A BALANCING ACT

Since 1938, American hop farmers sought to balance the market through Federal marketing orders that regulated the supply available for sale. Farmers and merchants couldn’t trust each other, which led to their failure (Figure 1).

Figure 1. Comic art anonymously mailed to U.S. industry members during the third Federal marketing order.

Source: The artist’s identity is not publicly known

Prior to 2024, a hop cycle existed where one or two years out of every 10 saw hop prices skyrocket[2]. The strategy that developed in response exploited brewers for maximum profit in the shortest amount of time to recover losses in low price years. While fortunes were made and lost under the old paradigm, boom-and-bust cycles strained relationships. Merchant/farmers craved stability. Like the dog who doesn’t know what to do with the car once he catches it, the hop industry didn’t know what to do once they got what they wanted when the craft boom began. The industry continued to rely on the playbook from previous hop cycles. With proprietary varieties a managed equilibrium is possible, but the old strategies did blend well with managed equilibrium.

PREDICTION: Once the current situation is corrected, Intellectual Property (IP) owners won’t make the same mistake. New methods for contracting hops will be coming.

Yakima Chief Hops™ has already presented what they call the “Action Plan”[3]. Brewers should beware of schemes and programs with fancy new names. The hop industry is looking for ways to encourage breweries to contract over the next few years while the surplus works through the system. Contracts are the life blood of the hop industry. Without them, merchants and farmers receive less bank financing[4]. I discussed this in my March 2023 article titled, “Surplus Contracting Tactics”. Brewers who would like to discuss the pitfalls to look for can DM me on LinkedIn. Something for brewers to consider is that price, quantity and duration are not the only contract terms that are open to negotiation.

“You can put lipstick on a hog and call it Monique, but it is still a pig,”

- Ann Richards, Governor of Texas, 1991-1995[5]

CORRECTION IS PROTECTION

EXPECT MORE ACREAGE REDUCTION: It’s tempting to view the 2022, 2023 and 2024 acreage reductions as a shift away from proprietary varieties if that fits your business model. Some have called it the beginning of the latest hop cycle[6]. It has the potential to be the last iteration of the hop cycle if IP owners can figure out how to align production and demand. Proprietary varieties offer total supply control and so this surplus will be different from those of the past. The aroma acreage farmers were told to remove is the calibration of a powerful weapon. There will be significant acreage reduction in the U.S. again in 2024. A return to 2016 production levels is warranted. That is when the current overproduction likely began. Farmers aren’t happy about that. They will struggle to maintain efficiency on their farms. Size matters to American hop farmers for more reasons than efficiency though. Bragging rights have been a big part of being a hop farmer. Once acreage is managed properly, however, IP will forever change the balance of power in favor of those who own the varieties, not the people who produce the most. To a certain extent, it already has, but the transformation is not yet complete. Those allowed to produce them in the future will be in the position to succeed.

The current oversupply resulted from seven things:

The rapid shift of the U.S. hop industry away from public to proprietary aroma varieties requiring production and sales licenses.

The increase from fewer than 2,000 customers in 2008 to over 10,000 customers in 2023 many of whom had little to no experience buying hops[7].

Forward contracts that cost brewers nothing at the time of signing.

Exploitation of artificial scarcity to force long-term contracts at inflated prices and the implication that without contracts the hops would not be available.

Bank financing of merchant and farmer operations separately based on the same brewer demand.

Draconian terms and conditions ensuring brewers could not escape their relationship with the merchant/farmer.

Greed

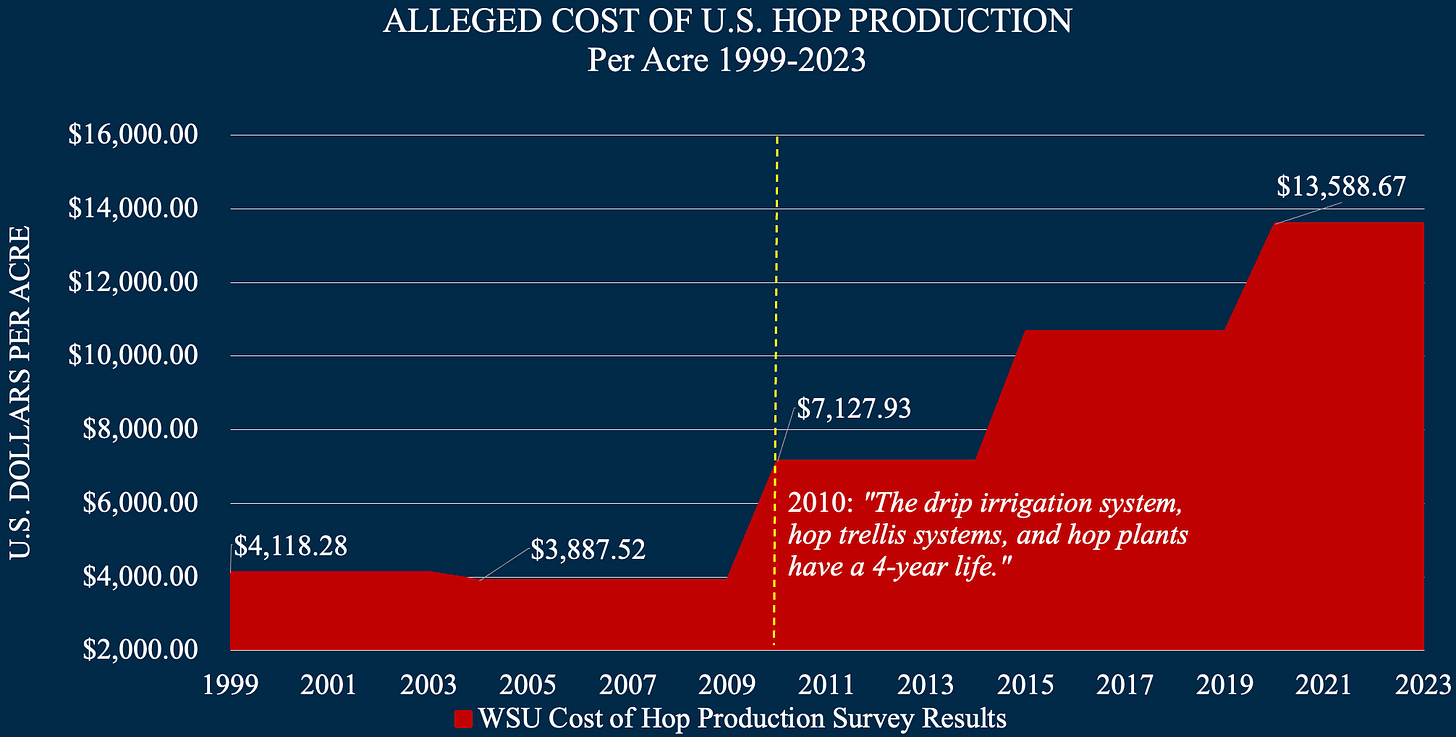

The decreased season average price in 2023 can be explained by the reintegration of alpha varieties, which sell at lower prices. The fact that aroma variety prices have also decreased while thousands of acres were removed demonstrates the scale of the oversupply. This surplus follows a 12-year bull market, which creates a problem. During that time, American farmers anchored price negotiations at inflated levels by overstating their cost of production (Figure 1). Brewers acting in good faith believed the numbers the hop industry reported.

Figure 2. Rapid increase in alleged U.S. cost of hop production.

Source: 1999, 2004, 2010, 2015, 2020 WSU Cost of Hop Production Surveys

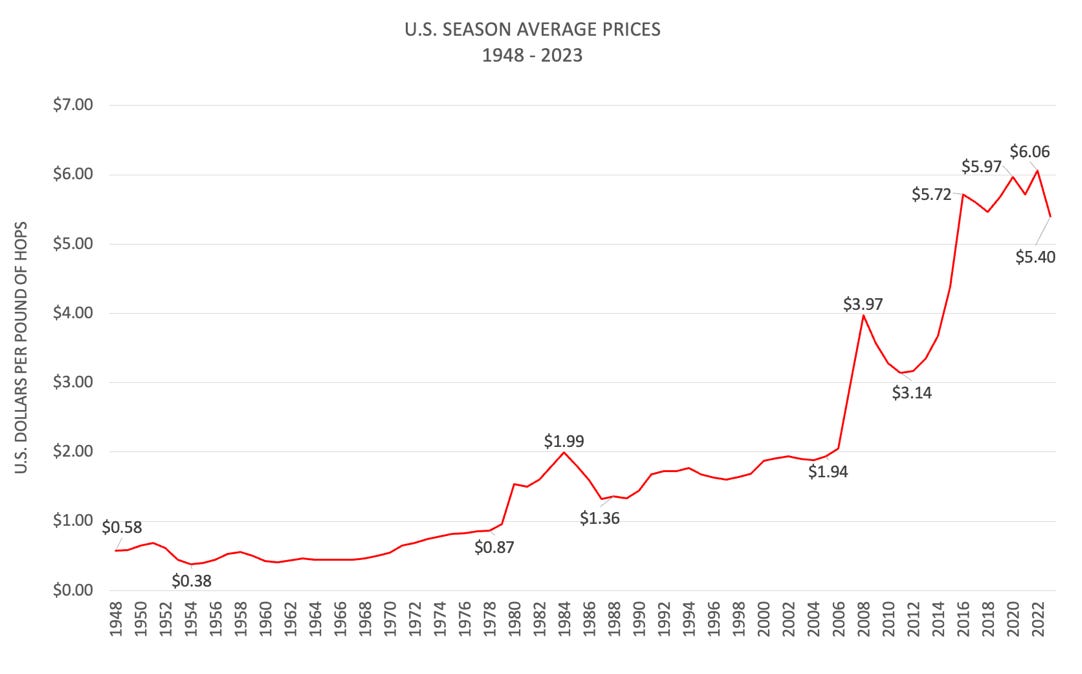

This led to the highest hop prices in 70 years even when adjusted for inflation (Figure 3, 4 & 5).

Figure 3. U.S. Season Average Hop Prices Adjusted for Inflation to 2023 Dollars

Source: USDA NASS, CPI data accessed at: https://www.usinflationcalculator.com

Figure 4. U.S. Season Average Price for Hops Raw Prices

Source: USDA NASS

Figure 5. U.S. Season Average Prices Raw Data and Prices Adjusted for Inflation Using the Consumer Price Index to 2023 USD 1948-2023.

Source: USDA NASS

In 2023 inflation caused U.S. cost of production to increase. Farmer options are limited. More on that below in the Fun Fact section below.

CHALLENGES AHEAD

LOOK FOR STRUCTURAL CHANGES: The aging contracted inventory brewers must purchase before they can access fresh hops are at inflated prices. Between 2011 and 2021 American acreage doubled[8]. Farmers expanded their acreage far beyond the needs of the world’s breweries, much like they did in the early 1980s. They used massive profits to build massive efficient state-of-the-art harvest facilities. Their challenge will be to downsize to adjust to the real needs of the brewing industry. Those needs continue to decrease. The easiest way for the hop industry to adjust to the decreasing demands of the brewing industry would be for several farmers to get out of the business. Every farmer would be happy for their neighbor to do that, but nobody will step forward voluntarily. The good …or bad … news depending on which side of the issue you’re on is that American farms are well capitalized and prepared to fight to maintain their acreage. That can mean opportunities for low prices for breweries especially those willing to work with public varieties in the coming years.

“New conditions require, for solution – and new weapons require, for maximum application – new and imaginative methods. Wars are never won in the past.”

- General Douglas MacArthur[9]

The proprietary supply chain and level of service to which brewers have grown accustomed over the past decade is expensive. It’s a necessary component of the plan to maintain supply control. Don’t expect that system to change because supply control is an essential component of price control. Resellers facilitating the anonymous sale of brewery owned inventory are a consequence of tyrannical hop merchant empires. While they are necessary, this is an inefficient way to manage inventory caused by merchants’ desire for secrecy and total control. They would rather nobody negotiate outside of their approved system. Merchants and farmers vying for limited new sales in markets will force lower margins.

ALPHA DOG

EXPECT AN ALPHA RACE: The alpha market was a low priority for American farmers for over a decade. They could make more money selling aroma varieties. Germany became the low-cost alpha producer. Now that the American aroma market shows less potential, American farmers want to get “their” alpha acreage back. Much of the German alpha acreage is still under contract for the next few years. They won’t wait. Those conditions alone would be the reason for alpha prices to decline. Enter Helios ™ HS15619.

If the early data is accurate, Helios ™ HS15619 promises to be the most efficient alpha producing variety in history. More importantly, it is proprietary. In 2023, the U.S., harvested 1,509 acres (610.93 ha.). Farmers there are motivated to fill empty trellis from 2023 and 2024. They will plant alpha if any offers are available. Because alpha acid is a commodity, sales are price based. The entry of a new more efficient alpha varieties will intensify price competition in the alpha market. According to the November 2022 German Hop Merchant Association (DHWV) report to the International Hop Growers Convention (IHGC), there was already a global alpha acid surplus of 3,600 metric tons caused by the overproduction of high alpha aroma varieties produced for the craft market.

The Hop Breeding Company (HBC) has dominated the proprietary game. Their varieties were planted on over 50% of U.S. acreage in 2022. Helios ™ HS15619, a Hopsteiner variety, represents their chance to become a significant player in the proprietary space. The hop industry is a zero-sum game. The HBC won’t want a competitor to take away their market share. They released HBC 682, of the variety formerly known as Pahto®, back in 2018[10]. In 2023, Washington farmers planted an additional 517 acres (209.3 ha.). With the increased motivation for American farmers to plant alpha varieties comes the potential for an alpha war. Inflation increased the European cost of production more than it did in the U.S. European hop farmers will have a difficult time competing with the Americans (Figure 6).

Figure 6. Rate of inflation for the largest European hop producing countries 2022-2023

Source: Financial Times[11].

A recent proposal to balance the German budget by reducing farm subsidies pushed German farmers to protest. This week they will protesting in Berlin, Munich and other big cities around the country despite freezing temperatures[12]. As you can see from the picture below, hop farmers were represented. A hop farmer friend of mine visited Munich this week. He reported that it’s not just farmers united against the government. It was something close to a general strike with butchers, bakers, and probably even candlestick makers all participating. 💪🏼

Margins for German hop farmers have not been as large as for the Americans. Average annual prices reported for German hops between 2011 and 2023 increased by 64%[13]. American prices, in Euro equivalent increased by only 55.8%[14][15]. BUT … Putting prices on equal terms, however, reveals that German hops have traded at a significant discount to American hops for years (Figure 7).

Figure 7. American versus German annual average prices adjusted to Euros per kilogram.

Source: USDA NASS, IHGC, Average annual exchange rates available at www.ofx.com[16]

TRAGEDY OF THE COMMONS

We’ve all heard the argument for pursuing Artificial Intelligence (AI). If “we” don’t do it “they” will, and “we” can’t allow that to happen. This “us versus them” mentality exists between merchant/farmers. The fact that Helios ™ HS15619 is proprietary increases the stakes. Proprietary control locks in customer loyalty. That creates a forced loyalty and recurring revenue. That’s one reason it is the goal. Before proprietary varieties, there was very little loyalty to suppliers. In previous races for market share, merchants traded profit for market share until there was no profit left to trade. That resulted in record low prices (Figure 3 & 4).

If that happens again, and there’s every reason to expect it will, merchants will abuse the alpha market until it is barely profitable. That will be create opportunities for breweries between 2024 and 2030. Brewers, large and small, that haven’t already explored the efficiencies of using extract and downstream products offer should explore their use for bitterness at least at the beginning of the boil.

Helios ™ HS15619 will fuel competition for the alpha market via dueling proprietary varieties. If both alpha and aroma markets can reach equilibrium (that is the goal), hop merchant/farmers will manage an artificial scarcity to create prices they believe are profitable. That goal may be 10 years off, but it is within reach. Once that happens, hop farms that produce proprietary varieties will be money printing machines. All that presumes craft breweries continue to prefer proprietary varieties.

MANAGED DECLINE

LOOK FOR MOTIVATED SELLERS: Merchants locked breweries into contracts for five years. Contracts to many farmers, on the other hand, were renewed each year. That was a very clever move. It enabled the quick acreage correction we saw in 2023 and will see again in 2024. It provides flexibility for the middleman’s liability while it locks in revenues from breweries. Structuring the deals in this way demonstrates that managing supply is possible and was the plan all along.

Varieties like Helios ™ HS15619 guarantee fewer acres will be necessary. Managing the decline will be the challenge confronting a shrinking hop industry. This happened in the 1980s with the introduction of Nugget and Galena (the higher yielding alpha varieties of the day) and continued in the 1990s as CTZ varieties entered the market. Without supply controls or IP in place, farmer optimism (or stubbornness) resulted in the delayed surplus response, expensive acreage changes and wild price fluctuation (Figure 8). That can be avoided if proprietary varieties are properly managed. That is the incentive.

Figure 8. 1980-2008 ACREAGE AND PRODUCTION

Source: The Barthhaas Report, USDA NASS National Hop Report season average prices

When macro breweries canceled alpha contracts in 2009 and 2010, it freed up thousands of acres of trellis. Motivated farmers planted aroma varieties for craft breweries. Last year, farmers were told one or two years of idling acreage would be sufficient. They hoped they might repeat their good fortune from the past. If the 2024 U.S. acreage reduction is close to 10,000 acres (4,048 ha.), there is a chance some idle trellis can be used to increase proprietary aroma variety production again once it becomes necessary in a few years.

I’d like to take a little break to thank you for reading this article. I hope you get some value from it. If you do, please pay it forward. Create some value for somebody else without expecting anything in return. It’s a good feeling. 😊

Back to our regularly scheduled program.

OUTSIDE FORCES

EXPECT SIGNIFICANT SHRINKAGE: Beer Marketers Insights reported at the end of December 2023 that American beer consumption was at the lowest point since 1999[17]. Markets for all segments except imported beer are contracting, albeit at a slower rate than the previous year (Figure 9).

Figure 9. National Beer Wholesalers Association changing demand estimates for segments of the beer market.

Source: NBWA

Big Pharma’s success may also contributing to the decline in hop demand. Over 40% of Americans are obese[18][19]. In 2023, 5.8 million people were prescribed the popular weight loss drugs Ozempic® and Wegovy®. These drugs alter the dopamine response, which reduces the cravings for and the perceived satisfaction from a variety of things, including alcohol[20]. Reduced demand for beer translates into reduced demand for hops over time. Goldman Sachs has projected the market for anti-obesity medications will increase 1,600% by 2030[21]. If these estimates are correct, weight loss drugs will likely continue to contribute to the decrease in American beer consumption … and hop demand through the decade. The world seems to have reached peak beer for the time being[22].

Beyond 2030, the managed decline of the industry will likely continue. According to people like Jordan Peterson and Elon Musk, population collapse is a greater threat than climate change (Figure 10).

Figure 10. Elon Musk tweets about population collapse

Source: X.com

Traditional media outlets disagree[23][24]. Their claims are based on fertility rates of countries around the globe[25]. It is more accurate to say global demographics will change before any eventual collapse. According to the CIA World Factbook, developed countries have population replacement rates below 2.0. That means they cannot maintain their current population without immigration. Beer consumption, particularly craft beer, is the highest in developed countries[26][27]. In late December 2023, Elon Musk emphasized the point again during this conversation in Italy during which he stated that within three generations the global population will be less than one billion people. If he is correct, that is a steep decline. It may be hard to see how that problem matters in a difficult 2024 economy, but it may be on the horizon.

FUN FACT:

If the American industry’s claims about the cost of hop production were accurate, using the 2023 average U.S. yield of 1,915 pounds per acre (2.14 mt./ha.) and the 2023 season average price of $5.40 per pound ($11.90/kg.), we are to believe the average farmer lost $3,247.67 per acre ($8,021.74/ha.) in 2023. That would equate to a loss of $176.4 million for the U.S. industry in 2023. If we go all the way back to 2010 when U.S. farmers began aggressively misrepresenting their costs, the industry LOST $1.05 BILLION! Of course, they didn’t lose money every year. In 2017 and 2019, American hop farmers in Oregon, Washington and Idaho made a combined profit of $12.6 million. Anybody who has visited a hop farm in the past decade might find this hard to believe.

Brewers who believe the hop industry acted in good faith were victims of an organized industry wide effort to overstate production costs … designed to inflate hop prices. If that sounds like a conspiracy, it’s because it is. According to the Cambridge dictionary, a conspiracy is “The act of secretly planning with other people to do something bad or illegal”[28]. Merchants and farmers conspired against brewers to make it easier for them to justify higher prices. The industry was bent on revenge for canceled contracts in 2009. They stated as much in the second paragraph of the 2010 WSU survey, which you can read for yourself here.

The industry maintained their false narrative even after the industry changed to producing proprietary aroma varieties for craft breweries on contract. Breweries signed the contracts they were told to sign and paid the higher prices the industry claimed it needed. Inexperienced craft brewers who sincerely wanted to support farmers didn’t know to question their claims.

If the manipulation of the WSU cost of production survey continues, by 2025 the current trajectory will send the alleged U.S. cost of production over $20,000 per acre ($49,400 per hectare). A more price-oriented market combined with continued production at lower prices will reveal the extent of the deception. The losses inferred by 2026 or 2027 could be greater than the value of the crop produced. Nevertheless, it would be difficult for the industry to change their claims without revealing the deception.

PREDICTION: If the survey continues, the industry will likely change the way it presents the cost of production while maintaining the narrative. If they don’t, it will reveal a brazen arrogance and blatant contempt for brewers.

DATA FOR PEOPLE WHO LOVE DATA

Figure 11. Annual U.S. Depletion Relative to Previous U.S. Crop

Source: Data Set Calculated from USDA NASS Hop Stocks Report Source Data 2002-2023

COMMENTARY

The graph above compares the movement of hops out of storage (i.e., depletion) relative to the previous year’s crop. Although depletion also includes foreign hops, the relationship between the numbers is significant and demonstrates the direction of the market over time.

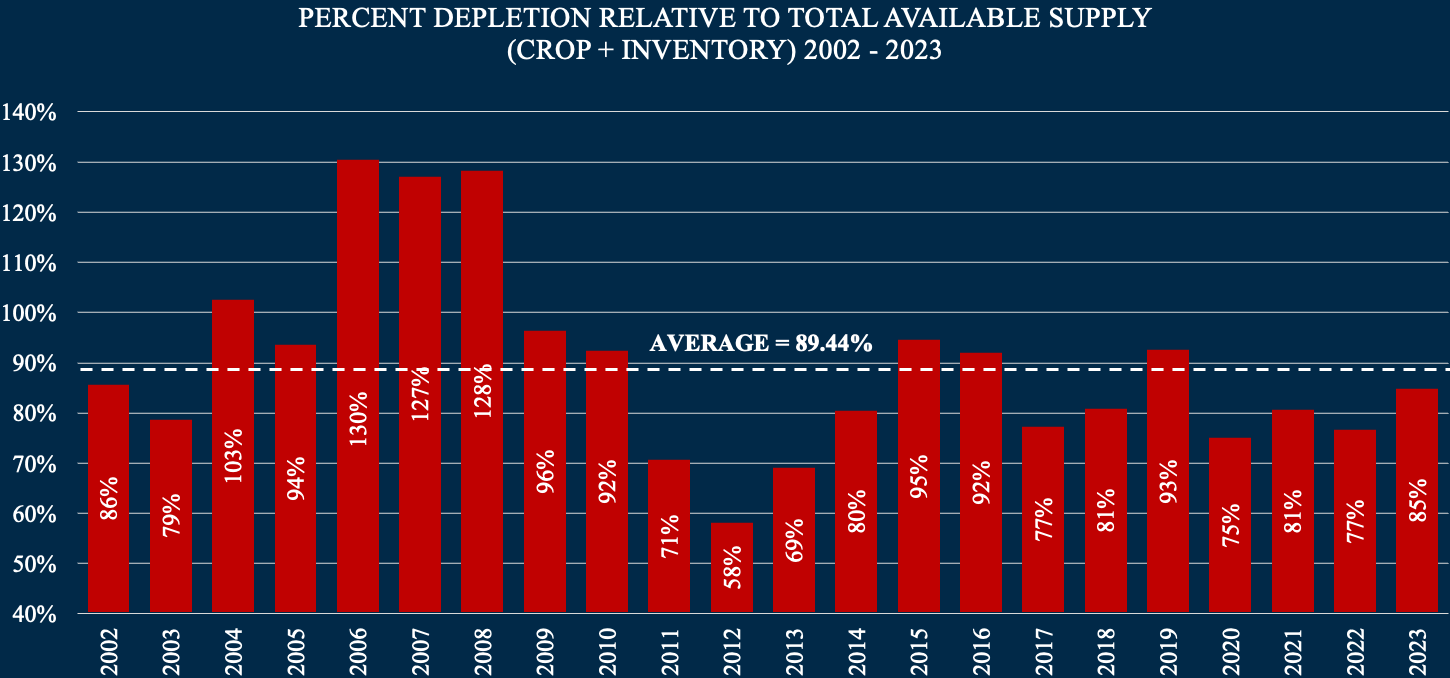

Figure 12. Annual U.S. Depletion Relative to Previous U.S. Crop from Previous Year + Available Inventories from Previous Year.

Source: Data Set Calculated from USDA NASS Hop Stocks Report Source Data 2002-2023

COMMENTARY

In this graph we can see the depletion relative to the total available supply of hops in the U.S. The two numbers are converging in 2023, which means the industry is getting the surplus issue under control.

Figure 13. Difference Between Annual U.S. Depletion Relative to Total Available Supply (Crop plus Inventories) Expressed in Pounds.

Source: Data Set Calculated from USDA NASS Hop Stocks Report Source Data 2002-2023

COMMENTARY

This graph represents the shrinking surplus. This format enables the viewer to have a better concept of the rate at which inventory built up since 2016.

Figure 14. Difference Between Annual U.S. Depletion Relative to Total Available Supply (Crop plus Inventories) Expressed as a Percent.

Source: Data Set Calculated from USDA NASS Hop Stocks Report Source Data 2002-2023

COMMENTARY

This graph best demonstrates the relationship between the movement of inventory, which is a way to visualize demand. As the percent depletion decreases, it represents a surplus situation. In 2023, the data demonstrate that the market is moving closer to balance. The average line does not represent equilibrium. That number is different than the average because the market has been oversupplied more often in the past.

HOW TO READ THIS FORECAST

These forecasts are based on available data at the time of publication combined with my perspective from over 20 years in the hop industry. As such, they are subject to change as new information comes to light. The information above should be used for informational purposes only. Supply chain shortages, war, drought, pestilence, alien invasions, unpredictable weather and other unforeseen events occurring after publication may affect the accuracy of these forecasts.

[1] https://www.probrewer.com/production/ingredients/a-peek-at-the-2023-pacific-northwest-hop-outlook-with-peter-mahony-at-john-i-haas/

[2] https://www.marshmma.com/us/limitless/family-hops-farms-grow-up.html

[3] https://www.yakimachief.com/commercial/hop-wire/action-plan

[5] https://slate.com/news-and-politics/2008/09/where-does-the-expression-lipstick-on-a-pig-come-from.html

[6] https://brewingindustryguide.com/tricks-of-the-trellis-when-to-switch-hop-varieties/

[7] https://www.brewersassociation.org/statistics-and-data/national-beer-stats/

[8] USDA NASS

[9] https://apps.dtic.mil/sti/tr/pdf/ADA421911.pdf

[10] https://www.yakimachiefranches.com/blog/high-alpha-hop-pahto

[11] https://www.ft.com/content/088d3368-bb8b-4ff3-9df7-a7680d4d81b2

[12] https://www.cnbc.com/2024/01/08/german-farmers-protest-against-economic-agriculture-policies.html

[13] Figures for the annual average prices for German hops comes from International Hop Growers Convention country reports.

[14] https://www.ofx.com/en-us/forex-news/historical-exchange-rates/yearly-average-rates/

[15] U.S. Dollars per pound were converted into Euros per kilogram using the average annual exchange rate

[16] https://www.ofx.com/en-us/forex-news/historical-exchange-rates/yearly-average-rates/

[17] https://www.nbcnews.com/news/us-news/beer-drinking-america-falls-lowest-level-generation-rcna131478

[18] https://www.pbs.org/newshour/health/why-new-weight-loss-drugs-are-out-of-reach-for-millions-of-older-americans

[19] https://news.yahoo.com/chasing-weight-loss-dream-many-024917937.html

[20] https://www.npr.org/sections/health-shots/2023/08/28/1194526119/ozempic-wegovy-drinking-alcohol-cravings-semaglutide

[21] https://www.goldmansachs.com/intelligence/pages/anti-obesity-drug-market.html#:~:text=Earlier%20this%20year%2C%20the%20global,according%20to%20Goldman%20Sachs%20Research.

[22] https://www.economist.com/graphic-detail/2017/06/13/around-the-world-beer-consumption-is-falling?utm_medium=cpc.adword.pd&utm_source=google&ppccampaignID=17210591673&ppcadID=&utm_campaign=a.22brand_pmax&utm_content=conversion.direct-response.anonymous&gad_source=1&gclid=Cj0KCQiAhc-sBhCEARIsAOVwHuRjXfAnH3o6yuwUguc3X7jpRqNCMWM4ZnubEMBqvrwBd_VOUoOys3IaAs4wEALw_wcB&gclsrc=aw.ds

[23] https://www.cnn.com/2022/08/30/health/elon-musk-population-collapse-wellness/index.html#:~:text=Billionaire%20Elon%20Musk%20tweeted%2C%20not,it%27s%20difficult%20to%20compare%20problems.

[24] https://www.wired.com/story/elon-musk-population-crisis/

[25] https://www.cia.gov/the-world-factbook/field/total-fertility-rate/country-comparison/

[26] https://worldpopulationreview.com/country-rankings/beer-consumption-by-country

[27] https://www.cia.gov/the-world-factbook/field/total-fertility-rate/country-comparison/

[28] https://dictionary.cambridge.org/us/dictionary/english/conspiracy