the brewing industry. The practices implemented in 2010 remain in place in 2023.

Has a Cartel Taken Over the Hop World?

Originally Published: JUL 18, 2022

792 Views on Substack

1,370 Impressions on LinkedIn

Article Summary:

The article presents the definition of a cartel to the reader and highlights the similarities between that and the situation in the U.S. hop industry in 2022. It was the first article that documents the duplicitous practice implying that entities that share common ownership are independent. This is something one might expect in the world of money laundering where separate entities are used to wash the traces of money ownership. This article discusses why such practices are used in the hop industry and documents how a very cartel-like organization, which is made stronger through tacit collusion, runs the industry and influences pricing.

Who Owns Your Beer?

It’s probably not who you think.

Originally Published: AUG 15, 2022

767 Views on Substack

1,204 Impressions on LinkedIn

Article Summary:

This article discusses the Faustian bargain brewers made with the companies that own the proprietary varieties on which they now depend for their success. If the reader is not familiar with the story of Dr. Faustus, there is a colorful and entertaining video summary of the story performed by Thug Notes. The article lists who owns which varieties and highlights the concentration of variety development efforts within the industry.

How Much Do U.S. Hops Really Cost?

How U.S. farmers changed the way they calculate their costs of production.

Originally Published: OCT 15, 2022

759 Views on Substack

848 Impressions on LinkedIn

Article Summary:

This article is the second to document the use of the WSU Cost of Production Survey by the U.S. hop industry to misrepresent the cost of production. The article goes into detail and provides the links necessary to demonstrate how the alleged cost of production has been inflated by at least 25%. Every brewer who wants to understand how American hops got so expensive should read this article. Spoiler Alert … it all began with the shortage of 2007/2008.

Who Sets Hop Prices … and How?

Networks, Propaganda … and Collusion? Plus … a few words on the 2022 Market

Originally Published: SEP 15, 2022

721 Views on Substack

889 Impressions on LinkedIn

Article Summary:

This article details how price information spreads throughout the industry through an informal network that meets daily. The efficacy of the network ensures that opportunities to increase price are not missed. This creates what may appear from the outside to be a coordinated effort (i.e., explicit collusion) by the hop industry to manipulate prices.

A Chat with AI about Hops

Discussing the Hop Industry with OpenAI and ChatGPT

Originally Published: JAN 4, 2023

714 Views on Substack

952 Impressions on LinkedIn

Article Summary:

ChatGPT 3 was one month old when this article was published. The prompts used elicited the chatbot’s impression of events in the hop industry. The prompts were printed as presented to OpenAI unedited as were the answers received. The discussion confirms the conclusions of MacKinnon Report articles until this point.

Did you Get the Hops You Paid For?

All hops are equal, but some hops are more equal than others.

Originally Published: NOV 16, 2022

688 Views on Substack

769 Impressions on LinkedIn

Article Summary:

This article discusses the developing preference for proprietary hop varieties, their ubiquity in the brewing world and the effect that popularity has on the prices charged for those varieties. The question of value is at the forefront of this article, which discusses DNA fingerprinting and variety variability among other topics.

The Golden Age of Hops

The Future History of the Hop Industry: Choose Your Own Adventure

Originally Published: NOV 1, 2022

662 Views on Substack

1,532 Impressions on LinkedIn

Article Summary:

This was a fictional story loosely based on the current players in the hop industry. It was written in a “choose your own adventure” style so the reader could determine how the story ended. The choice was between continued increases in the use of proprietary varieties or a return to the use of public varieties. The article was for entertainment purposes but also could be seen as a forecast of sorts. Readers who are aware of the current players in the industry might enjoy trying to figure out which character represents which person or company.

June Acres Strung for Harvest Analysis

Be concerned brewers ... be very concerned

Originally Published: JUL 12, 2022

128 Views on Substack

Article Summary:

This was one of the first articles of the 2022 MacKinnon Report. In it, the June Strung for Harvest Data were presented. The article points out the unprecedented nature of an acreage reduction at a time when prices are stable at a high level. The article explains the reason for this as well as the potential consequences to brewers and farmers.

PROGRESS REPORT 3:

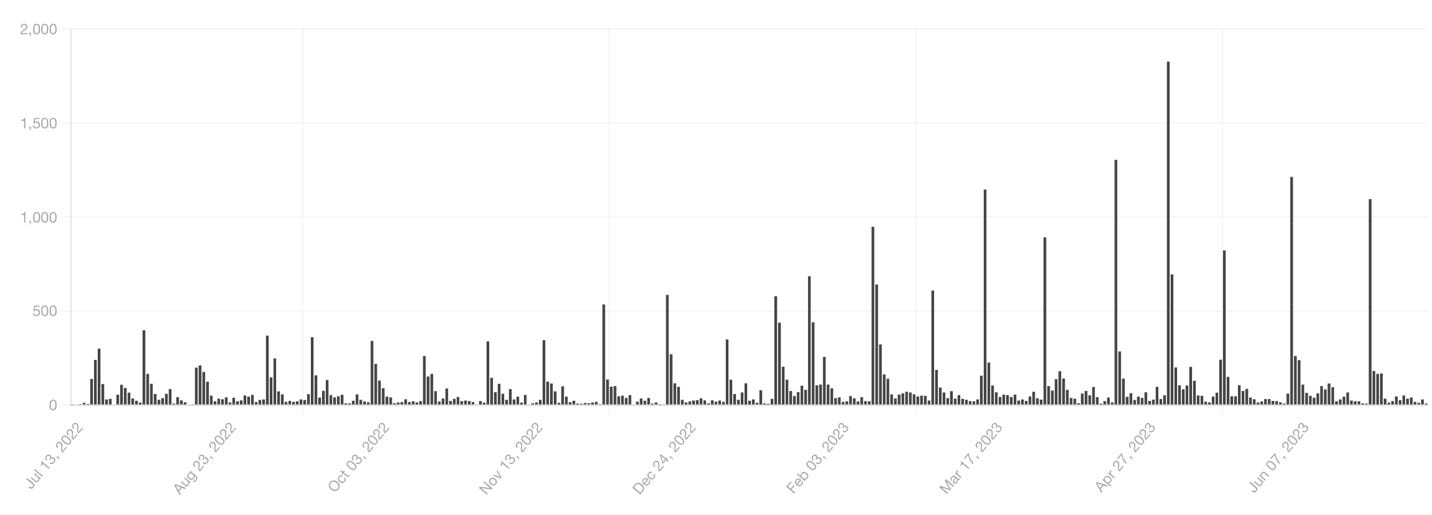

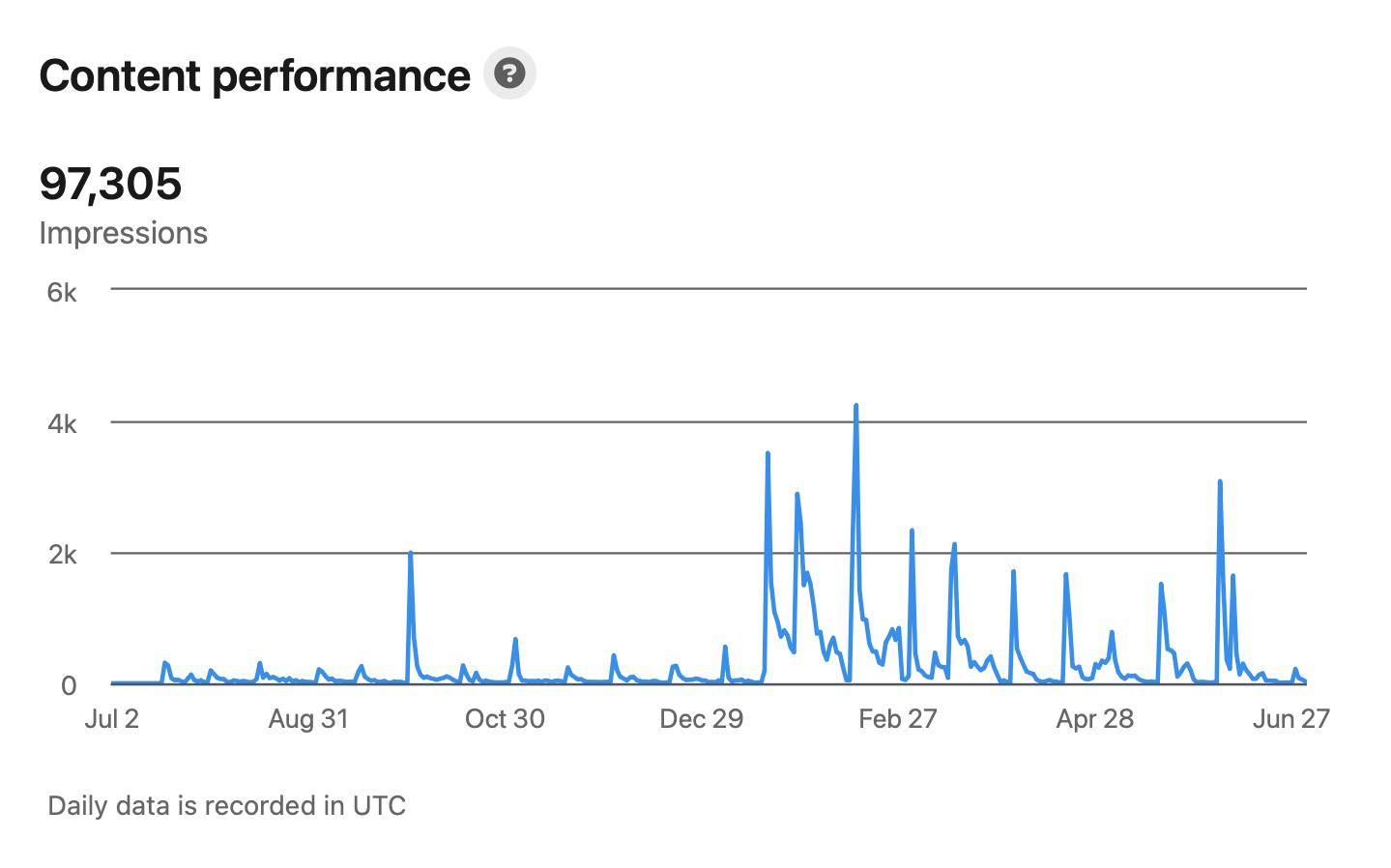

I ranked the articles in this list by Substack views (Figure 3) rather than the number of impressions on my LinkedIn Profile, which were much larger (Figure 4). In my opinion, the way LinkedIn impressions are calculated make them less valuable. Nevertheless 97,305 is a significant number of impressions over the past 12 months. What is consistent between LinkedIn impressions and Substack views is the fact that interest spikes the day an article is released and dwindles until the next article release.

Figure 3. Substack views between July 2022 and July 2023.

Figure 4. LinkedIn impressions between July 2022 and July 2023.

According to LinkedIn:

Impressions: The number of times your posts were displayed on screen. This number is an estimate and may not be precise. The graph below shows the change in impressions on each day in the selected time range.

[1] https://fractalfoundation.org/resources/what-is-chaos-theory/