For most of the 20th century, American hop farmers tried to manage hop supply so they could receive better prices. Each time they tried, they failed. There were simply too many variables and too many American farmers who could freely plant the available varieties independently based on their read of the market. Farmers were competitors for limited market share and could be played against each other with the result being ever lower prices. If you've only been involved in brewing for the past 10 years or so, it might be hard to imagine that was ever the situation. That's the way it was just 16 years ago. No to today.

During the past decade, prices have been on the rise. So too has the acreage of proprietary varieties. Many hop farmers, if asked, would likely tell you they're just getting by, times are tough, they're not sure about this year's crop, they're going to need higher prices to deal with all that government regulation and then don't forget the inflation. The joke among some merchants ... back when I was one ... was that farmers will lose the crop 10 times before harvest and then somehow pull out an average crop or better almost every time. That's because today's hop farmers are really good at what they do. They have amazing technology and smart consultants helping them make even better decisions. The reason prices are high, stable and likely to increase still further, however, is because there are fewer cooks in the kitchen today than there were only a few years ago. As proprietary acreage increases, their influence becomes stronger each year.

Hop Monopolies

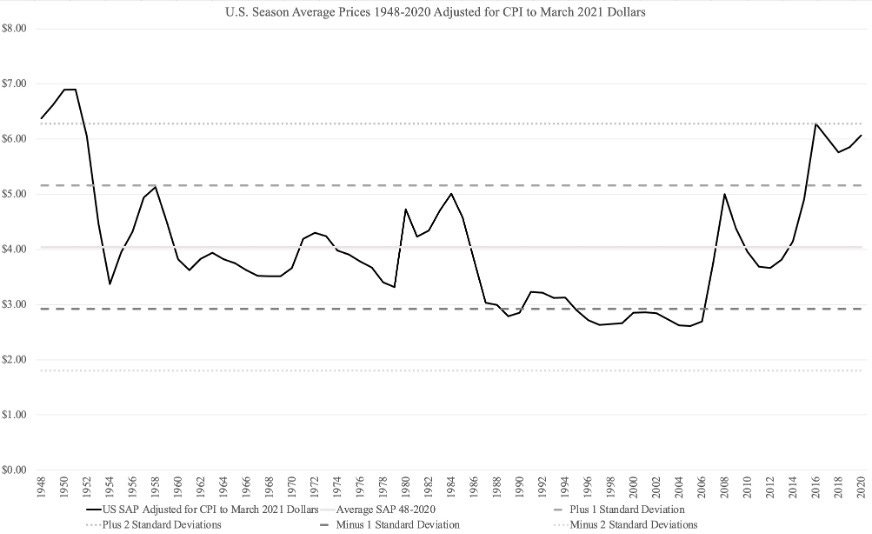

Once the popularity of patented and trademarked varieties soared past 50 percent, their owners, who ultimately controlled the purse strings, gained greater influence over the influence. Today, they can proactively manage production and supply for the monopolies those varieties represent. Their influence, made possible through the incredible consolidation of power, calmed the chaos of centuries of cyclical shortages and surpluses. This enables prices to remain stable at levels quite a bit higher than the inflation adjusted 73-year season average price (Figure 1).

Figure 1. U.S. Season Average Prices 1948-2020 adjusted for CPI into March 2021 U.S. Dollars.

Source: USDA NASS, U.S. Bureau of Labor Statistics

Patented or trademarked varieties represents a monopoly that can be managed by its owners however they choose. They can restrict production to only licensed growers and can restrict sales to only licensed outlets if they choose. That's what most of them do to maintain the perception of value. Sony Playstations wouldn't cost $600 if they were languishing on department store shelves. There must be the perception of exclusivity for prices to remain high.

For the most part, the people that own proprietary varieties also own hop farms. In some cases, they're merchants. It would be easy for a brewer to misinterpret all these different entities operating completely independently of one another like Coke and Pepsi might. Conversations like the one in this video on Facebook[1] talking about how the good people at Yakima Chief Hops Inc. and Yakima Chief Ranches, L.L.C. are "like one big family" infer there is distance between the owners of these two companies. Some of the people involved in these and other companies that appear independent are quite literally family. The U.S. hop industry really isn't that big. A number commonly thrown around is that there's only 100 families involved in hop farming in the Pacific Northwest. In Germany, by contrast, there are over 1,000 hop farmers. This is relevant only because it introduces the concept of the circles of influence present in the industry. That's a theme we'll develop over the coming months.

A Changing Market

Between 2010 and 2020, the line between farmer and merchant blurred. Everybody and their dog tried to sell hops to craft brewers ... myself included. What can I say ... it seemed like a good idea at the time. ¯\_(ツ)_/¯. I won't make that mistake twice. Proprietary varieties have completely changed the landscape of the hop market in just under 20 years. Would it even be possible for somebody without access to proprietary varieties to make a go of becoming a hop merchant? As somebody who knows what doing so entails, I don't think so.

In 2021, Hop Growers of America reported that six of the top ten varieties had some form of intellectual property rights (Figure 2). Six years earlier, in 2016, there were only four proprietary varieties. Go back still further and you'll find still fewer proprietary varieties on that list.

Figure 2: Hop Growers of America Top 10 Varieties by Acreage 2016-2021

Source: Hop Growers of America 2021 Statistical Packet

The trend is obvious even over this short period. There are five companies today, which, when considered together, appear to enjoy cartel-like powers over the U.S. hop industry. How and why the actions of five separate and independently run companies can be considered together deserves an explanation. That's a tangent but it has to do with tacit collusion and complex monopolies. Digging too deeply into that topic would make this article much longer than it already is. I'll return to that in a future article. It has to do with the way monopolies interact and explains how hop pricing works. I'd encourage you to investigate those on your own in the meantime. In a nutshell, hop prices have more to do with opportunity than cost ... not to be confused with opportunity costs.

Based on the acreage their varieties represent, the Hop Breeding Company (HBC[2]), HopSteiner, The Association for the Development of Hop Agronomy (ADHA), Virgil Gamache Farms (VGF) and CLS Farms influenced approximately 70 percent of acreage and production in the U.S. Pacific Northwest in 2021 according to USDA data published in the 2021 National Hop Report[3]. This percentage most certainly understates the influence proprietary varieties represent in total in the Pacific Northwest. That's by design. Sadly, there's no way to account for the 8.8% of the crop in the Pacific Northwest reported as "other" or "experimental" in 2021 (Figure 1). Those are aggregate categories designed by the USDA with the intention of ensuring confidentiality for varieties produced by fewer than three farmers[4]. Those are no man's land categories where new varieties thrive before they are reported separately, where less popular varieties go on their way out, and where some varieties only ever grown by one or two farmers exist. So, the actual acreage and production represented by proprietary varieties in 2021 was likely higher than the roughly 70 percent mentioned above.

Figure 3: U.S. Proprietary, Public and Total "Other" and "Experimental" Acreage 1999-2021

Source: USDA NHR 2000-2021

A Rising Tide

When craft brewers pay premium prices for popular proprietary varieties in short supply, prices increase for all varieties across the Pacific Northwest. Craft brewers, therefore, are partially responsibile for the high prices they are paying for American hops today. This is also how the influence of the owners of proprietary varieties extends beyond the varieties they own. The effect is isolated however to the region in which farmers can grow them. Premium prices for American proprietary varieties, for example, do not increase prices for European noble aroma varieties. The perception of opportunity costs created by high ROI proprietary varieties standardizes returns per acre across varieties and increases farmer expectations.

Pete Mahoney, Vice President of Supply Chain Management and Purchasing at John I. Haas (one of the partners of HBC) explained how prices for popular proprietary varieties can increase prices for other varieties when he said the following during a conversation about pricing varieties,

"...return per acre must be competitive with some of these bigger more popular varieties

otherwise growers [sic] are not going to keep growing that variety." [5]

Before we look at how the hop variety development companies grew to the point where they are today, if you're interested, you can take a step back and read a little bit about the history that led to the current trend of proprietary varieties.

What is a Cartel

It is at this point we should examine what exactly a cartel is. We're all familiar with the word. We assume we know its meaning. It's a word that may spark different feelings based on your experiences.

If you enjoyed watching Ozark as much as I did, then Mexican drug cartels might come to mind when you think of cartels. Assuming you don't approve of or profit from the activities of Mexican drug cartels, chances are you view cartels in a negative light due to the violence and illegal activities associated with them. If, on the other hand due to the high gas prices we're all paying nowadays, OPEC is the first thing that comes to mind when you hear the word Cartel, you might have a much less negative opinion about cartels. In a world dependent on oil, we have grown to appreciate the products OPEC brings to us. Certainly, we all want oil producers to get a sustainable price so they can survive. Due to oil's importance in our daily lives, it seems reasonable for them to manage supply and avoid surpluses. Are you beginning to see some parallels? Still, we don't always perceive a cartel as a bad thing, and they seem to have an accepted place in our world.

Cartel as defined on the Encyclopedia Britannica web site[6]:

"CARTEL, association of independent firms or individuals for the purpose of exerting some form of restrictive or monopolistic influence on the production or sale of a commodity. The most common arrangements are aimed at regulating prices or output or dividing up markets. Members of a cartel maintain their separate identities and financial independence while engaging in common policies. They have a common interest in exploiting the monopoly position that the combination helps to maintain. Combinations of cartel-like form originated at least as early as the Middle Ages, and some writers claim to have found evidence of cartels even in ancient Greece and Rome.

The main justification usually advanced for the establishment of cartels is for protection from "ruinous" competition, which, it is alleged causes the entire industry's profits to be too low. Cartelization is said to provide for distributing fair shares of the total market among all competing firms. The most common practices employed by cartels in maintaining and enforcing their industry's monopoly position include the fixing of prices, the allocation of sales quotas or exclusive sales territories and productive activities among members, the guarantee of minimum profit to each member, and agreements on the conditions of sale rebates, discounts and terms."

As the Encyclopedia Britannica's definition explains, the existence of cartels is nothing new and may or may not include anti-competitive behavior.

The New Market Share

The market share of merchant sales to brewers has never been public information and has always been a closely guarded secret. Under the old paradigm, a grower that had more acreage might be viewed by his neighbors as more relevant because they controlled more resources. This is a farmer rendition of seeing who has the biggest penis. With proprietary hop varieties and contract production, the size of a farmer's ... tracts of land ... no longer determines relevance. With proprietary varieties and contract farming, a new power dynamic is governing the hop industry.

An article from the August 2017 edition of the New Yorker magazine explained how Driscoll's implemented a similar strategy in the berry market. They were quite candid about the nature of their relationship with contract farmers. The article quoted Driscoll's senior vice president and general counsel when he compared the company to its neighbors in Silicon Valley saying,

"Growers are sort of like our manufacturing plants. We make the inventions, they assemble it and then we market it, so it's not that dissimilar from Apple using someone else to do the manufacturing but they've made the invention and marketed the end product."[7]

It's a great analogy! When we think of an iPhone, we think of Apple Inc. in Cupertino, California. That's whose brand is on the box. Who put that phone together in China or the companies that made its components in other countries doesn't matter. In fact, any of those companies may change from year to year based on Apple's needs. The consumer would never know. Each proprietary hop variety, similarly, is a product that represents part of a larger brand. The trade names accompany the technical names or numbers from the patent (a variety number for example) for a reason. Patents expire. Brands and trademarks last forever. That's a long time.

Is There a Cartel?

Let's have a look at the facts we know and can address and compare them with our Encyclopedia Britannica definition.

· Variety development is a costly process that can take ten years or more before a viable new variety is released[8]. The time during which companies began developing proprietary hop varieties was some of the most difficult times the industry ever faced with record low prices. Saving resources, as the HBC claimed it was doing, made perfect sense. Regardless, it seems at least some individuals came together[9] as required by the Encyclopedia Britannica definition above.

· Plant patents grant a 20-year time-limited monopoly on the invention[10] from the original filing date. Since each patented variety bestows upon its owners the exclusive rights to use their invention, it is possible to say that individuals involved came together to exert monopolistic influence on the production or sale of a commodity. It is important to note at this point that the word "monopolistic", which, in capitalist societies, often has a negative connotation[11] implies absolutely no wrongdoing. Limited monopolies, as previously mentioned, are the intended goal of patents.

· There are individuals in the industry who, while cooperating on some issues such as variety development, maintain their independence from one another legally via their ownership in separate companies and continue to compete with one another. While HBC is certainly one example of this, it is not the only example in the industry in 2022. Their interests are aligned in that they are marketing the proprietary varieties to which their mutual competitors lack access. It appears, therefore, that some companies have a common interest in exploiting the monopoly position that the combination helps to maintain.

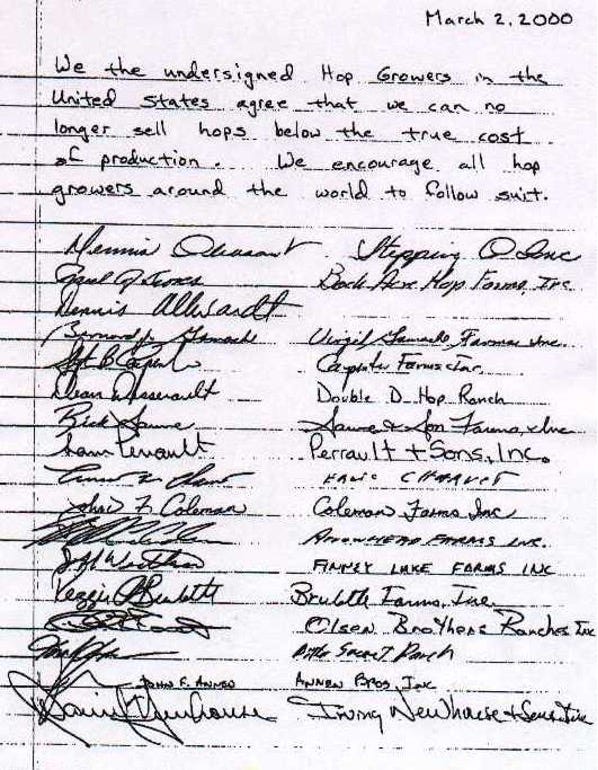

· USDA season average price information from the past 70+ years demonstrated that what one might consider ""ruinous" competition" existed in the hop industry between 1986 and 2006 (Figure 1). Many in the industry stated over the years that entire industry's profits were too low. A public statement called "The Hop Growers' Doctrine" from a loosely formed group of growers referred to as the Hop Alliance demonstrated the mood in 2000 as well as the intolerance for continued low prices (Figure 5).

Figure 5: The Hop Growers' Doctrine

Source: Hop Growers of America March 2000 Newsletter

· Through the licensing of production rights with farmers, proprietary variety owners can influence the production, and therefore the availability, of those varieties. Via sales licensing agreements, they can influence the first tier of suppliers through which their varieties are sold. The initial distribution of proprietary varieties via licensed channel partners suggests some degree of exclusivity. Nobody can expect to control second-hand sales between brewers on more public venues like lupulinexchange.com so there can never be total exclusion from access to a variety. It could be argued that this criterion, therefore, is not fully met.

· That is not the only part of our Encyclopedia Britannica definition that has not been met. There is no evidence of what are referred to as the "most common" activities mentioned in the definition above (i.e., price-fixing). There is no evidence of any such activity in the hop industry today. While there have been anti-trust accusations in the industry in the past,[12] that was a different era. The people involved today deserve the benefit of the doubt. We should assume they are not involved in any impropriety or any illegal behavior unless there is evidence to the contrary. Tacit collusion is a common practice, but that is a far cry from price fixing. In fact, one could argue that tacit collusion makes the market more efficient as it reduces opportunities for arbitrage. Millions of dollars in royalties are paid to proprietary variety owners each year adding to the price of the hops. That, however, cannot be considered price fixing by even the most liberal definition of the word. So, on this important count, the events in the industry today do not meet the definition of a cartel.

In the end, whether you call the structure dominating the hop industry a cartel or not must remain up to the interpretation of the individual. There are certainly some cartel-like activities. The companies in question appear to satisfy some of ... but not all ... the criteria as defined by the Encyclopedia Britannica. An argument can, and most probably will, be made that no cartel exists.

An old saying, however, comes to mind ...

"When I see a bird that walks like a duck and swims like a duck

and quacks like a duck, I call that bird a duck."

- James Whitcomb Riley

In the end, labels don't really matter. Call the current structure whatever you like. Just beware of the effect it is having upon the price you pay for hops and how those prices are influenced. In 2021, decisions regarding more than 75 million pounds of American hops were influenced by the people who run five companies. The people profiting from the current system will likely call that the market. Technically, they're not wrong.

If the trend of the past 10 years continues, the influence of proprietary varieties in the industry will grow. Proprietary varieties (patented and trademarked hops) have increased competition between independent farmers and larger agribusinesses which may lead to reduced varietal diversity[13]. Comparing the pie chart presented in the Hop Growers of America 2021 Statistical Packet representing PNW acreage (Figure 6) with the pie chart presented in the Hop Growers of America 2016 Statistical Packet (Figure 7), it certainly seems the hop industry has already moved toward a greater concentration in fewer varieties.

Figure 6: Hop Varieties in the Pacific Northwest as a Percent of Acreage

Source: 2021 Hop Growers of America Statistical Packet

Figure 7: Hop Varieties in the Pacific Northwest as a Percent of Acreage

Source: 2016 Hop Growers of America Statistical Packet

I hope you found this article interesting. If you haven't already, I hope you will consider subscribing. I'll be publishing something around the 1st and 15th of each month so as not to fill up your inbox.

These articles are free. If, however, you found some value in what you read and would like to provide some value in return, you can donate here. There’s no obligation to donate if you cannot afford it.

Cheers!

[1] https://www.facebook.com/watch/?v=1831608463590304

[2] HBC is a joint venture between John I. Haas, Inc. and Yakima Chief Ranches, Inc. A cursory look at a German merchant group BarthHaas tells us that John I. Haas is somehow intimately involved with the BarthHaas Group. According to the web sites of both companies, the owners of Yakima Chief Ranches, Inc. are also part owners of Yakima Chief Hops, Inc.

[3] https://www.nass.usda.gov/Publications/Todays_Reports/reports/hopsan21.pdf

[4] https://www.nass.usda.gov/Publications/Todays_Reports/reports/hopsan21.pdf

[5] The Haas® HopCast™ 2021 Hop Harvest Update: time stamp 23:40 - 24:00. https://tunein.com/podcasts/Food--Cooking-Podcasts/The-HAAS-HopCast-p1372086/?topicId=165549928

[6] https://www.britannica.com/topic/cartel

[7] https://www.newyorker.com/magazine/2017/08/21/how-driscolls-reinvented-the-strawberry

[8] https://www.craftbeer.com/craft-beer-muses/birth-of-a-hop

[9]https://www.hopbreeding.com

[10]https://www.uspto.gov/sites/default/files/about/offices/ous/Cooper_Union_20130604.pdf

[11] https://www.huffpost.com/entry/when-capitalism-fails---t_b_623600

[12] https://case-law.vlex.com/vid/hops-antitrust-litigation-in-893414586

[13] https://www.legalzoom.com/articles/plant-patents-how-has-this-altered-farming-practices